3D Secure protection for more peace of mind

3D Secure (3DS) adds an extra layer of protection to online shopping. With 3DS enabled, you have 2-step authentication on every online purchase—so no payments will ever go through unless you authorize them yourself.

What is 3D Secure protection?

3D Secure is an additional step you can enable to happen every time a card transaction is made online. It enhances security measures for shoppers and vendors alike. When you turn on 3D Secure, you’ll be asked to validate every transaction with your PIN code.3D stands for “three domains.” The first is the card issuer; second, the retailer receiving the payment; and third is the 3DS infrastructure platform that acts as a secure go-between for the consumer and the retailer.

3D Secure—how does it work?

When you make a payment for an online purchase, 3DS technology gauges if further safekeeping is needed to make sure that you are the rightful card owner. If so, you’ll be directed to a 3DS page and asked for a password or PIN. Simultaneously, your bank generates a one-off PIN and sends it to your phone via SMS. This is the PIN you’ll need to enter before you can complete the transaction.

Advantages of 3D Secure technology

The process was developed by Visa and is now licensed to Mastercard, so most major card providers already use this technology. And just because 3D Secure is enabled doesn’t mean you’ll always have to enter a PIN—you’ll only have to complete this step if your bank notices a possible security issue.Is there a downside to 3DS?

Some users can find it difficult to tell if a 3D Secure pop-up is legitimate, as they can direct you away from the payment site. Users often mistake these pages for phishing scams. But 3D Secure only uses one-off codes, so none of your other details should ever be at risk. 3DS also adds time on to the checkout process when you verify yourself—but isn’t keeping your information safe worth a few extra seconds?Encrypt your details with Mastercard SecureCode

Mastercard SecureCode is a free 3D Secure security tool, similar to using a PIN at a checkout. When using your Mastercard online, you may need to identify yourself as the authorized card owner. With SecureCode, your bank generates a one-time code that is sent to your mobile phone via SMS. Enter the code and the payment is complete. Mastercard encrypts all your card and personal details, so it is never passed on to third parties. All N26 debit Mastercards come with 3DS technology.

Activate 3D Secure with N26

At N26 we offer free 3D Secure protection using Mastercard SecureCode with every account. 3D Secure is automatically triggered as soon as you activate your N26 Mastercard debit card through the app. When you make a card payment online, 3D Secure confirms the transaction in seconds, notifying you in a push notification.Whether you’re using your virtual N26 Mastercard, a brightly colored plastic card, or a sleek card made of stainless steel, you’ll always be protected.

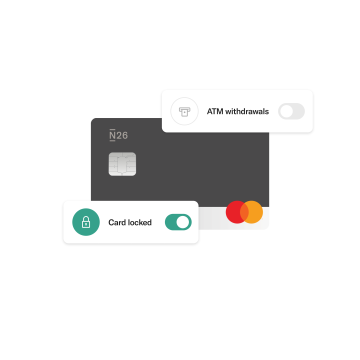

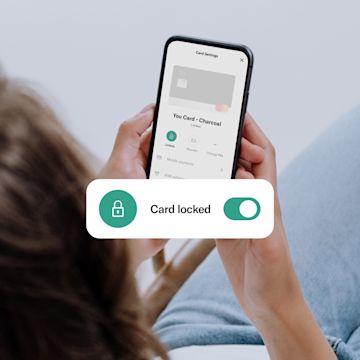

Further security with the N26 app

In addition to 3DS, your N26 banking app uses three additional layers of high-tech security for maximum protection.With secure login, your app login requires a username and password, fingerprint ID, or face recognition. Then, every time you make a transfer, you’ll be asked for your personal 4-digit PIN.Plus, receive push notifications whenever money goes in or out of your account, so you’re always aware what’s going on with your balance.

Full identity protection with Customer Support

We never discuss account details with our customers without first confirming their identity. We’ll always ask security questions with answers unique to you to make sure we’re talking to the right person.

Also, we’d never ask you for card details over the phone or chat—always remember to keep this information private.

For N26 banking support, contact our Customer Support specialists through the in-app chat function or by emailing support@n26.com.

Visit our Support Center

Find a plan for you

N26 Standard

The free* online bank account

Virtual Card

€0.00/month

A virtual debit card

Free payments worldwide

Deposit protection

POPULAR

N26 Go

The debit card for everyday and travel

€9.90/month

Up to 5 free withdrawals in the Eurozone

Flight and luggage delay cover

Medical emergency cover

Winter activities insurance

Pandemic coverage

N26 Metal

The premium account with a metal card

€16.90/month

An 18-gram metal card

Up to 8 free withdrawals in the Eurozone

Purchase protection

Phone insurance

Dedicated N26 Metal line

This is a one-time use code generated through Mastercard SecureCode technology, for added security for card holders. This 3D Secure process is an additional way to authenticate the identity of the card owner by providing the code at checkout. It is usually sent via SMS to the user’s cell phone.

3D Secure is an additional layer of card holder authentication on online card transactions. If a card holder is making a payment online and the bank detects that the transaction might be suspicious, the bank card issuer redirects them to a 3DS page for extra verification. The bank then asks them to provide a password or PIN. Once this is entered, the purchase is completed.

Two examples of 3D Secure protection platforms are Visa Secure and MasterCard SecureCode. Both use 3DS technology as a further layer of consumer protection, to shield card holders from fraud and counterfeiting.

When making an online purchase with your Mastercard, during the checkout process you may be prompted to give a unique passcode. This is a one-time passcode (or OTP) and it’s generated by your bank and sent to your cell phone via SMS.

To quickly check if a merchant or vendor you are making a payment with is 3D Secure compliant, look for the Verified by Visa or Mastercard SecureCode logo on their site.