A 100% digital, free business bank account for freelancers

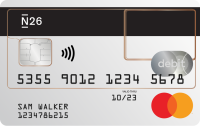

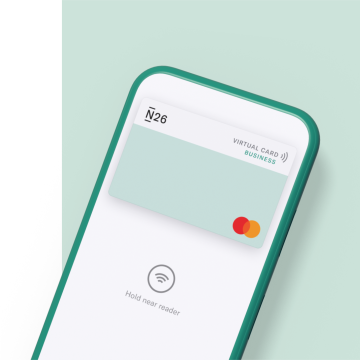

Your debit Mastercard virtual card

Earn as you spend with 0.1% cashback

Save time and money with instant bank transfers

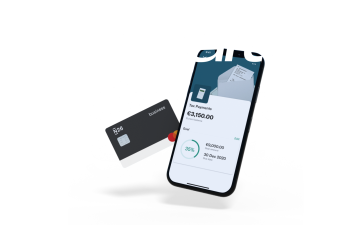

Breezy business banking in one nifty app

Fast and secure login

Your account security is our top priority. Protect your account details by securely logging in using fingerprint identification or FaceID.

3D Secure for online payments

Pay online with peace of mind thanks to Mastercard 3D Secure (3DS), a two-factor authentication step for confirming online purchases.

Organize your business expenses

Create personalized #tags for each of your transactions, and readily find all related business expenses with a single tap in your N26 app.

Your money is protected

With our full European banking license, your funds are protected up to €100,000 by the German Deposit Protection Scheme.

Effortlessly manage your money with N26 Spaces

Prefer to bank from your laptop? Easy.

If you're more comfortable on your desktop, there’s no need to switch. Access your business bank account at any time via the N26 WebApp.

Stress-free tax returns

Export your transaction list in CSV or PDF format from the N26 WebApp, or download your bank statements directly from the mobile app.

N26 Customer Support at your service