A beginner’s guide to investing

How does investing work?

How can you start investing?

Set a goal

Having a clear objective helps you define your investment timeline, budget, and strategy.

Choose the right investment for you

Your risk tolerance and personal goals will help you narrow down your options, and you can look for beginner-friendly investment products like ETFs or tangible assets.

Decide whether to invest once or regularly

Depending on the type of investment, you can opt for a one-time payment or make regular contributions — whatever fits your budget and risk tolerance.

Keep an eye on your investments

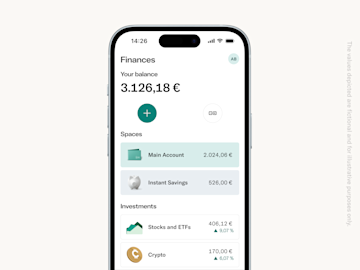

Different investment types and strategies need more or less monitoring, but generally, the key is to know what’s going on with your money.

How much should I invest per month?

Why it’s important to diversify your investment portfolio

Which investment options are good for beginners?

Stocks

When companies want to raise capital, they can go public on the stock market and issue shares. Shares, also known as stocks, represent part ownership in a company. Sometimes, they also come with voting rights and a piece of the profits, called dividends. By buying stocks, you become a part-owner and can benefit from the company's growth. Investing in stocks is a popular strategy, but it comes with higher risks. Stock prices can rise or fall dramatically, and many factors can influence their value. Before investing, research the company thoroughly, such as by reviewing recent financial reports, and monitor the stock's performance. Be wary of tips about "hot stocks" and use your best judgment to make independent decisions — you're the one who’s in charge of your finances.Mutual funds

Investment funds are like baskets that contain a variety of stocks. Depending on the type of fund and management company, a fund can have different assets in it. For example, a real estate fund mirrors trends in the real estate market, holding stocks from multiple companies in the sector. Mutual funds are actively managed. As fund managers adjust holdings to maximize returns, the composition of a fund can change. Active management can be helpful, but there’s also the risk a fund manager could make poor decisions. By nature, mutual funds are diversified because they include dozens or even hundreds of companies. This makes them generally lower risk compared to individual stocks.ETFs

Like investment funds, exchange-traded funds (ETFs) track the average performance of multiple companies, sectors, or regions. But ETFs are passively managed, meaning they have the same composition no matter what the market trends are. The goal isn't for an ETF to outperform the index it’s tracking, but to match its performance. As a result, ETFs often yield "average" returns and can be a good choice for long-term investments. They can also be traded on an exchange, just like a stock. Many beginners choose ETFs because they’re relatively safe and easy to manage. Since they’re passively managed, the fees are typically lower. You can also invest in ETFs through monthly plans that let you buy shares in fractions, depending on what you can afford to invest. Some brokers or platforms let you start with as little as €1 per month.Cryptocurrencies

Investing in cryptocurrencies is a high-risk move for beginners. Blockchain-based currencies like Bitcoin and Ethereum are relatively new and still extremely volatile. There’s also little regulation in the crypto market, and unlike ETFs, cryptocurrencies aren’t classified as protected assets. This means there’s no government safety net if the exchange goes bankrupt or the currency fails. Crypto investing takes a lot time and effort. You’ll need to monitor the market daily and trade frequently if you want to maximize gains and minimize losses. But if you want to go ahead with crypto, there are different tools and guides available online to simplify the process for beginners.Government bonds

Like stocks, bonds are issued to raise money — but by governments rather than companies. Governments use the money they bring in from bonds to fill budget gaps or finance infrastructure and education projects. Bonds have fixed terms, usually between 10 and 30 years, and pay regular interest, making them a relatively low-risk option. However, their value can still go down if market rates fall, and they’re only as secure as the government that issued them. Stick to bonds from stable governments — that makes it more likely that you’ll get your full investment back when the bond’s term ends.Precious metals

Gold, platinum, and silver have long been considered safe investments that offer protection against inflation. In Germany, holding precious metals for over a year exempts them from taxes. However, precious metals aren’t quite risk-free. For example, gold prices often fluctuate more than stock prices, due to supply and demand dynamics. And unlike stocks or bonds, precious metals don’t generate passive income through interest or dividends. It’s also essential to choose a trustworthy dealer. The market is unregulated, which makes it attractive to some pretty unscrupulous sellers. A safer alternative could be gold or commodity ETFs, which let you invest indirectly. Gold investment plans are also an option if you’re working with a smaller budget.Real-world assets

Items like sneakers, trading cards, wine, or diamond jewelry are popular investments. Like precious metals, they can protect against inflation and can become more valuable over time. For instance, a designer handbag might sell for much more years later — as long as it still has collector appeal. Just keep in mind that trends can change, and what’s valuable today might lose its worth tomorrow.Real estate

With rising real estate prices, property investments like houses and apartments have become even more popular, especially in major cities. Some private investors make substantial profits in just a few years. However, buying real estate takes a significant upfront investment, often involving loans and long-term commitments. Renting out a property can cover the mortgage payments, but being a landlord comes with responsibilities and expenses. Construction issues, poor location, interest rate changes, or economic downturns can also hurt property values and limit the value of the investment. These are just a few of the investment options out there. With some time and consideration, you can find an investment approach that’s right for your goals and risk tolerance. Remember: Every investment carries some level of risk, so never invest more than you can afford to lose.What is the best investment option at the moment?

Find a plan for you

N26 Standard

The free* online bank account

€0.00/month

A virtual debit card

Free payments worldwide

Deposit protection

N26 Go

The debit card for everyday and travel

€9.90/month

Up to 5 free withdrawals in the Eurozone

Flight and luggage delay cover

Medical emergency cover

Winter activities insurance

Pandemic coverage

N26 Metal

The premium account with a metal card

€16.90/month

An 18-gram metal card

Up to 8 free withdrawals in the Eurozone

Purchase protection

Phone insurance

Dedicated N26 Metal line

FAQs

- Financial goals: Are you investing short-term or long-term? Do you want high or moderate returns?

- Time horizon: How long can you commit your money without needing it?

- Financial situation: How much can you afford to lose without jeopardizing your financial stability?

- Personality: Are you comfortable with risk or do you prefer to play it safe?

- Not doing enough research before making investment decisions.

- Trying to time the market rather than focusing on long-term growth.

- Investing based on emotions or following the latest trends without understanding them.

- Not diversifying your portfolio, which increases risk.

- Ignoring the fees and costs associated with investments, which can erode returns over time.