Risk indicator for all N26 accounts.

1

/6

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

The free online bank account from N26

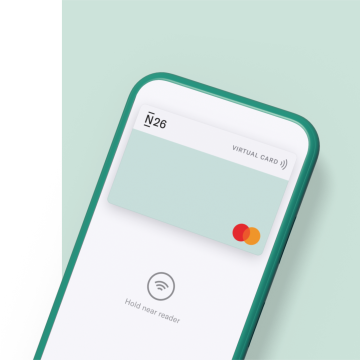

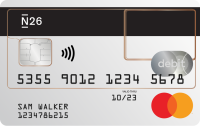

Every N26 online bank account comes with a virtual Mastercard debit card, accepted worldwide. Use your app to set daily spending limits, lock or unlock your card and reset your PIN anywhere in the world, 24/7.

Your N26 account with Spanish IBAN

We’re a licensed bank, 100% digital and secure. Every N26 bank account is guaranteed by the Compensation Scheme of German Banks up to €100,000.

Money management made easy

3D Secure for online payments

Shopping online? Your free bank account is equipped with Mastercard’s 3D Secure (3DS)—an advanced two-factor authentication step that keeps your money safe.

3D Secure

Real-time push notifications

Stay on top of all account activity with instant push notifications on your phone. Be alerted in seconds for every incoming and outgoing payment.

Biometric log in

Always forgetting passwords? Quickly and securely log in to your free bank account by using fingerprint identification or FaceID to verify your identity.

Free instant bank transfers

Make free real-time bank transfers to other N26 customers with MoneyBeam, and receive incoming payments in seconds with SEPA Instant Credit Transfers.

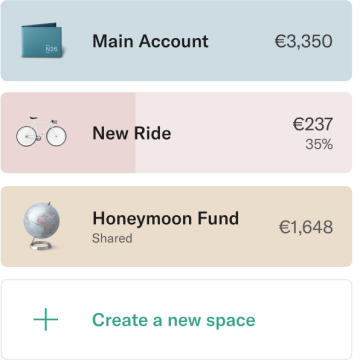

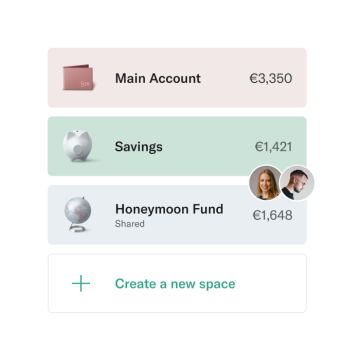

How to save money with Spaces

Make saving a breeze with N26 Spaces and Shared Spaces sub-accounts, available with every N26 premium subscription. Automatically stash funds aside from your main account with Rules, or turn on Round-Ups to save up the spare change in your chosen space with every card transaction.Living in a shared household, or making group plans? Try creating a Shared Space to easily manage your money together with other N26 customers.

Discover the premium feature spaces

Premium plans for digital natives

Sometimes you need more than just a card for accessing your money. N26 premium memberships offer additional benefits such as free worldwide ATM withdrawals, travel insurance and mobile theft cover.

Discover our Business Mastercard for freelancers

N26 Business is free to open online, with no account management fees. It’s the easiest business bank account to open if you’re a freelancer or you’re self-employed.

- No minimum deposit

- 0.1% cashback on all purchases

- Fast sign-up process

- Free and unlimited SEPA transfers

2013

Market Launch

24

Countries

~1,500

Employees

~1.8 B $

Invested

Compare Accounts

Open a new N26 bank account from your phone or computer in an easy, paperless signup process.Frequently asked questions

- Be at least 18 years old

- Be a resident of a supported country

- Have a compatible smartphone

- Not already have an existing N26 account

- Have a supported ID document, applicable to the country that you’re a resident in.

Launched in 2013, N26 is a bank operating with a full European banking license. We currently operate in 24 markets worldwide and have over 8 million customers.

As a bank, N26 is supervised by the Financial Markets Regulator and meets all European regulatory requirements. Our clients' funds are guaranteed up to €100,000 by the Deposit Protection Fund. In addition, the N26 app has many features to ensure the security of its users' bank accounts and data.

To open an N26 Standard bank account, you need to:

To open your free online N26 Standard bank account, you must meet the eligibility criteria. If you do, simply sign up via the N26 website, or download the N26 mobile app onto your compatible smartphone.

Opening your N26 Standard bank account requires no paperwork, and only takes a few minutes. Just remember to have an official ID ready—once we’ve verified your identity, your N26 Standard bank account will be ready to use right away.

Your N26 Standard bank account is 100% mobile and free of charge, adding extra flexibility and convenience to your everyday. No more visiting bank branches, waiting in queues, or inconvenient opening hours. You can send, receive, and manage your money all in one app for free—from anywhere, at any time.

You’ll get a free Mastercard virtual card to pay with your smartphone in-stores, online, and in apps using Apple Pay or Google Pay. You can also withdraw cash for free 2 times per month at any NFC-enabled ATM with the contactless symbol. Plus, enjoy learning about your spending habits with Insights, a smart tool that automatically categorizes your spending in real time.

The standard N26 bank account is free and doesn’t charge any opening or maintenance fees. The N26 Smart bank account costs €4.90 per month, the N26 Go bank account costs €9.90 per month and the N26 Metal account is available for €16.90 per month, with a 12-month commitment period. To open an N26 account, no deposit or minimum income is required.

Yes, N26 is a collaborating entity with Social Security, which is essential to be able to process public benefits and pay some taxes, so you can process these types of benefits with N26 accounts. This means that it is possible to pay some taxes from your N26 account (such as self-employment tax, VAT, personal income tax, etc.), and to collect social benefits (such as pensions, sick leave, unemployment or family benefits, Minimum Living Income, etc.).

We continue to work to make our customers' day-to-day life easier through beautifully simple banking.

You can easily switch your bank account to N26 from almost every Spanish bank! Just type in the name of your current bank, whether it’s Bankia, BBVA, Santander, ING, Sabadell or CaixaBank. Discover how to switch banks with our tool to facilitate the process.

N26 Bank AG, Sucursal en España with NIF W2765098E, is a permanent establishment in Spain of the German entity N26 Bank AG, registered at the Bank of Spain with entity number 1563 and head office at Paseo de la Castellana 43, 28046, Madrid. N26 Metal Instant Savings account from 0 euros and without limit of amount.

These statements are intended to provide general information and do not constitute investment advice or any other advice on financial services and financial instruments such as Stocks, ETFs and Ready-made funds. These statements also do not constitute an offer to conclude a contract for the purchase or sale of Stocks, ETFs and ready-made funds. Stocks, ETFs and Ready-made funds can be subject to high fluctuations in value. A decline in value or a complete loss of the money invested are possible at any time. The values depicted are fictional and for illustrative purposes. The numbers of available Stocks and ETFs can vary per market.

*1.30% AER (1.50% annual NIR). With this interest rate, if you maintain a daily balance of 100,000 euros in your N26 Metal Instant Savings account for a period of 12 months, you will obtain a total gross interest of 1,500 euros. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://n26.com.

**0.50% AER (0.50% annual NIR) with N26 Standard. With this interest rate, if you maintain a daily balance of 100,000 euros in your N26 Instant Savings account for a period of 12 months, you will obtain a total gross interest of 500 euros. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://n26.com.

**0.50% AER (0.50% annual NIR) with N26 Smart. With this interest rate, if you maintain a daily balance of 100,000 euros in your N26 Instant Savings account for a period of 12 months, you will obtain a total gross interest of 500 euros. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://n26.com"

**0.50% AER (0.50% annual NIR) with N26 Go. With this interest rate, if you maintain a daily balance of 100,000 euros in your N26 Instant Savings account for a period of 12 months, you will obtain a total gross interest of 500 euros. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://n26.com

***Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

*****Eligible spending: Detailed T&Cs for customers who sign up before July 17 and after October 15 can be found here: https://n26.com/hb-ex