N26 Business

Business banking for freelancers and the self-employed

N26 Business is the free bank account for freelancers and the self-employed. Earn 0.1% cashback on all purchases you make, and enjoy free card payments worldwide. Open yours in minutes, and start making mobile payments before your physical card arrives.

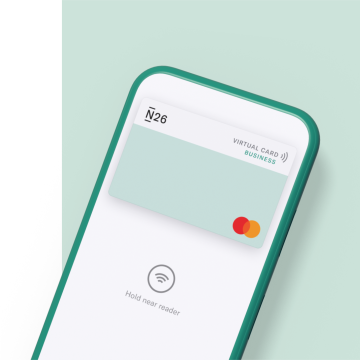

Your free virtual N26 Mastercard

Get your virtual N26 Mastercard at no extra cost when you open your free business account. Link it to Apple Pay or Google Pay and start making secure contactless payments in-store, online, and in apps.

Need a physical card? Order a plastic debit Mastercard card for a one-time €10 delivery fee.

Enjoy 0.1% cashback on purchases

Reinvest back into your business with 0.1% cashback on all purchases made using your N26 Mastercard. We’ll calculate your earnings automatically and deposit them into your account every month.

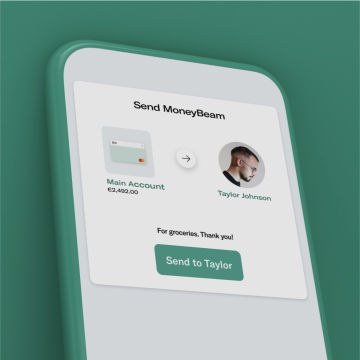

Stay updated in real-time

Track changes in your finances as soon as they happen. Get instant notifications any time money leaves or enters your account, so you’re always up to date on which clients have paid or what recurring expenses have been deducted. Plus, discover MoneyBeam—the feature that lets you send, receive, and request money from other N26 customers instantly and at no extra cost.

Discover the N26 Mastercard

Take charge of your business expenses

Zero hidden fees

Your free business bank account has no hidden fees—no minimum deposit amount, recurring monthly fees, or any other surprise costs.

Security first

N26 uses Mastercard 3D Secure two-step authentication to make sure you’re the only one with access to your card.

Customize your spending record

Create hashtags and link them to transactions so you can keep track of #TravelExpenses #IndependentProjects, or whatever else you choose.

Protection up to €100,000

N26 owns a European banking licence. Deposits are protected up to €100,000 by the German Deposit Protection Scheme.

Stocks and ETFs the simple way

How about investing in your future without having to leave your banking app? With N26, you can buy stocks and ETFs right from your phone, without paying commission***.

Discover Stocks and ETFs

Organize your money with Spaces

Unlock N26 Spaces, the feature that lets you create up to 10 personalized sub-accounts alongside your main account. Save for emergencies, special projects, professional development, and more.Create Rules to automatically transfer money into certain spaces whenever you choose, without having to manually manage it every time. Plus, save up spare change with Round-Ups, rounding up your card purchases up to the nearest euro and stashing away the difference in a chosen space.

Download your transaction history

Make tax time even easier—download and print your transaction history and account statements whenever you need them.

Try out the WebApp

Prefer to work on your desktop? No problem. Access your account any time from the N26 WebApp.

N26 Business Metal, THE business account

N26 Business Metal is our most premium account, dedicated to you and your business. Get a signature metal Mastercard, and enjoy 0.5% cashback on all your purchases, an extensive insurance package, special partner offers, and more.

Upgrade to N26 Business Metal

We speak your language

Our Customer Support specialists speak English, French, Spanish, Italian, and German. Contact us via the in-app chat function, or find answers to FAQs in the Support Center.

Visit our Support Center

Get your N26 Business bank account. It takes minutes.

Open a new N26 business bank account from your phone or computer with our easy, paperless signup process.***Investments in stocks and ETFs carry a risk of capital loss. N26 Stocks and ETFs is provided by N26 Bank AG in partnership with Upvest Securities GmbH. Stocks and ETF is currently only available to N26 account holders with a French IBAN (customers in a business relationship with N26 Bank AG, Succursale France). Learn more N26 Stocks and ETFs on this page.

Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

Frequently asked questions

- You’re 18 years old or older

- You’re a freelancer or self-employed individual, planning to use this account for professional purposes.

- You aren’t already an N26 account holder.

- You live in a country where N26 operates—Germany, Austria, Belgium, Denmark, Estonia, Finland, France, Greece, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Norway, Netherlands, Poland, Portugal, United Kingdom, Slovakia, Slovenia, Spain, Sweden, Switzerland or the United States.

The N26 Business Standard account is a free, flexible bank account for freelancers and self-employed individuals. It comes with a free virtual debit Mastercard that you can link to Google Pay or Apple Pay and use to make purchases in stores, online, and in apps. Or, you can order a physical Mastercard for a €10 delivery fee and use your card to make up to 3 free ATM withdrawals per month.

Earn 0.1% cashback on all purchases made with your N26 Mastercard. This extra money will be added up monthly and deposited directly into your account, so you don’t have to do anything extra.

Get notified every time money enters or leaves your account thanks to instant push notifications. Send, receive, and request money from other N26 customers instantly with MoneyBeam, or get paid right away from outside bank accounts thanks to SEPA Instant Credit transfers.

Track all your spending with Statistics and tailor it to your specific information with your own set of hashtags. Then use your Statistics chart to optimize your budget for the months ahead.

To learn more, read our Terms & Conditions.

As a self-employed person, it’s a good idea to have a bank account dedicated to your business. This allows you to separate your personal and business finances and makes it easier to manage your budgets and taxes. With the free N26 Business Standard bank account, you can download your bank statements and transaction history whenever you need to.

Yes. There is no set-up fee or recurring monthly fee for opening your free N26 Business Standard bank account, and you’ll never be hit with any surprise charges. Please read our terms and conditions for more information.

No. This account is intended for freelancers and self-employed individuals doing business in their own name. Therefore, the name that appears on your account and on your N26 Mastercard must be your own name.

Your 0.1% cashback will be automatically calculated and deposited into your Business Standard bank account at the end of each month.

No. Right now, you can only have one bank account with N26. If you already have an N26 Personal account for your personal finances and wish to open a Business account, you’ll have to close your personal Standard account first. Then you can open your business account.

The free N26 Business Standard bank account for the self-employed is designed for professional use. This means it should be for managing your professional finances, like paying rent on an office space or website domain. You can use the account for some personal expenses, but these should be in the minority.