N26 Credit

Apply for an instant loan right in the N26 app — no paperwork needed.

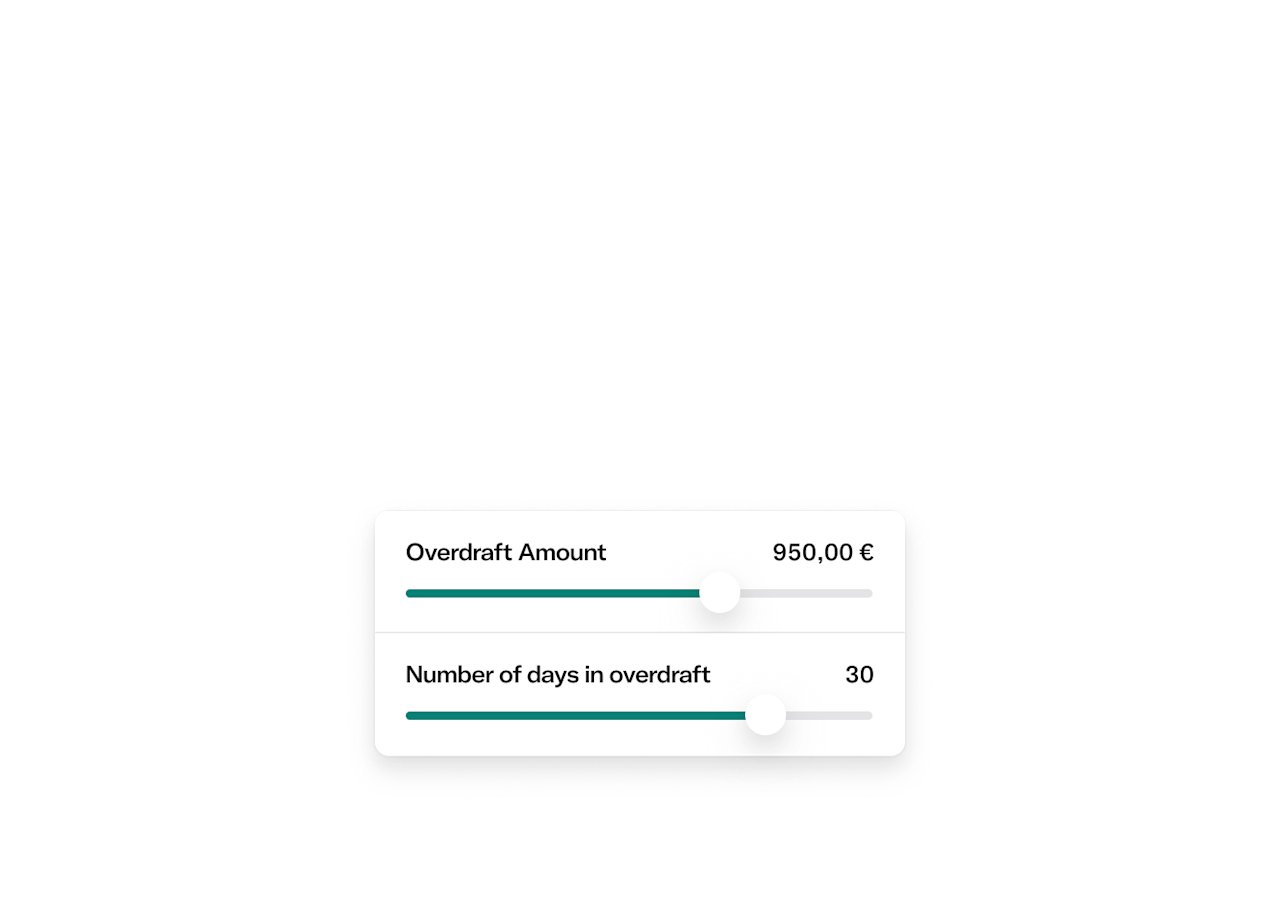

N26 Overdraft

Activate your overdraft in minutes. Stay in control with easily adjustable limits and transparent costs.

N26 Installments

Buy now, pay later, and free up cash instantly.

Extra money made simple

Transparent costs. Zero paperwork. Money in minutes.

A loan is an amount of money that you borrow, which is then paid back over time with added interest on top. When you first take out your loan, you can choose how many months your loan will last, and how much you’ll have to pay back each month. With N26 Credit, you can get a personal loan of €1,000 to €15,000 directly in the N26 app, and pay it back over 12 to 60 months.

Your personal loan offer is based on the amount you’d like to borrow, the repayment period, and your credit rating. Depending on these factors, N26 Credit offers effective interest rates ranging from 3.99% NIR (4.06% AER) to 12.90% NIR (13.69% AER). You can see your personal loan offer in the N26 app before making a decision.

The maximum amount of your loan depends on the lending product, the details you provide, your transaction history, as well as your credit rating. We offer personal credit loans ranging from €1,000 to €15,000. N26 Overdraft can provide you with a safety net of up to €10,000. And with N26 Installments, you can split eligible purchases of up to €200 in total into installments.

No, we are legally required to assess your creditworthiness using both our internal data and information from external credit bureaus. This helps ensure responsible lending, protects you from taking on too much debt, and contributes to the overall stability of the financial system.

Yes, as part of our legal obligations and responsible lending practices, we may share certain information with external credit bureaus and the Bank of Spain's CIRBE (Central Credit Register). This helps us—and other financial institutions—assess creditworthiness accurately and supports transparency and financial stability. Additionally, in case of default, credit bureaus may be informed to maintain responsible credit management.

You can find more details in our Privacy Policy.

An overdraft allows you to borrow a certain amount of money through your bank account. For specific situations where you lack liquidity or have to deal with unexpected payments. For example, if you are waiting for a car insurance bill and your balance is too low at that moment.

The fixed interest rate we apply to your overdraft is 11.0% NIR (11.63% APR*)

*For example:

Overdraft of €500 with a nominal annual interest rate (NIR) of 11%. The monthly interest rate is 11% divided by 12, i.e., 0.9167%. This results in €46.76 per year if the amount remains fully drawn without changes. Since interest is capitalized monthly, the APR (Annual Percentage Rate) of the operation is approximately 11.63%.

APR (Annual Percentage Rate) is the annual percentage rate that reflects the total cost of your loan, including interest and any applicable fees, expressed as an annual percentage.

*For example:

Suppose you take out a loan of €1,000 with a term of 24 months.

The NIR (Nominal Interest Rate) is 8% per year.

The APR (Annual Percentage Rate), which reflects the total annual cost of the loan including any fees, is 8.3%.

Your monthly installment would be €51.33

Each month, this amount is automatically debited from your N26 account.

Over 24 months, you will repay the full €1,000 plus the total interest (€77,83), for a total repayment of around €1,077.83.

No other fee apply.

NIR (Nominal Interest Rate) is the nominal interest rate applied to your loan, not including fees or other costs.

N26 Installments allows you to split eligible purchases that you've made in the last four weeks, and instantly free up cash. Split eligible past purchases with a value from €20 up to €200 into smaller installments, and pay them back over three to six months with an annual percentage rate ranging from 8.99% to 15.49%. We'll put the full amount into your account immediately, and you'll pay the first installment a month later.

N26 Installments is available for a wide range of eligible purchases from €20 up to €200 across multiple categories like electronics, fashion, furniture, flights, train tickets, and more. You’ll also be notified in the N26 app once you’ve made an eligible purchase that can be split into installments.

Currently, N26 lending products are available only to eligible customers who’ve opened their account in Spain, Germany and Austria. Eligibility is based on their transaction history of the past 90 days for N26 Credit and Overdraft and 30 days for N26 Installments. If you’re eligible, you’ll find the products in the ‘Finances’ tab of your N26 app. If you can’t find it yet, keep using your N26 account and check again in a few months to see if you’ve become eligible.

Currently, N26 does not offer credit cards.