Banking that’s always there for you

Our comprehensive business continuity program helps us ensure that you have a seamless and uninterrupted banking experience. Learn more here.

More than an app: A fully licensed bank

N26 is a fully licensed German bank. That means we have the same security regulations as any other bank. It also means your funds are protected up to €100,000 by the German Deposit Protection Scheme. But our security measures don't stop there.

Secure banking designed for today

Fully hosted in the cloud, we use artificial intelligence and machine learning to protect your account, fight financial crime and card fraud. It’s security technology you can trust.

You can always pay it safe

From biometric authentication to extra layers of protection like 3D Secure, you can always spend confidently with N26. Want extra peace of mind? Your account can only be paired with your own smartphone, and you get real-time push notifications on all account activity — no surprises.

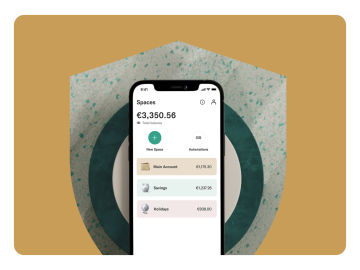

Your money is in safe hands — yours

Get full control over the security of your account with customizable settings in your N26 app. Lock and unlock your card, change your PIN, set spending limits, and hide your sensitive data from prying eyes — instantly and effortlessly. It’s security your way.

N26 — Simply Secure

At N26, security is a priority. Which is why, no matter which account you have, it’s always protected by innovative security measures and features.How N26 keeps you and your money safe

Deposit protection scheme: why your money is protectedLooking for reassurance that your money is protected? Deposit protection schemes help secure the money in your bank account.

Money laundering: how banks stay one step ahead of criminal activityMoney laundering accounts for billions each year. Here’s how banks fight back with anti-money laundering processes to detect suspicious activity.

5 tips for secure mobile bankingFrom deactivating bluetooth to locking your screen, we’ve got 5 essential tips for you to enjoy mobile banking with peace of mind.

Security at N26

N26 is a 100% mobile bank. We have a full European banking license, and offer a free bank account, plus premium accounts such as N26 Smart, N26 Go and N26 Metal. For freelancers and the self-employed, we also offer business accounts that help you manage your business finances. All bank accounts are accessed online, allowing you to manage your banking transactions easily and securely via your smartphone—in real-time, and with no annoying paperwork.

N26 operates with a full European banking license, which protects deposits up to €100,000, as directed under EU law. With 3D Secure and Mastercard Identity Check, as well as fingerprint and face recognition, your online payments are even better protected.

We want to offer you a secure banking experience—today and tomorrow. That’s why we work closely with financial institutions and communicate with authorities on a regular basis.

In addition to your N26 bank account’s advanced security features, you can take steps to further increase your security. Never write down your passwords or PIN, only log into your account from a device you trust, and only use your account when you have a secure WiFi connection. Additionally, to protect yourself from online fraud, avoid clicking on links in emails or text messages that seem suspicious. For more information on how to spot fraudulent behavior—and maintain your online banking security—check out our Security Guide.

N26 is a 100% mobile, fully licensed bank, which means that we provide the same level of security and follow the same regulations as traditional banks. Thanks to our European banking license, your money is protected up to €100,000 by the German Deposit Protection Scheme. At N26, we take extensive steps to keep you safe when banking online. 2-Factor-Authentication protects your account from being accessed by others, while 3D Secure technology encrypts your personal payment information when you shop online.

As an N26 customer, you’ll always have full control of and access to your funds. Plus, you can personalize your security settings, wherever you are. Lock or unlock your card, set spending limits, and much more with just a few taps in your N26 app.

You can reach N26 Customer Support everyday from 7 a.m. CET to 11 p.m. CET via the support chat directly in your N26 app—even on Sundays and bank holidays.

The in-app chatbot can answer simple questions, and if you need more help, additional information is available at our N26 Support Center.

Premium customers also benefit from phone support via a direct hotline. Learn more about our bank accounts here.