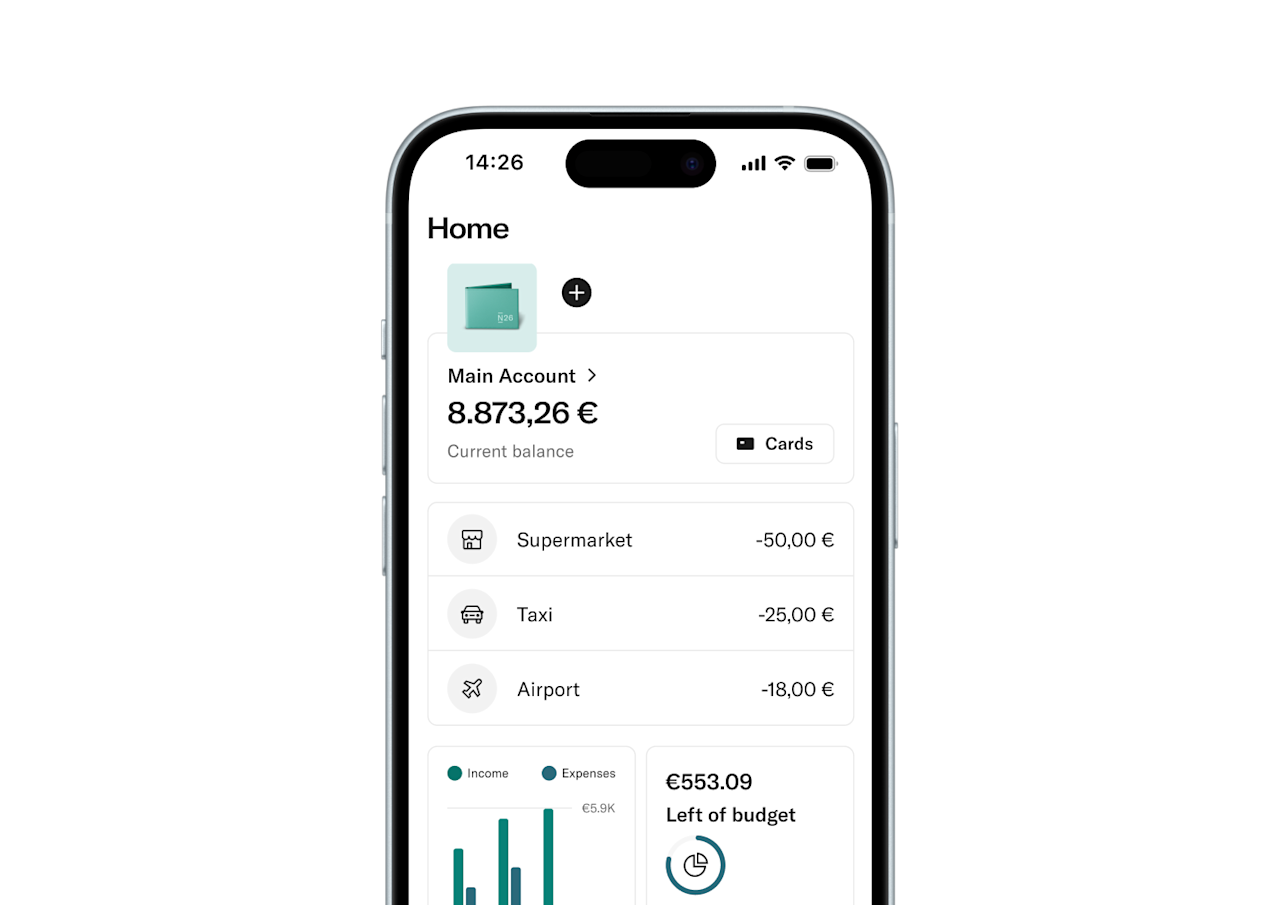

Bank for free — with no hidden fees

Open your euro bank account in minutes. Get a virtual Mastercard and two free ATM withdrawals in euros per month.

Save with Spaces

With N26 Smart, get up to 10 Spaces sub-accounts with individual IBANs to save for your goals and stay on top of your bills.

Open your free euro account now

Open your account in minutes and with no paperwork — right from your phone.

Bank for free: There is no account management fee for the N26 Standard Account. For all other account plans fees apply. See List of Prices and Services for current fees.

N26 is the first 100% mobile bank to be granted and operate with a full German banking license from BaFin. That means the money in your bank account is fully protected up to €100,000 by the German Deposit Protection Scheme. We currently operate in 24 markets worldwide and have over 8 million customers.

N26 has been granted a full German banking license from the German regulator BaFin. By law, each customer’s funds are protected up to €100,000 by the German Deposit Protection Scheme. With 3D Secure, Mastercard Identity Check, and fingerprint and face recognition, the security of our customer's online payments is always guaranteed.

As a bank, N26 is supervised by the Federal Financial Supervisory Authority (BaFin). Our clients' funds are guaranteed up to €100,000 by the German Deposit Protection Scheme. In addition, the N26 app has many features to ensure the security of its users' bank accounts and data.

In order to open a bank account with N26, you must have a government-issued ID. Don’t worry, there’s no fussy paperwork or long wait times involved — just present your valid ID during a quick call and you’ll be up and running. It’s worth noting that you’ll also need a smartphone to use your account, and must live in an eligible country where N26 operates.

The standard N26 bank account is free and doesn’t charge any opening or maintenance fees. The N26 Smart bank account costs €4.90 per month. To open an N26 account, no deposit or minimum income is required.

You can open your mobile N26 account online in minutes from your phone or the N26 website — no paperwork or waiting times. But best of all: Once your N26 bank account is active, you can start using it right away. This means you can start spending with your virtual card as soon as your account is set up, and you don't have to wait for your physical card to arrive.

Yes, the currency of your bank account from N26 is in euros. But we don’t charge any fees for payments in foreign currencies.

N26 is an online bank that was founded in Berlin in 2013 by Valentin Stalf and Maximilian Tayenthal. In 2016, N26 received a full German banking license from the German regulator BaFin. This means that the deposits in your euro account are protected up to €100,000 by the German Deposit Protection Scheme.

As an N26 customer, you can contact our customer support seven days a week from 7 a.m. to 11 p.m. The easiest way to do this is via chat directly in your N26 app. If you have an N26 Smart account, you also benefit from phone support. Our customer support team speaks five languages: German, English, Spanish, French and Italian.

Find out more

N26's Complete Guide to Secure Online BankingThe complete N26 guide to banking safely online

Banking Basics: getting startedWe’re here to demystify all things banking-related. Read our guide to take a closer look at the basics of your account.

Banking Basics: ATM feesConfused why you’re getting charged ATM fees when you withdraw your cash? Read more about why it’s happening and how to avoid them next time.