Risk indicator for all N26 accounts.

1

/6

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

Grow your savings

With N26 Instant Savings, your savings can earn you interest* — and you can still dip into it whenever you need. No minimum or maximum deposit limits**. Join N26 and start growing your savings

Start saving now

Zero foreign currency fees

When it comes to business, small fees can add up fast. With N26 Business Go, enjoy fee-free card payments anywhere in the world and unlimited free ATM withdrawals abroad — in any currency.

Get comprehensive travel insurance

Go global thanks to an extensive insurance package from Allianz Assistance. Get coverage for travel delays, trip cancellation, trip interruption, and lost or stolen baggage. Plus, you’re also protected if you’re personally liable for damage to a third party or in case of a medical emergency — including emergency dental treatment — while you're traveling.

Free trades every month

Trade stocks and ETFs for free*** in your banking app. Start investing in a few taps, with flexible savings plans, and with as little as €1.

Discover Stocks and ETFs

Reinvest with 0.1% cashback

You’ll receive 0.1% cashback on any purchases made using your N26 Mastercard, calculated monthly and paid directly into your account.

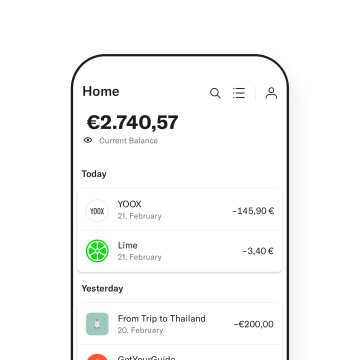

#Tag your transactions

#client, #office, #bizness… create your own personal hashtags and attach them to your transactions to organize them better.

Real-time activity notifications

Stay up to date. Get a push notification immediately after all account activity, including card payments, withdrawals and transfers.

3D Secured payments

Mastercard SecureCode gives you an extra layer of security that helps prevent fraud when making payments online with your N26 Business Go account.

Always get a breakdown of your spending

Your N26 Business Go account comes with built-in artificial intelligence that automatically categorizes and labels your purchases and gives you a clear visual overview of your finances. It’s all right at your fingertips in the Insights section of your N26 app.

Open Bank Account

Discounts on the tools you need

With brand-name partners like Grover, Bolt, and Booking.com, N26 Business Go comes with a wide range of continuously updated offers and discounts to help your freelance business grow – whether you’re working at home or abroad. Discover current perks in the N26 app.

Invest in yourself with 0.5% cashback

N26 Business Metal is much more than a premium plan for freelancers. Get a metal Mastercard and enjoy 0.5% cashback on all your purchases to give your business a boost. Plus, enjoy free withdrawals worldwide, zero foreign transaction fees in any currency, special partner offers, and extensive travel and lifestyle insurance.

Get Business Metal

Frequently Asked Questions

- You are over 18 and hold a valid form of ID (varies by location)

- You’re a freelancer or are self-employed (the account must be registered in your name, not your business’s name)

- You intend to use the account primarily for business purposes

- You’re not already an N26 user

- You reside in one of the following countries: Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Iceland, Ireland, Italy, Latvia, Lichtenstein, Lithuania, Luxembourg, The Netherlands, Norway, Portugal, Poland, Spain, Slovakia, Slovenia and Sweden.

N26 Business Go is a premium membership bank account purely intended for freelancers and the self-employed. It has all the same benefits of N26 Go, plus 0.1% cashback on purchases.

You may be eligible to open an N26 Business Go bank account if…

You’ll receive your 0.1% cashback on all Mastercard purchases made directly into your N26 Business Go automatically. This is calculated and deposited on a monthly basis. You don’t need to take any additional action!

N26 Business Go comes with an extensive insurance package provided by Allianz. This includes trip cancellation insurance, coverage for luggage loss and theft, and coverage for travel delays and medical emergencies while traveling.

No, it doesn’t have any foreign transaction fees. You can withdraw money for free worldwide, and pay anywhere Mastercard is accepted. With N26 Business Go, you’ll never pay foreign currency fees and we’ll never charge you for withdrawing money.

N26 Go is a personal account, not to be used for business purposes. In comparison, N26 Business Go is a business account for freelancers and the self-employed, who also benefit from 0.1% cashback on purchases in addition to all the benefits of N26 Go. At the moment, it’s only possible to hold one bank account per person with N26.

Yes, N26 is a collaborating entity with Social Security, which is essential to be able to process public benefits and pay some taxes, so you can process these types of benefits with N26 accounts. This means that it is possible to pay some taxes from your N26 account (such as self-employment tax, VAT, personal income tax, etc.), and to collect social benefits (such as pensions, sick leave, unemployment or family benefits, Minimum Living Income, etc.).

We continue to work to make our customers' day-to-day life easier through beautifully simple banking.

This means that you can receive benefits to which you are entitled to from the Spanish Social Security and SEPE directly on your N26 account (e.g. pension, sick leave, unemployment, Minimum Living Income or other types of benefits). In addition, if you are self-employed or a freelancer, you can also pay your self-employment fees using your N26 account.

You can easily switch your bank account to N26 from almost every Spanish bank! Just type in the name of your current bank, whether it’s Bankia, BBVA, Santander, ING, Sabadell or CaixaBank. Discover how to switch banks with our tool to facilitate the process.

TIN 0%, APR: -2.35% for a scenario in which a daily balance of €5,000 is maintained consistently for 1 year, applying an annual nominal interest rate of 0% and the monthly cost of the account of €9.90/month. The settlement of the account is made monthly.

N26 Bank AG, Sucursal en España with NIF W2765098E, is a permanent establishment in Spain of the German entity N26 Bank AG, registered at the Bank of Spain with entity number 1563 and head office at Calle de Don Ramón de la Cruz, 84, 28006 Madrid. N26 Instant Savings account from 0 euros and without limit of amount.

The interest rates vary based on your membership. Interest rates per membership are variable and subject to change any time. Learn more here.

***Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.