The free business bank account for self-starters

Go global with a Mastercard debit card

Start earning interest

Stay on top of business in real-time

Stocks and ETFs the simple way

More than a free business bank account

0.1% cashback

Spend money to make money—for every purchase with your N26 Mastercard, you’ll receive 0.1% cashback that we’ll deposit into your account every month.

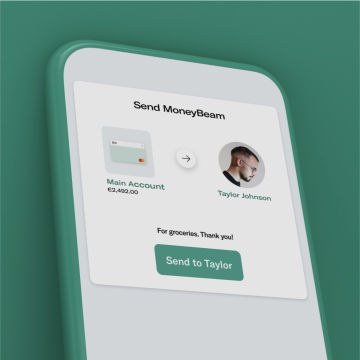

Push notifications

N26 offers instant push notifications so you’ll always know when funds enter or leave your free business bank account.

Personalized hashtags

Curious about specific expenses? Create your own hashtags and assign them to your transactions so you can see exactly where your money is going.

Insights

View your overall monthly spending at a glance. Insights automatically categorizes your spending, helping you optimize your budget.

Reach your savings goals with Spaces

Relax knowing your business is secure

Thanks to Mastercard 3D Secure, your online payments are protected with two-factor authentication. Enjoy an advanced level of security thanks to biometric verification via fingerprint or facial recognition, making sure no one can access your account without consent.

Deposit protection

N26 is a fully licensed European bank. This means that the balance of your free business bank account is insured up to €100,000.

Invest in yourself with N26 Business Metal

Our Customer Support is here for you

Desktop access via N26 WebApp

Prefer to use your desktop? No worries. You can access your free business bank account on your computer via the N26 WebApp.

Transaction lists and balance statements

Tax time? Easily download your transaction list from the N26 WebApp. Balance statements can also be found and downloaded directly from the N26 app.