N26 Metal — your financial future at your fingertips

The exclusive plan that’s made for saving and investing. Make a statement with a metal debit card, and enjoy travel insurance, purchase protection, and more.

Risk indicator for all N26 accounts.

1

/6

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

Make every trip pay off

Get 1% back when you pay abroad with your N26 Go

or Metal card, with no limit to how much you can earn!

This cashback** applies whenever you use

your card outside the European Economic Area,

UK, and Switzerland — for up to 12 months. Get an additional 0.1% cashback on card payments

with N26 Business Go and 0.5% with Business Metal.

Open an account

More than a pretty face

Here’s an at-a-glance look at everything you get with Metal.

Build your portfolio

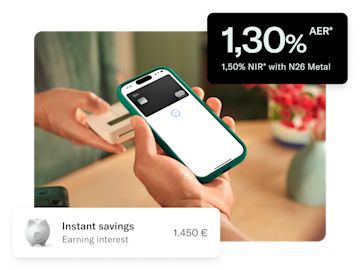

Earn 1.30%* AER (1.50% NIR) on your savings and trade stocks and ETFs for free*** to expand your investment portfolio.

Discover Stocks & ETFs

Enjoy true peace of mind

We’ll take care of the unexpected with versatile travel insurance, purchase protection, and mobile phone coverage.

The 18-gram metal bank card

With our exclusive metal debit card you’ll enjoy free withdrawals abroad and card payments with no foreign transaction fees.

Show me the Metal card

You’re always our priority

Contact our designated Metal Customer Support team by phone, or chat directly in the app.

Visit Support Center

Invest in your future

Metal is the premium bank account that helps you build your portfolio with lower crypto fees****, free stock and ETF trading***, and flexible investment plans.

Discover Stocks & ETFs

Earn 1.30% AER on your savings

With N26 Metal, grow your saving with interest rates starting from 1.30% AER (1.50% NIR)*, full flexibility, and no deposit limits*****.

Explore Instant Savings

Your ticket to the lounge

Travel stress-free with access to 1,300+ airport lounges worldwide. Your first visit is free with N26 Metal.

Open an account

Travel the world with one eSIM

Set up your travel eSIM once and get affordable data for 100+ destinations.

Get travel eSIM

We’ve got you covered

Metal customers enjoy our most extensive insurance package, provided by Allianz Assistance.

Mobile phone insurance

Get covered up to €2,000 for accidental damage or theft of a phone less than two years old.

Travel insurance

You’re covered for trip delay, interruption, and cancellation, baggage delay, loss, and theft, emergency medical treatment, and personal liability.

Purchase protection

You’ll get up to €2,500 per claim for accidental damage or theft of an eligible purchase.

Exclusions and restrictions apply. For more information, please see the Allianz Assistance Insurance Product Information Sheet and Conditions for Beneficiaries.

Customers with a German IBAN account in Spain can find more information here.

TIN 0%, AER: -3.98% for a scenario in which a daily balance of €5,000 is maintained consistently for 1 year, applying an annual nominal interest rate of 0% and the monthly cost of the account of €16,90/month. The settlement of the account is made monthly.

N26 Bank AG, Sucursal en España with NIF W2765098E, is a permanent establishment in Spain of the German entity N26 Bank AG, registered at the Bank of Spain with entity number 1563 and head office at Paseo de la Castellana 43, 28046, Madrid. N26 Metal Instant Savings account from 0 euros and without limit of amount.

*1.30% AER (1.50% annual NIR). With this interest rate, if you maintain a daily balance of €100,000 in your N26 Metal Instant Savings account for a period of 12 months, you will obtain a total gross interest of €1,500. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://www.n26.com.

**Eligible spending: Detailed T&Cs for customers who sign up before July 17 and after October 15 can be found here: https://n26.com/hb-ex

***All investments carry a risk of loss of principal. Equities, ETFs and Ready-made funds can be subject to large fluctuations in value. The amounts invested are not guaranteed and a complete loss of the investment is possible at any time. Past performance is neither a reliable indicator nor guarantee of future performance. These products are not suitable for all investors, and clients should ensure that they are sufficiently well-informed before carrying out any transactions. The information contained in this message is intended for general purposes only and does not constitute investment advice or any other advice regarding financial services or financial instruments (Equities, ETFs and Ready-made funds). It also does not constitute an offer to enter into a contract for the purchase or sale of financial instruments. The service of receiving and transmitting orders for financial instruments is exclusively available to clients of N26 Bank AG. The N26 broker service is provided via the N26 app in partnership with and through Upvest Securities GmbH.

Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

****Investing in crypto-assets is not regulated, may not be suitable for retail investors and the full amount invested may be lost. It is important to read and understand the risks of this investment which are explained in detail at this location: n26.com/en-es/crypto-risks. The statements above do not constitute investment advice or any other advice on financial services or financial instruments. The values and returns depicted above in the images are fictional and are for illustrative purposes only.

*****The money in your N26 bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme. Trading stocks and ETFs with N26 is fee-free. Note that fund issuers may charge their own ETF management fees directly.

- Travel delays

- Baggage delay

- Baggage coverage

- Medical emergencies while traveling abroad

- Trip cancellation

- Trip interruption

- Personal liability while travelling

- Mobile phone coverage

- Purchase protection

- Death; Illness (incl. epidemic/pandemic disease of the beneficiary, such as COVID-19) or medical condition; Injury; Hospitalization

- Individual quarantine and other events listed in the collective insurance agreement

- Serious accidental injury or unexpected serious illness including an epidemic/pandemic disease such as COVID-19 or Individual quarantine

- Trip delayed due to covered reasons by at least two hours.

- Reimbursement in case of damage, theft or loss of items

- Reimbursement for essential items purchased if luggage is delayed by more than four hours

- Reimbursement in case of damage, theft or loss of travel documents

- Illness or accidental injury during travel — including treatment for an epidemic or pandemic disease such as COVID-19

- Theft, accidental damage; high voltage (including lightning) damage

- Theft; accidental damage to eligible goods for 12 months immediately after purchase

- Events occurring outside the validity dates indicated in the conditions for beneficiaries

- Claims arising from an event the beneficiary had prior knowledge of before opening their account (or booking a trip for travel-related claims).

- Natural disasters, events directly or caused by or contributed to or arising from nuclear reactivity

- Damage of any kind caused intentionally by the beneficiary or with their complicity

- An epidemic or pandemic, except as expressly stated under Trip Cancellation, Trip Interruption, Emergency Medical/Dental Services Abroad and Emergency Transportation sections.

- Systemic (non-individual) epidemic/pandemic events

- Claims arising due to pre-existing medical conditions

- Violation of international sanctions, laws or regulations

- The policy deductible that is applicable to claims made under some benefit sections

- Financial limits apply to each benefit section

- There are general conditions that you must meet for cover to apply and some benefit sections contain conditions specific to that section

- For purchase protection, objects with a minimum value below €100

- For Mobile telephone accidental damage and theft, objects older than 2 years

- War (declared or undeclared) or acts of war

- Civil disorder or unrest, except when and to the extent that civil disorder or unrest is expressly referenced in and covered under trip interruption coverage or travel delay coverage

- Terrorist events, except when and to the extent that terrorist events are expressly referenced. This exclusion does not apply to Emergency Medical or Emergency Transportation coverage.

- Intentional self-harm or attempt or comit suicide

- Unstabilized illnesses or injuries that were diagnosed or treated

- An epidemic or pandemic, except when and to the extent that an epidemic or pandemic is expressly referenced in the coverage description

- Local health situations, pollution, weather or climate events

- Natural disaster, except when and to the extent that a natural disaster is expressly referenced in the coverage description

- Expenses incurred without the prior agreement of our assistance department

- The cost of treatment or care not resulting from a medical emergency

- The consumption of alcohol or drugs not medically prescribed

- Participation in a professional or dangerous sport

- Trip cancellation:

Deductible: €20 per beneficiary - Purchase protection:

Deductible: €50 per claim, Depreciation: 10% every 6 months following the purchase date - Mobile phone: Purchase less than 2 years old, Depreciation: 10% every 6 months following the purchase date

You can sign up to N26 Metal if you meet the eligibility criteria. There are no other requirements or a minimum deposit needed to open this account.

To open an N26 Metal account, you must meet the eligibility criteria. You can then register on our website or in the N26 mobile app. Sign up only takes a few minutes, and no paperwork is needed. Once your identity is verified, you’ll be able to start using your bank account.

Already an N26 customer? Then you can easily upgrade to N26 Metal in the N26 app — simply head to the Explore tab.

You can find more information at our Support Center.

When you open your N26 Metal account via the website or app, you can choose the color of your metal bank card. This step takes place before identity verification. Once your identity has been verified, we’ll send your N26 Metal Mastercard to your delivery address.

To learn more about N26 Metal card delivery, head over to this article in our Support Center.

The card you receive with your N26 Metal premium bank account is a debit Mastercard. Some of its features are the same as what you get with a credit card, although there are also a few key differences. You can pay online, in stores, and in apps with your N26 debit card, as well as withdraw cash from ATMs with no hidden fees. Forgot your card at home? Simply add your N26 card to Apple Pay or Google Pay and pay with your phone — that way, you’re always prepared.

Your N26 Metal bank card comes in one of three distinct metallic shades: Charcoal Black, Quartz Rose, and Slate Grey. You'll receive a card number, expiration date, and CVC for your debit Mastercard — just like you would with a credit card. Find out more about the differences between debit and credit cards in our guide.

If you opened your account in Spain, your N26 Metal Mastercard includes eight fee-free ATM withdrawals per month within Spain. After that, you’ll be charged €2 for every additional withdrawal. You can see in the app how many free withdrawals you have left.

Elsewhere in the Eurozone, and just like with all foreign currency payments, all ATM withdrawals are free and unlimited with N26 Metal.

N26 Metal account include:

Alongside the insurance package available with N26 Go, N26 Metal also gives you additional mobile phone and purchase protection insurance.

No, mobile phone insurance is already included in your monthly N26 Metal membership fee.

N26 Metal also offers unlimited ATM withdrawals in foreign currencies, as well as free card payments worldwide. It’s ideal for those who travel, and comes with travel insurance benefits that covers trip delay and cancellation, baggage delay and loss, and emergency medical care abroad. That’s all in addition to personal liability cover during travel and purchase protection.

Planning for your financial future? With N26 Metal you can also enjoy a fully flexible Instant Savings account at our highest interest rate. You can also buy crypto, and invest in stocks and ETFs with no trading fees, right from your N26 app. Metal customers enjoy lower crypto fees to build their portfolio.

The N26 Metal account costs €16.90 per month, and is an annual subscription.

N26 Spaces are sub-accounts that sit alongside your main account, giving you an easy way to manage your finances. As a Metal customer, create up to 10 Spaces sub-accounts in an instant, and effortlessly put money aside for your savings goals, upcoming expenses, or even an emergency fund.

Try using Rules to automatically set money for your bills aside, then pay via direct debit from your sub-account. With your monthly expenses taken care of, you can relax knowing that you won’t overspend in your main account. You can also link a virtual or physical card to a Space to make payments directly from it.

If you want to save and spend as a group, simply create a Shared Space, and manage funds together with up to 10 other N26 customers. Find out more about Spaces and Shared Spaces here.

If you want to switch banks to N26, then we’ve got good news for you: together with finleap connect, we offer a free account switching service, and it only takes 10 minutes to submit a request to switch banks. Discover how you can quickly and easily switch banks here.

To find out more about the insurance benefits associated with your N26 Metal account please refer to the Insurance Product Information Document (IPID) and the Conditions for Beneficiaries.

Customers with a German IBAN account in Spain can find more information here.

Trip Cancellation

Which events are covered?

Which events are covered? Completion of the trip as scheduled is not possible or cannot be expected due to e.g.:

Which events are covered?

Which events are covered?

Which events are covered?

Which events are covered?

Which events are covered?

Which events are covered?

Which events are covered?

Which events are covered? Completion of the trip as scheduled is not possible or cannot be expected due to e.g.:

Which events are covered?

Which events are covered?

Which events are covered?

Which events are covered?

Which events are covered?

Which events are covered?

To find out more about the insurance benefits associated with your N26 Metal account please refer to the legal documents made available to you, especially the Insurance Product Information Document (IPID) and the Conditions for Beneficiaries.

- General exclusions apply to the whole policy and some benefit sections contains conditions specific to that section

Please consult the general section, and respective information of each benefit in the Conditions for Beneficiaries for a precise overview of the respective restrictions and limitations.

Main exclusions