Risk indicator for all N26 accounts.

1

/6

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

Banking that’s always there for you

Our comprehensive business continuity program helps us ensure that you have a seamless and uninterrupted banking experience. Learn more here.

More than an app: A fully licensed bank

N26 is a fully licensed German bank. That means we have the same security regulations as any other bank. It also means your funds are protected up to €100,000 by the German Deposit Protection Scheme. But our security measures don't stop there.

Secure banking designed for today

Fully hosted in the cloud, we use artificial intelligence and machine learning to protect your account, fight financial crime and card fraud. It’s security technology you can trust.

You can always pay it safe

From biometric authentication to extra layers of protection like 3D Secure, you can always spend confidently with N26. Want extra peace of mind? Your account can only be paired with your own smartphone, and you get real-time push notifications on all account activity — no surprises.

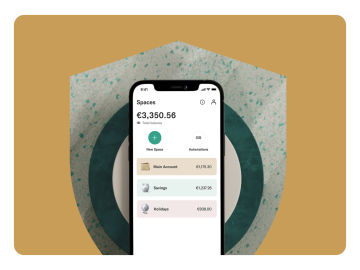

Your money is in safe hands — yours

Get full control over the security of your account with customizable settings in your N26 app. Lock and unlock your card, change your PIN, set spending limits, and hide your sensitive data from prying eyes — instantly and effortlessly. It’s security your way.

N26 — Simply Secure

At N26, security is a priority. Which is why, no matter which account you have, it’s always protected by innovative security measures and features.How N26 keeps you and your money safe

Deposit protection scheme: why your money is protectedLooking for reassurance that your money is protected? Deposit protection schemes help secure the money in your bank account.

Money laundering: how banks stay one step ahead of criminal activityMoney laundering accounts for billions each year. Here’s how banks fight back with anti-money laundering processes to detect suspicious activity.

Tips for secure mobile bankingFrom protecting your password to locking your screen, read our 5 essential tips for secure mobile banking.

Security at N26

- Be over the age of 18

- Live in an eligible country

- Have your own smartphone

- Not yet have an online account with N26

- Have a valid ID

You must meet the following requirements to open an N26 Standard free bank account:

N26 has been granted a full German banking license from BaFin. By law, each customer’s funds are protected up to €100,000 by the German Deposit Protection Scheme. With 3D Secure, Mastercard Identity Check, and fingerprint and face recognition, the security of our customer's online payments is always guaranteed.

All N26 accounts opened after April 17, 2019 have a Spanish IBAN. This means that, in addition to using your account to withdraw money or make card payments, you can also use it to deposit your salary, direct debits or to manage your daily expenses from the app. Enjoy all the advantages of a 100% mobile account with a Spanish IBAN.

Alongside your bank account’s advanced security features, you can take further steps to increase your online banking security. Never write down your passwords or PIN, only log into your account from a device you trust, and only via a secure WiFi connection. Additionally, to protect yourself from online fraud, avoid clicking on links in emails or text messages that seem suspicious. For more information on how to spot fraudulent behavior—and maintain your online banking security—take a look at our Security guide.