Open a bank account online in minutes

Sign up

Hit the button below and enter your personal details in order to create your account.

Verify your identity

Please have a valid ID at hand. We don't have branches so you can verify your identity within the app.

Add your card to your wallet

Your N26 virtual debit card is ready to use.

Enjoy your N26 account!

You're good to go! You can already top up your account and start using your virtual card.

All in one app

N26 Standard— free account, no commissions, and with Bizum

More than an app: A fully licensed bank

N26 features you’ll love

Get a virtual or physical debit Mastercard

Your debit Mastercard is accepted worldwide and offers zero foreign transaction fees—as well as SecureCode authentication for extra security.

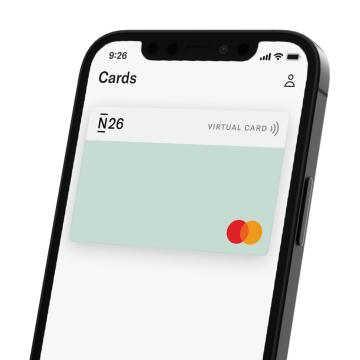

Virtual card

Connect your virtual card to Apple Pay or Google pay, and start spending right from your mobile wallet the minute you open your account.

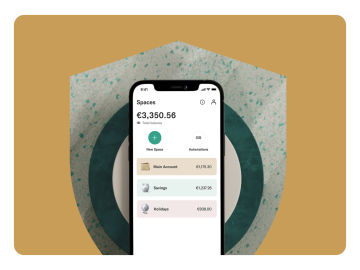

Budgeting tools

From instant push notifications to spending limits to in-depth features like N26 Insights, you’ll have all the tools you need to stay within budget.

Instant payments

Send or receive money 24/7, and top up your account in seconds with Bizum. Plus, easily transfer money to other N26 customers via MoneyBeam.

3D Secure for online payments

Shopping online? Your free bank account is equipped with Mastercard’s 3D Secure (3DS)—an advanced two-factor authentication step that keeps your money safe.

Split the bill

Choose between splitting the bill evenly or assign custom amounts to each person, so everyone pays their fair share.

Grow your savings

Your money is safe with deposit protection

Switch banks the easy way with N26

- Open an N26 account on the N26 mobile or web app

- Head to My Account and scroll to Switch to N26. Alternatively, use the N26 bank account switching website, and log in with your old bank details.

- finleap will automatically recognize your direct debits, incoming payments and standing orders—simply select the ones you want us to transfer to your N26 account.

- Confirm the account switch—and you’re done!

Find a plan for you

N26 Standard

The free* online bank account

€0.00/month

A virtual debit card

Free payments worldwide

Deposit protection

N26 Go

The debit card for everyday and travel

€9.90/month

Up to 5 free withdrawals in the Eurozone

Flight and luggage delay cover

Medical emergency cover

Winter activities insurance

Pandemic coverage

N26 Metal

The premium account with a metal card

€16.90/month

An 18-gram metal card

Up to 8 free withdrawals in the Eurozone

Purchase protection

Phone insurance

Dedicated N26 Metal line

300,000+

5-star app ratings

1,600+

Team members