What are the main types of taxes in Spain?

When setting out into the world of taxation, it’s easy to get lost in the maze of legal terminology. To help you navigate the complexities of the Spanish tax system, we’ve put together a quick guide with everything you need to know about the main types of direct and indirect taxes. You’ll also learn about different tax brackets, rates, exemptions, and discounts.

The self-employed quota

Just like employees, self-employed people and freelancers also contribute to the state’s revenue via the “self-employed quota”—or cuto de autónomos in Spanish. Although the self-employed quota isn’t the only tax that self-employed people face in Spain, it’s still one of the most important. If you’re planning on becoming self-employed, make sure you read up on the self-employed quota on our blog.

Personal income tax (IRPF)

Anyone who has an annual income over €22,000 must submit a tax return and pay personal income tax (IRPF). However, bear in mind that personal income tax (IRPF) is a progressive tax that takes into account the taxpayer’s financial capacity or earnings.Looking for more info on taxes in Spain? Check out our articles about IRPF, different tax brackets, and the deductions you can benefit from when submitting your tax return.

Value-added tax

Value-added tax, or “VAT” for short, is the most important indirect tax in Spain. It’s charged on practically all goods and services, with the earnings then passed on from the seller to the tax office.For a deeper look at VAT and the different types of VAT that exist in Spain, head to our blog.

Taxes on cryptocurrency trading

Although cryptocurrencies and NFTs are relatively new, the Spanish tax authority has already started work to establish a tax on income generated from these technologies.You’ll find the most up-to-date information on this topic in our articles aboutcryptocurrency and NFT taxes and cryptocurrency mining taxes.

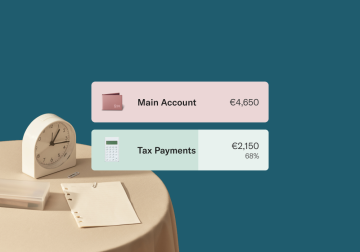

Tax payments and refunds

Your personal circumstances play a key role in the amount of tax you have to pay, whether you’re self-employed or work for someone else. Getting married or having children will affect your tax liability, as will certain types of expenses you might have. Our articles have more information about the differences between tax deductions and tax breaks, and what you can expect if your tax return is being audited. You can also get info on what to do if you’re going through the tax debt recovery process.

Find a plan for you

N26 Standard

The free* online bank account

Virtual Card

€0.00/month

A virtual debit card

Free payments worldwide

Deposit protection

POPULAR

N26 Go

The debit card for everyday and travel

€9.90/month

Up to 5 free withdrawals in the Eurozone

Flight and luggage delay cover

Medical emergency cover

Winter activities insurance

Pandemic coverage

N26 Metal

The premium account with a metal card

€16.90/month

An 18-gram metal card

Up to 8 free withdrawals in the Eurozone

Purchase protection

Phone insurance

Dedicated N26 Metal line

Premium Insurance package may differ for N26 You, Business You, Metal, and Business Metal customers who have opened their N26 account before 18.04.2023. By mid-May 2023 all existing N26 You, Business You, Metal, and Business Metal customers will receive individual communication regarding changes to their insurance benefits.

Following the VAT law reform and after the 2012 increase in VAT rates, there are now three VAT rates in Spain: General VAT at 21%, Reduced VAT at 10% and Super-Reduced VAT at 4%.

Los contribuyentes que opten por presentar su declaración de la renta por internet podrán hacerlo entre el 3 de abril y el 28 de junio. Si prefieres hacerlo de forma telefónica, tienes de plazo entre el 7 de mayo y el 28 de junio y si eres de los que hace este tipo de gestiones presencialmente, podrás hacer tu declaración entre el 3 y el 28 de junio.