Discover our account switching service

Change banks in just 10 minutes

Switching to N26 isn’t just easy—it’s also fast and free. That’s because as a fully digital bank, we won’t bother you with one bit of paperwork—all you’ll need is your desktop computer and your bank details. Read on to find out how to switch banks in just 10 minutes with the N26 bank account switching service!

Risk indicator for all N26 accounts.

1

/6

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

Things to do before switching your bank

Things to do before switching your bank

Before waving goodbye to your current bank, we recommend taking a few steps to make sure the transition is as easy as possible.Don’t rush to close your account

First of all, make a list of all your regular direct debits, bills and scheduled payments that are charged on your account. Once you have your list, make sure all of them are moved to your new account before closing the old one.Take note of your new IBAN and transfer some money

Avoid going into the red—make sure you have enough money in your account when your direct debits are due to be collected.Remember to transfer your salary

This means you won’t have to worry about transferring money to your new account regularly, if you decide to keep your old one open.Try out our bank account switching service

If you’re not a fan of banking bureaucracy, then you’re in luck—the N26 bank account switching service takes care of everything for you. All you have to do is decide what bills and direct debits you want to transfer to N26, and we’ll take care of the rest.Switch banks the easy way with N26

We’ve partnered with finleap to make switching accounts easier than ever. Here’s how it works:

- Open an N26 account on the N26 mobile or web app

- Head to My Account and scroll to Switch to N26. Alternatively, use the N26 bank account switching website, and log in with your old bank details.

- finleap will automatically recognize your direct debits, incoming payments and standing orders—simply select the ones you want us to transfer to your N26 account.

- Confirm the account switch—and you’re done!

Switch banks now

Go premium to access top perks, insurance, and more

With an N26 Smart, Go, or Metal account, there’s never been a better time to go premium. Get 10 Spaces sub-accounts, try Shared Spaces to spend and save with friends, and enjoy discounts with top retailers thanks to N26 Perks. Plus, our N26 Go account includes comprehensive travel insurance, while N26 Metal comes with an elegant stainless steel Mastercard, smartphone insurance, free instant transfers, and even more exclusive perks. So don’t wait—open your N26 premium account today.

View plans

Switch to a secure online bank

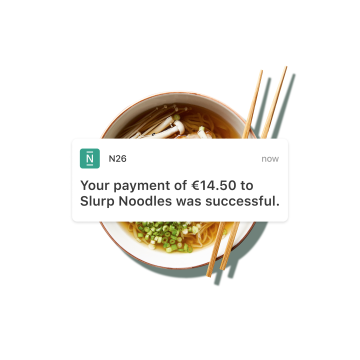

As a fully licensed bank, your security is our top priority. That’s why we’ve put top security measures in place to keep your money safe. Alongside 3D Secure technology that prevents unauthorized access to your bank account, you can log in to your N26 app with fingerprint ID or face recognition. And while push notifications will always keep you updated about incoming and outgoing payments, you can rest assured your deposits are protected up to €100,000 by the German deposit protection scheme.

N26 Support—we’re here to help

Whether you’re experiencing technical issues, or just have a question about your bank account, we’re here for you. Simply contact our team of specialists via our chat function right in your N26 app. Plus, you can discover helpful information on the Support Center, 24/7. Got questions about opening an N26 account and switching banks? Check out our FAQ below!

Visit our Support Center

Find out what documents you need to open your N26 account

We aren’t huge fans of paperwork — or of making you waste your time looking for the information you need. To make it easier for you, we explain here in detail what identity documents you need to open your N26 bank account, depending on your nationality.

See list of documents

2013

Founded

ES IBAN

Local

~8 Million

Customers

~1.8 B $

Funding

N26 Bank AG, Sucursal en España with NIF W2765098E, is a permanent establishment in Spain of the German entity N26 Bank AG, registered at the Bank of Spain with entity number 1563 and head office at Paseo de la Castellana 43, 28046, Madrid. N26 Metal Instant Savings account from 0 euros and without limit of amount.

These statements are intended to provide general information and do not constitute investment advice or any other advice on financial services and financial instruments such as Stocks, ETFs and Ready-made funds. These statements also do not constitute an offer to conclude a contract for the purchase or sale of Stocks, ETFs and ready-made funds. Stocks, ETFs and Ready-made funds can be subject to high fluctuations in value. A decline in value or a complete loss of the money invested are possible at any time. The values depicted are fictional and for illustrative purposes. The numbers of available Stocks and ETFs can vary per market.

*1.30% AER (1.50% annual NIR). With this interest rate, if you maintain a daily balance of 100,000 euros in your N26 Metal Instant Savings account for a period of 12 months, you will obtain a total gross interest of 1,500 euros. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://n26.com.

**0.50% AER (0.50% annual NIR) with N26 Standard. With this interest rate, if you maintain a daily balance of 30,000 euros in your N26 Instant Savings account for a period of 12 months, you will obtain a total gross interest of 150 euros. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://n26.com.

**0.30% AER (0.50% annual NIR) with N26 Smart. With this interest rate, if you maintain a daily balance of 30,000 euros in your N26 Instant Savings account for a period of 12 months, you will obtain a total gross interest of 150 euros. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://n26.com"

**0.10% AER (0.50% annual NIR) with N26 Go. With this interest rate, if you maintain a daily balance of 30,000 euros in your N26 Instant Savings account for a period of 12 months, you will obtain a total gross interest of 150 euros. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://n26.com

FAQs

Requesting your account switch only takes 10 minutes. Once you’ve submitted your request, it will take 5-7 business days to contact all your payment partners. However, you may need to factor in additional time to process certain changes for future payments.

Qwist GmbH (formerly known as finleap connect GmbH) is our partner who offers the account switching service platform. Using Qwist via the N26 link is easy, free, and 100% digital.

Currently, the account switching service is only available in Germany, Austria, and Spain. Unfortunately, IBANs from other countries cannot be processed yet.

You can easily switch your bank account to N26 from almost every Spanish bank! Just type in the name of your current bank, whether it’s Bankia, BBVA, Santander, ING, Sabadell or CaixaBank. Discover how to switch banks with our tool to facilitate the process.

Yes. You also have the option to transfer all your direct debits, incoming payments, and standing orders manually. To do this, you’ll need to contact the relevant companies yourself. In Germany, every bank is required to offer an account switching service, however this service is usually not free.