The business account for freelancers and self-employed

Earning interest on your savings

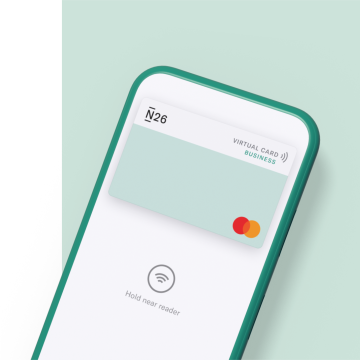

A free N26 Mastercard for your virtual wallet

Earn 0.1% cashback with your N26 card

Stay updated in real-time

Organize your business expenses

No hidden fees

Your free business bank account has zero surprise fees — no minimum deposit threshold, no recurring monthly fees, and no other hidden costs.

Top-level security

N26 uses biometric recognition and multifactor authentification with Mastercard 3D Secure. That means that no one else gets access your account.

Make accounting easier than ever

Tag your transactions with custom categories and keep track of #TravelExpenses #IndependentProjects, or anything else you need for your work.

Up to €100,000 deposit protection

N26 has a full European banking licence, so our customers' deposits are protected up to €100,000 by the German Deposit Protection Scheme.

Manage your money seamlessly with Spaces

Download your statements

Make your life easier at tax time — download and print your account statements and transaction history at any time.

Bank online with the WebApp

Make your life easier at tax time — download and print your account statements and transaction history at any time.

N26 Business Metal — a bank account made for your business

Get help in your language

Open your N26 Business bank account.

Signing up takes minutes. Get a new N26 business bank account with our simple, paper-free process — right from your phone or computer.Frequently asked questions

- You’re 18 years old or older

- You’re a freelancer or self-employed individual, planning to use this account for professional purposes.

- You aren’t already an N26 account holder.

- You live in a country where N26 operates—Germany, Austria, Belgium, Denmark, Estonia, Finland, France, Greece, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Norway, Netherlands, Poland, Portugal, United Kingdom, Slovakia, Slovenia, Spain, Sweden, Switzerland or the United States.