Kids, pocket money, and financial education—N26

Parents have many responsibilities—including educating their kids about money. Experts agree that one of the best ways to do this is to give children pocket money and discuss finances openly, but approaches vary from family to family.

At N26, we’re eager to know more about how families manage money. So, in September 2021, we surveyed 2,500 parents in Germany about pocket money and financial education in their homes. We also spoke to Leonie Ries, an educational consultant, about the outcomes.

Families and pocket money

Offering kids pocket money can be a great way to encourage financial responsibility. It allows them to practice spending and saving, and learn about money management more broadly. In our research, we discovered that the majority of German families give their children pocket money on a regular basis. According to respondents, 71% of kids between 4 and 6 receive pocket money, which jumps to 95% for those ages 10-12. Just 13% of kids between 4-18 receive no pocket money at all. The amount of money parents give their children varies, averaging out to about €13.60. Below, you’ll find a breakdown of the average amount of pocket money kids get per month based on their age group:Pocket Money and Financial Education Insights

| Average pocket money per month | 6.65 € | 10.13 € | 14.54 € | 19.41 € | 22.06 € |

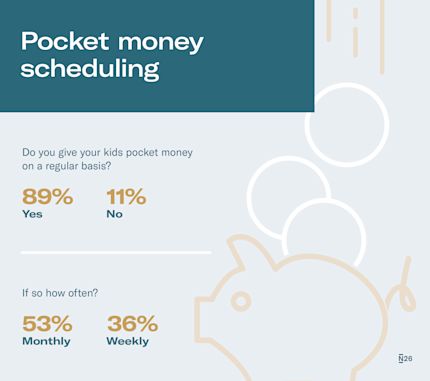

A fixed or flexible approach to pocket money

In total, 89% of those surveyed say they follow a strict pocket money schedule, with 36% giving their kids money on a weekly basis and 53% on a monthly basis. Conversely, we found that some parents prefer to pick and choose when their children receive money:- 11% of parents say their kids receive money when they need it, but not on a regular schedule

- 18% of the parents award pocket money based on their kids’ behavior

The benefits of sticking to a schedule

Deciding on the right amount of pocket money to give your kids—and how often—is a personal choice for every parent. But if you decide to offer your children an allowance, Leonie Ries suggests you consider giving it to them at regular intervals. Offering kids pocket money on a weekly or monthly basis not only gives them structure, it also helps them learn budgeting skills, she tells us.“Children learn through experience. In the protected setting of the family, they have the opportunity to practice managing their own money. They learn what it's like to have less after spending a lot, and on the other hand, how their options increase when they don't spend anything for a while. This knowledge is extremely important for later on in life.” -Leonie Ries

Pocket money spending habits

Spending spree? Yes, please!

44% of parents surveyed allow their kids to spend their pocket money on whatever they like. Leonie Ries supports this approach, saying that it’s important to give children financial autonomy, while encouraging them to make good choices.

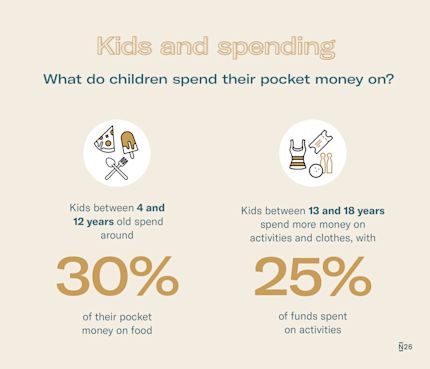

Where does all the cash go?

As they get older, parents tell us their kids spend more on clothes and activities, and less on books. Savings also decline with age. Between the ages of 4-12 years old, kids are most likely to spend their money on food and snacks.

“For children to become self-reliant adults, it’s important for parents to give them a certain level of responsibility as early as possible, without overburdening them.” -Leonie Ries

A new normal for pocket money

The COVID-19 pandemic has had a meaningful effect on families' finances throughout Germany. It has also influenced how parents view the importance of financial education for their kids. Our survey found that a third of parents now consider financial education more important than before the pandemic. Many parents have also adapted their approach to how much pocket money they give their children. According to our survey, 21% of parents have adjusted their children’s total pocket money since the onset of the pandemic, with 14% receiving more now than before.

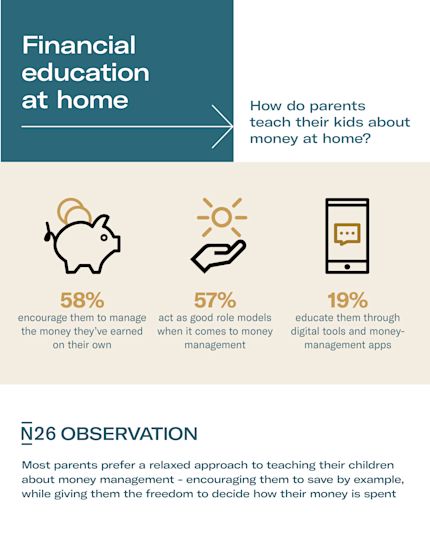

Teaching money management—at school and at home

Pocket money is a great way to teach your kids about money, but it’s also important to find other ways to educate them about financial responsibility. The majority of parents agree—saying that they make an effort to teach their children about money management at home. However, approaches to teaching kids about finances differ. 58% say they prioritize autonomy by encouraging their kids to manage the money they’ve earned on their own. 57% try to educate their kids by being good role models when it comes to money management, and 19% teach them about finances with digital tools and money-management apps.“Being financially literate helps you make independent and informed decisions. As a parent, my overall objective is to educate my kids in a way that encourages their independence and ability to make their own choices.” -Michael Marsch, N26 employee

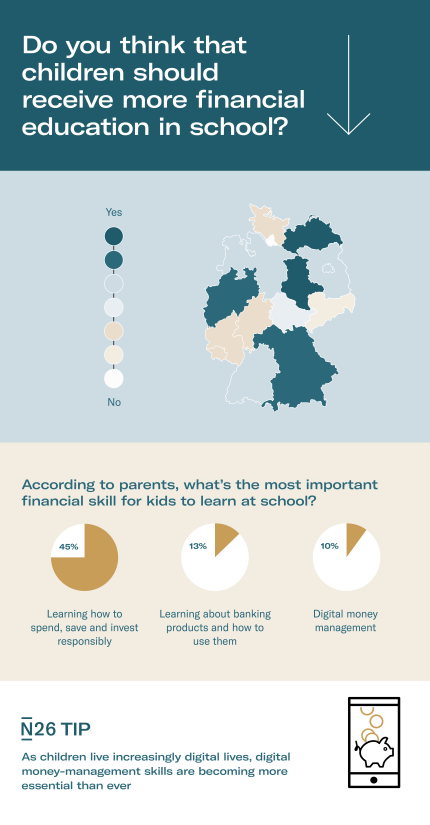

Perhaps as a response to the destabilizing effects of the COVID-19 pandemic, 83% of parents report wanting more financial education in schools. And although overall 62% of parents are satisfied with their children’s knowledge of finances, 18% consider it insufficient.

When it comes to finances, there’s plenty that can be taught in schools. Yet when we asked parents what financial topics schools should prioritize, their answers differed. 45% consider learning to spend, save, and invest responsibly as the most important skill to learn, while 13% believe bank products and how to use them are most important.

Financial literacy for kids in Germany—according to parents

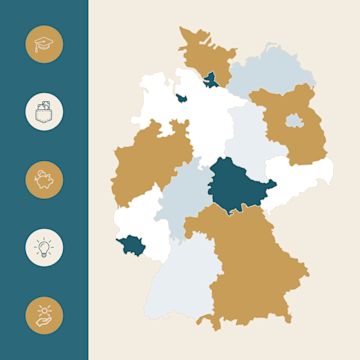

Our research shows us that parents have different perceptions of their children’s financial knowledge across Germany. On a scale of 1-6 (with 1 being the best and 6 being the worst) the state of Rheinland-Pfalz comes out on top, with parents rating their kids’ knowledge of finances at an average grade of 2.2. Meanwhile, Schleswig-Holstein came in with the poorest rating nationwide at 3.0. However, in both states, 79% of parents said they would like to see more financial education in schools—a sign that a high rating of financial literacy in kids does not necessarily have much bearing on parents’ level of satisfaction concerning the financial education of their children. Respondents in Mecklenburg-Vorpommern saw an even stronger desire for more financial education in the classroom, with 88% of parents saying this was a priority. We also found some interesting differences between the states when it comes to digital learning. The metropolitan areas of Hamburg and Berlin are at the forefront here: 26% and 23% of the parents surveyed said that their children acquire financial knowledge using digital apps and tools. The proportion is also above average in Bayern and Baden-Württemberg. However, things look quite different in Saarland, where only 6% of parents said they teach their children how to handle money with the help of digital tools.Financial literacy for kids in Germany—according to parents

| Baden-Württemberg | 2.6 | 83% | 16% |

| Bayern | 2.6 | 85% | 24% |

| Berlin | 2.3 | 84% | 23% |

| Brandenburg | 2.6 | 85% | 20% |

| Bremen | 2.5 | 83% | 17% |

| Hamburg | 2.3 | 85% | 26% |

| Hessen | 2.3 | 80% | 19% |

| Mecklenburg-Vorpommern | 2.3 | 88% | 17% |

| Niedersachsen | 2.6 | 83% | 14% |

| Nordrhein-Westfalen | 2.4 | 84% | 20% |

| Rheinland-Pfalz | 2.2 | 79% | 22% |

| Saarland | 2.3 | 79% | 6% |

| Sachsen | 2.6 | 76% | 18% |

| Sachsen-Anhalt | 2.5 | 88% | 14% |

| Schleswig-Holstein | 3 | 79% | 18% |

| Thüringen | 2.5 | 81% | 13% |

| Total | 2.5 | 83% | 19% |

*Grade parents give their children for financial literacy (1 = very good, 6 = insufficient)

Improving financial education for kids in the digital age

Online banking was already popular before the pandemic, but lockdowns and closed bank branches saw many adults heading online to manage their money. And kids growing up today may never know a world without digital banking.“For the future generations, banking will mostly be done digitally. For the next generation, dealing with money digitally will mean taking care of their finances online, while remaining vigilant about phishing, scams, etc.” - Joao Moreira, N26 employee

For any questions about the methodology of this project, please reach out to press@n26.com