N26 Business Standard

The free business bank account for freelancers

Stay on top of your daily business finances with one easy app to receive, send, and manage all payments—anytime and anywhere. Open your free* business bank account online in minutes—no minimum balance, no account fees, and no paperwork required.

*Up to €50,000 balance, after which a deposit fee of 0.5% p.a. may apply. Please find the Terms & Conditions here.

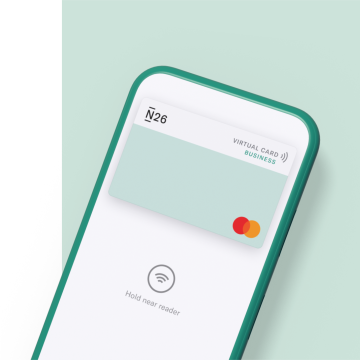

Your free Mastercard virtual card

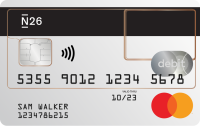

Enjoy fast and secure contactless payments with your free debit Mastercard virtual card, accepted worldwide. Start spending right away with Apple Pay or Google Pay on your smartphone, and get up to 2 free cash withdrawals per month at NFC-enabled ATMs.Prefer to keep a physical card at the office? No worries—simply order an optional physical card for a one-off delivery fee of €10.

Start earning interest

No deposit limits,** simple conditions, and full flexibility. Discover N26 Instant Savings, the easy-access savings account available at no extra cost in the N26 app.

Discover Instant Savings

Enjoy 0.1% cashback every month

Earn 0.1% cashback every time you pay with your N26 Mastercard, and automatically get it deposited into your free business bank account each month. When you’re growing your business, every little bit counts.

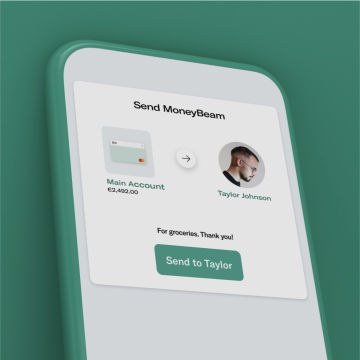

Get paid instantly with zero fees

Waiting for payment from a client? Receive, send or request money from other N26 customers in real-time with MoneyBeam, or use SEPA Instant Credit Transfers to receive incoming payments from other banks in seconds. Plus, with immediate push notifications on your phone after all account activity, you’ll know about every incoming or outgoing payment, direct debit and card transaction as it happens.

Plan ahead with N26 Spaces

Setting money aside for taxes, or saving for a future project? Effortlessly organize your business finances with Spaces sub-accounts, available with an N26 premium subscription.Create up to 10 Spaces, give each space a name, then easily put money aside to budget in real-time. Set Rules to automate your savings, or try Round-Ups to save up the spare change every time you pay by card.

Stocks and ETFs the simple way

How about investing in your future without having to leave your banking app? Trade stocks and ETFs for free***, in just a few taps, and with as little as €1.

Discover Stocks and ETFs

Bank online 24/7

Access your free business bank account online via the N26 mobile app or N26 WebApp on desktop—anytime, and anywhere.

Tax preparations made easy

Export your transaction list as a CSV or PDF file from the N26 WebApp on desktop, or download your bank statements in your N26 mobile app.

Discover N26 Business Metal, with 0.5% cashback

Upgrade to our most premium account for freelancers and the self-employed, packed with 0.5% cashback on all purchases, fee-free payments in all currencies, and a travel, lifestyle and mobility insurance package that includes smartphone coverage. Enjoy that extra peace of mind, wherever your business takes you.

Get Business Metal

N26 Support speaks your language

Need a hand with your free business bank account? Whatever the issue, our Customer Support specialists are ready to assist you in English, French, German, Italian, and Spanish. Reach us via the live chat in your N26 app, or visit the N26 Support Center to find answers to our most frequently asked questions.

Visit our Support Center

The free business bank account for freelancers

Join over 7 million customers and discover easy, flexible business banking in one app. Compare our premium business bank accounts, or sign up for your free business bank account online in minutes. No minimum balance, no account fees, and no paperwork. Just beautifully simple banking that works, so you can too.The N26 Business Standard bank account is a flexible and free business bank account that simplifies business banking. Get a free debit Mastercard virtual card to spend in stores, online or in apps, and easily manage all your business finances in one app. You’ll also enjoy free ATM withdrawals, intelligent spending analytics with Statistics, and free instant bank transfers with N26 MoneyBeam and SEPA Instant Credit Transfers. For full details and availability, see our T&Cs.

Separating your business finances from your personal banking is a smart move for freelancers and the self-employed. The N26 Business Standard free business bank account can help you to easily keep track of your business expenses and income in one place, which will make bookkeeping and accounting easier as your business grows. Enjoy convenient 24/7 banking with N26 Business Standard, and manage your business finances on-the-go directly on your smartphone, or via the N26 WebApp on desktop.

Opening your N26 Business Standard bank account is a quick, easy and paperless online process that takes minutes. All you need is your smartphone and a photo ID to get started—there’s no minimum deposit amount. Once we’ve verified your identity, you can begin using your free business bank account right away.

You can find our eligibility criteria and more information at our Support Center.

You must use your personal first and last name to open your N26 Business Standard bank account. This free business bank account is designed for freelancers and the self-employed doing business under their own name—your company name cannot be on the account or card.

Your 0.1% cashback is calculated for every purchase made with your N26 Mastercard. We’ll automatically deposit your cashback into your N26 Business Standard bank account each month—there’s no extra steps for you to take.

No, you cannot hold two N26 bank accounts at the same time. If you already have a personal account with us and wish to open a free business bank account, you must close your personal N26 bank account first before signing up for an N26 Business Standard bank account.

Because the N26 Business Standard bank account is designed for business banking, you’re expected to use it mainly for business purposes—including spending related to your business, such as paying the rent, or traveling for work. However, you may also use your free business bank account for personal spending, as long as these are a minority compared to your business spending.

Availability: Portugal, Ireland, Greece, Netherlands, Belgium, Luxembourg, Finland, Latvia, Estonia, Lithuania, Slovakia, Slovenia

The interest rates vary based on your membership. Interest rates per membership are variable and subject to change any time. Learn more here.

** The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

*** Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.