Freelancers, meet your free business bank account

Your free virtual debit Mastercard

Grow your savings

Earn as you spend with 0.1% cashback

Your money is safe with deposit protection

Stocks and ETFs the simple way

Send and receive money instantly with Bizum

Zero hidden fees

Because you and your business deserve it. There’s no account maintenance fees, no minimum deposit fees, and no minimum balance requirements.

Mastercard 3D Secure

Add an extra layer of security to your online payments with Mastercard 3D Secure (3DS)—this two-factor authentication helps to prevent fraud.

Transactions history

You can access the history of all the movements and transactions on your account at any time from the comfort of your smartphone, as well as download your balance statements for a more detailed overview of your account’s income and expenditure.

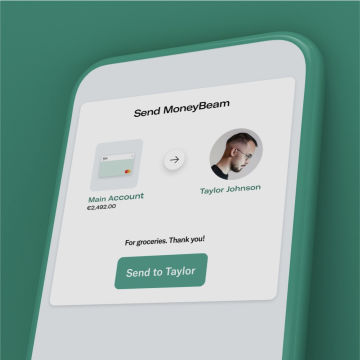

Free instant bank transfers

Make free real-time bank transfers to other N26 customers with MoneyBeam, and receive incoming payments in seconds with SEPA Instant Credit Transfers.

Mobile or web? You decide.

Whether you’re out and about or at your desk, N26 is convenient. Access your free business bank account at any time from the N26 app or N26 WebApp for desktop.

Export your balance statement

Preparing for taxes? Export your transaction list from the N26 WebApp as CSV or PDF files, and download your bank statements at any time from the N26 app.

Real Customer Support—in 5 languages

Invest in yourself with 0.5% cashback

Convenient business banking at your fingertips

Ready to discover why more than 7 million customers choose to bank with N26, The Mobile Bank? Compare business bank accounts below to find the perfect fit for your business, or sign up now for your free business bank account. There’s no paperwork involved—all it takes is 8 minutes, your smartphone, and a valid ID.Frequently asked questions

- use the account primarily for business purposes

- not be already an N26 user

- reside in a country where N26 Business is available: Germany, Austria, France, Italy, Spain, Portugal, Ireland, Greece, the Netherlands, Belgium, Luxembourg, Finland, Latvia, Estonia, Lithuania, Slovakia, Slovenia and Switzerland.