The business bank account to spend and save in confidence

A colorful Mastercard that fits in with you

Grow your savings

0.1% cashback on all card payments

Stocks and ETFs the simple way

Full control of your business spending

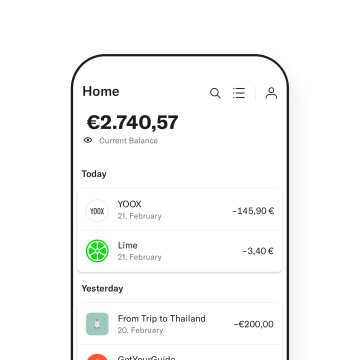

Expense tracking

Stay up to date with where your money goes each month, and learn from your spending habits with Statistics—a tool that automatically categorizes your expenses.

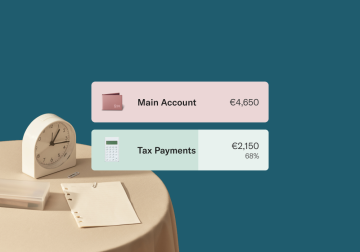

Rules for Spaces sub-accounts

Set up Rules to move money automatically between your Spaces sub-accounts and your main account—select a frequency, an amount, a date, and you’re good to go!

Your bank, always by your side

N26 Business Smart will make you forget what queuing at the bank once felt like. Access your business bank account at any time from your smartphone, or the WebApp.

All your documents in one place

Download your bank statements as PDF or CSV files in seconds. You can also add custom tags to your transactions to find them easily.

Move money from A to B with MoneyBeam and SEPA instant

Keeping your account secure

3D Secure

Add an extra layer of security to your online purchases with Mastercard 3D Secure, the most advanced two-factor authentication technology.

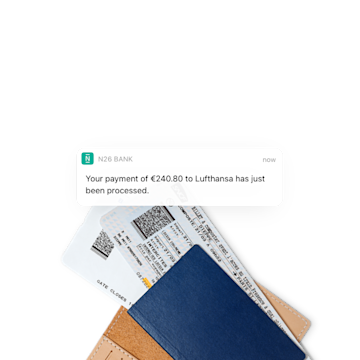

Real-time notifications

Receive push notifications on your smartphone after all account activity, and always stay informed of every incoming and outgoing transaction.

Smart ID

Access your bank account faster and safer by using your fingerprint or face ID when logging in.

Your funds are protected up to €100,000

We’re a fully licensed European bank, and whatever happens, your funds are protected up to €100,000.

Customer Support via phone and chat