N26 Standard — the free bank account you’ll love

Ideal for your everyday needs. Get a virtual card immediately, two free domestic ATM withdrawals per month, and 24/7 chat support.

You deserve hassle-free banking

Here’s a quick look at what you get with Standard.

Free virtual card

Pay with a tap of your phone. You may also order an optional physical Mastercard debit card for €10.

Discover your Mastercard

100% digital banking

Get your free online bank account in minutes with no paperwork.

Open bank account

24/7 chat support

Chat to Customer Support in English, French, German, Italian, or Spanish — right in the N26 app.

Visit Support Center

Free ATM withdrawals

Make up to two free domestic ATM withdrawals per month.

Learn about withdrawals

Let’s make this perfectly clear

If you prefer a card you can hold in your hand, order the iconic N26 transparent card for €10.

N26 is simply secure

Pay it safe — we make sure your account is in safe hands.Security your way

Effortlessly change your PIN, set spending limits, and hide your data in the app.

Extra layers of protection

Biometric authentication and 3D secure keep your account and your money safe.

Lock and unlock your card

Instant control over your card is in your hands.

Bank, save, and invest — in one app

Get interest** on your savings, invest in stocks and ETFs,*** buy crypto,**** and manage your everyday banking — all with N26.

Explore our savings account

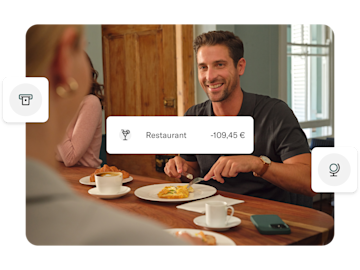

Keep track of your budget

The N26 app automatically categorizes your spending to make it easier for you to stay on budget. You also get to see your upcoming payments at a glance so there’s no surprises.

Discover Spaces

Travel the world with one eSIM

Set up your travel eSIM once and get affordable data for 100+ destinations.

Get travel eSIM

Open your account now

Open your N26 bank account in minutes and with no paperwork — from your phone or our website.

Want more? Upgrade to N26 Smart, N26 Go, or Metal to enjoy Spaces sub-accounts, savings automations, insurance, and more.

Open a free bank accountCompare N26 accounts

**The interest rates vary based on your membership. Interest rates per membership are variable and subject to change any time. Learn more here.

***These statements are intended to provide general information and do not constitute investment advice or any other advice on financial services and financial instruments such as Stocks, ETFs and Ready-made funds. These statements also do not constitute an offer to conclude a contract for the purchase or sale of Stocks, ETFs and ready-made funds. Stocks, ETFs and Ready-made funds can be subject to high fluctuations in value. A decline in value or a complete loss of the money invested are possible at any time. The values depicted are fictional and for illustrative purposes.

Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

****The market for crypto assets constitutes a high risk. A complete loss of the money spent is possible at any time. N26 Crypto is powered by Bitpanda Asset Management GmbH.

- Be over the age of 18

- Live in an eligible country

- Have your own smartphone

- Not yet have an account with N26

- Have a valid ID

- Be able to verify yourself in one of our supported languages: English, German, Spanish, Italian, or French

You must meet the following requirements to open an N26 Standard account:

First, you must meet all the requirements to open your free online bank account with N26. If you do meet all the requirements, then simply sign up for your account via the N26 website or download the app on your smartphone.

There’s no paperwork when you open your N26 Standard online account and it only takes a few minutes. Just have your valid ID on hand. As soon as you’ve verified your identity, you’ll receive your virtual N26 Mastercard and can start using it right away.

N26 Standard is a 100% online free bank account that allows you to manage your daily finances all in one place. Transfer, receive, and manage your money online whenever and wherever you are. Accept SEPA Instant Credit transfers from other banks at no extra cost and see the money in your N26 Standard account in seconds. Plus, MoneyBeam lets you send, receive, and request money among other N26 customers, all in real time and completely free.

As soon as you open your account, you’ll receive your virtual N26 Mastercard. Link it to Apple Pay or Google pay and use it for contactless payments in stores, online, or in apps. You can even make up to two free ATM withdrawals per month at any ATM equipped with a contactless reader. If you'd rather have a physical debit card, that's no problem — just order your transparent N26 Mastercard for a one-time delivery fee of €10.

Plus, thanks to the Insights feature, you'll also learn more about your spending habits, which can help you manage your finances even better.

N26 Standard is a free bank account. There are no account maintenance fees or minimum deposit amounts for this online account.

At N26 we offer the free N26 Standard account. You get an account with no maintenance fees or minimum balance. You also get a virtual Mastercard, which you can use for online purchases and mobile payments via Apple Pay or Google Pay.

You also have the option to open a paid N26 account and get access to more features and benefits. N26 Smart lets you add up to 10 sub-accounts and use innovative savings features, while N26 Go offers travel insurance benefits and free international withdrawals. And with N26 Metal, you get our ultimate premium account, including an elegant stainless-steel Mastercard, smartphone insurance, and priority customer support.

Open your fully mobile, online bank account in minutes — directly from your phone — and start banking from anywhere.

Yes — with N26 Standard, you get a bank account without any maintenance fees. This means that you don’t pay a monthly fee for the account, although you may also incur other costs when using your N26 account. For example, there might be costs for an overdraft interest payment, chargeback fees for direct debits that bounce, or foreign transaction fees. That means that the costs for your N26 account depend on how you use your account and which services you use.

If you’re looking for an account with no maintenance fees and no minimum deposit, our N26 Standard account is perfect for you. You'll benefit from a fully online bank account with a virtual Mastercard that you can use to pay via Apple Pay or Google Pay — both online and in stores. You'll also enjoy access to the Insights feature, which helps you keep better track of your spending and find places where you can save more.

However, with an N26 account, fees may apply for various services. These include, for example, fees for direct debits that bounce or the interest that accrues on an overdraft. You can find more information about the costs of our accounts and services in our detailed price list.