Risk indicator for all N26 accounts.

1

/6

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

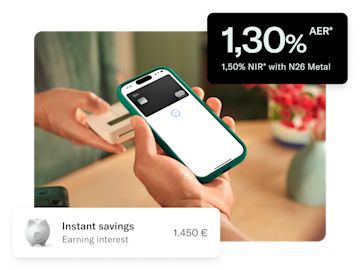

Earn 1.30% AER on your savings

With N26 Metal, grow your saving with interest rates starting from 1.30% AER (1.50% NIR)*, full flexibility, and no deposit limits.

More about the Instant Savings account

Get rewarded with 0.5% cashback

Earn 0.5% cashback on all card purchases and get money straight back into your account on a monthly basis. A smart way to reinvest it in your business—no fuss, no strings attached.

Stand out with Business Metal

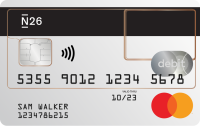

Discover a beautiful banking experience, with N26 Business Metal’s premium Mastercard in 18-grams of stainless steel. Available in 3 distinct metallic shades that best suit your style, the engraved contactless debit card offers a stylish, minimalist aesthetic that means business—and delivers all the functionality you need.

Stocks and ETFs the simple way

Invest in stocks and ETFs with no trading fees***. It’s the simple way to invest in your future without having to leave your banking app.

Discover Stocks and ETFs

Insurance for travel, mobility and lifestyle

Emergencies when travelling

Up to €1 million coverage for emergency medical and up to €250 for emergency dental costs while traveling

Purchase protection

Coverage up to €10,000 in 12 months for stolen or damaged eligible purchases bought with your N26 card

Baggage coverage and delay insurance

Get covered up to €500 for baggage delays over 4 hours, or up to €2,000 if your baggage goes missing.

Travel delay and cancellation

We know how inconvenient it can be when business trips don’t go to plan. Thankfully, if your trip is cancelled or delayed for more than 2 hours, you’ll be covered.

Stay covered with mobile phone insurance

We've all been there, but losing your smartphone doesn't have to be a big deal. To avoid the unexpected, your Business Metal account covers your phone in case of theft or damage up to €2,000, regardless of whether you paid for it with your N26 Business Metal card or not.

Go global with Mastercard, at no extra cost

Wherever your business takes you, make payments anywhere in the world with zero foreign transaction fees and at Mastercard’s best exchange rate. Plus, enjoy free unlimited ATM withdrawals abroad and stay up-to-date with instant push notifications that inform you of what comes in and out of your account.

Smart management tools at your fingertips

Forget clunky spreadsheets and mountains of paperwork—your N26 Business Metal bank account helps you keep track of all your business expenses all in one place. Get an automatic categorization of your spending with our Insights feature, and log in to the web app on your desktop to download your statements for easier tax returns.

Open Bank Account

Priority Customer Support, always at your service

Whatever you need, we’re here to help. Whether it’s a quick question about your account, guidance on using a feature, or urgent technical support, just reach out to a dedicated Customer Support specialist on the phone, or chat to the team directly via your N26 app.

Your card, your business style.

Join N26 or upgrade to Business Metal to redefine your banking experience.TIN 0%, APR: -3.98% for a scenario in which a daily balance of €5,000 is maintained consistently for 1 year, applying an annual nominal interest rate of 0% and the monthly cost of the account of €16.90/month. The settlement of the account is made monthly.

N26 Bank AG, Sucursal en España with NIF W2765098E, is a permanent establishment in Spain of the German entity N26 Bank AG, registered at the Bank of Spain with entity number 1563 and head office at Calle de Don Ramón de la Cruz, 84, 28006 Madrid. N26 Metal Instant Savings account from 0 euros and without limit of amount.

*1.30% AER (1.50% annual NIR). With this interest rate, if you maintain a daily balance of €100,000 in your N26 Metal Instant Savings account for a period of 12 months, you will obtain a total gross interest of €1,500. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://www.n26.com.

**The N26 Metal crypto fee discounts only apply to trading amounts up to €5,000 (including fees on purchasing and excluding fees on selling crypto) per calendar month. Above this amount, standard fees apply: 1.5% on Bitcoin and 2.5% on all other coins (fees are always rounded up to the nearest full cent — to a maximum of one cent — which may lead to a slight increase of the fee percentage shown in the order preview. Deviations for special coins are possible). The fees and cryptocurrency prices shown on the N26 app for every transaction, including a possible spread, are not determined by N26 but provided by Bitpanda GmbH. N26's liability is expressly excluded for any claim or damage arising from the formation of the prices of the assets offered by Bitpanda.

***Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

FAQ

To open a bank account with N26, you must meet the eligibility criteria. You can then register on our website or via the app—all you need is your smartphone and a photo ID to get started. The sign-up process only takes a few minutes and no paperwork is needed—and you don’t even need a minimum deposit amount.

You can find more information on how to open a business bank account at our Support Center.

Your N26 Business Metal bank account comes with a free contactless Mastercard debit in 18-grams of stainless steel. Once you’ve signed up and your identity has been verified, we’ll send your Business Metal card — in your choice of metallic shade — to the delivery address you’ve provided. Please note that we don’t currently offer credit cards at N26 for our business bank accounts.

Looking for a current account with cashback? With N26 Business Metal, earn 0.5% cashback on all your purchases made with your N26 Mastercard. This money is paid straight back into your account on a monthly basis.

Your N26 Business Metal account comes with travel insurance, courtesy of Allianz Assistance. Benefit from emergency medical coverage abroad for you, your spouse and your children, trip interruption or cancellation insurance, compensation for travel delays and baggage delays and baggage loss, mobile phone coverage in case of theft or damage, personal liability when travelling and purchase protection.

Find out more about what’s included in the Terms and Conditions.

Yes, it’s included with N26 Business Metal. You’re covered in case of theft or damage up to €2,000, regardless of whether you paid for your smartphone with your N26 card or not.

To open your free online N26 Standard bank account, you must meet the eligibility criteria. If you do, simply sign up via the N26 website, or download the N26 mobile app onto your compatible smartphone.

Opening your N26 Standard bank account requires no paperwork, and only takes a few minutes. Just remember to have an official ID ready—once we’ve verified your identity, your N26 Standard bank account will be ready to use right away.

Yes, as a premium Business Metal customer, you can enjoy a wide selection of business-orientated perks from brands such as Fiverr, Dropbox, Taxfix, and NordVPN. On top of this, benefit from a range of lifestyle deals and offers that support your general wellbeing.

The N26 Business Metal account costs €16.90 per month, and it’s a yearly subscription.

Yes, N26 is a collaborating entity with Social Security, which is essential to be able to process public benefits and pay some taxes, so you can process these types of benefits with N26 accounts. This means that it is possible to pay some taxes from your N26 account (such as self-employment tax, VAT, personal income tax, etc.), and to collect social benefits (such as pensions, sick leave, unemployment or family benefits, Minimum Living Income, etc.).

We continue to work to make our customers' day-to-day life easier through beautifully simple banking.

This means that you can receive benefits to which you are entitled to from the Spanish Social Security and SEPE directly on your N26 account (e.g. pension, sick leave, unemployment, Minimum Living Income or other types of benefits). In addition, if you are self-employed or a freelancer, you can also pay your self-employment fees using your N26 account.

Yes, N26 is a collaborating entity with Social Security, which is essential to be able to process public benefits and pay some taxes, so you can process these types of benefits with N26 accounts. This means that it is possible to pay some taxes from your N26 account (such as self-employment tax, VAT, personal income tax, etc.), and to collect social benefits (such as pensions, sick leave, unemployment or family benefits, Minimum Living Income, etc.).

We continue to work to make our customers' day-to-day life easier through beautifully simple banking.

You can easily switch your bank account to N26 from almost every Spanish bank! Just type in the name of your current bank, whether it’s Bankia, BBVA, Santander, ING, Sabadell or CaixaBank. Discover how to switch banks with our tool to facilitate the process.