Investing money: A comprehensive guide

Why investing matters

Building wealth

Investing is a chance for your money to grow over time instead of simply sitting in your bank account. Before you start investing, it's important to understand the risks. Values can fluctuate, and losses are possible.

Generating income

Certain investments, such as dividend-paying stocks, bonds, or rental properties, can become a source of regular income, giving you more financial stability and freedom.

Achieving financial goals

Whether it's saving for retirement, buying a home, paying for school, or building a nest egg, investing is one strategy for reaching your financial goals.

Protecting against inflation

Investing in stocks, real estate, or commodities can help hedge against inflation and preserve your money’s

How to start investing money

Set financial goals

Define what you want to achieve by investing, such as saving for retirement, buying a home, or paying for your education.

Set a budget

Look at your current financial situation and figure out how much money you can comfortably put towards investments.

Choose an investment strategy

Determine your investment strategy based on your financial goals, risk tolerance, and time horizon.

Open a brokerage account

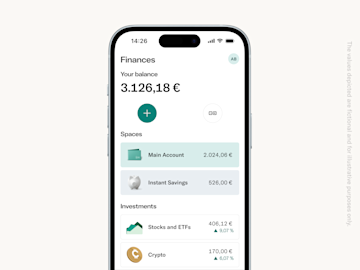

Choose a brokerage firm or investment platform that fits your needs and preferences.

Pick the right investment strategy for you

Long-term investing

This strategy (also called position trading) involves buying and holding investments for an extended period, typically five years or more. Long-term investors focus on fundamentals and aim to capitalize on the power of compounding. It's suitable for investors with a low to moderate risk tolerance who are saving for retirement, education, or other long-term goals.Diversification

Diversification involves spreading investments across different asset classes, sectors, and geographical regions to reduce risk. By diversifying, investors can minimize the impact of poor performance in any single investment. This strategy is suitable for investors of all risk profiles and can help protect against market volatility. It can also be paired with many other investing strategies.Index fund investing

Index fund investing involves buying into funds that track a specific market index, such as the S&P 500. These funds offer broad diversification and low fees, so they’re good for passive investors who are hoping for consistent returns over time. Index fund investing is especially popular with investors who have a long-term investment horizon and a low tolerance for risk.Value investing

Value investing involves identifying undervalued stocks — stocks that are trading below their intrinsic value. Value investors look for companies with strong fundamentals, stable earnings, and a margin of safety. It can be a good fit for patient investors who are willing to do their research and wait for the market to recognize the stock's true worth.Dividend investing

Dividend investing means buying stocks that pay regular dividends to shareholders. Dividend investors are usually looking for stable income streams and companies with a history of dividend growth. This strategy is suitable for income-focused investors seeking passive income and long-term capital appreciation.Growth investing

Growth investing involves buying stock in companies with high growth potential, often in emerging industries or sectors. Growth investors prioritize revenue and earnings growth over current profitability and dividends. This strategy is suitable for investors who have a high tolerance for risk, want to maximize their potential returns, and think they can spot a winner.Active vs. passive investing

Active investing involves selecting and managing individual investments with the goal of outperforming the market or a specific benchmark. In contrast, passive investing involves investing in index funds or exchange-traded funds (ETFs) that track a market index, such as the S&P 500, with minimal buying and selling.Dollar-cost averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps investors mitigate the impact of market volatility and take advantage of dollar-cost averaging over time. It's suitable for investors of all risk profiles who prefer a systematic approach to investing. Ultimately, the best investment strategy depends on you: your individual financial goals, risk tolerance, time horizon, and investment knowledge.

Individual financial goals

Risk tolerance

Time horizon

Investment knowledge

The different types of investments

For beginners

Index funds/ETFs: These funds track a market index like the S&P 500 and offer diversification at a relatively low cost. Dollar-cost averaging: Investors put in a fixed amount of money at regular intervals, regardless of market conditions. This can reduce the impact of market volatility.For conservative investors

Bonds: Government or high-quality corporate bonds can provide steady, predictable income and are usually considered lower risk than stocks. Dividend-paying stocks: Some companies pay regular dividends to their shareholders, which means income for investors and the potential for capital appreciation. High-yield savings accounts: A savings account at a reputable bank can be a safe place to park money and earn interest. Certificates of deposit (CDs): CDs offer fixed returns for a specified term, with minimal risk.For moderate investors:

Balanced funds: These funds invest in a mix of stocks and bonds to balance risk and reward. Real estate investment trusts (REITs): REITs offer exposure to real estate markets without the need to own physical properties. Blue-chip stocks: “Blue-chip” stocks are shares in large, well-established companies with a history of reliable performance.For aggressive investors

Individual stocks: Investing directly in individual companies can offer high returns but comes with higher risk. Sector funds: These funds focus on specific sectors like technology or healthcare, which can offer high growth potential. Cryptocurrencies: Crypto is highly volatile but can provide significant returns. Only invest as much as you can afford to lose!For long-term investors

Growth stocks: Investors might expect certain companies to grow at an above-average rate. These stocks may not pay dividends but can offer substantial capital appreciation. Real estate: Investing in property can provide rental income and potential appreciation over time.For short-term investors

Money market funds: These funds offer higher returns than traditional savings accounts but are relatively low risk. Short-term bond funds: These funds provide income with lower volatility compared to long-term bonds.For socially responsible investors

ESG funds: These funds invest in companies with strong environmental, social, and governance practices. Impact investing: Some investors choose companies or projects that aim to generate a positive social or environmental impact as well as financial returns.

Safe investments

Return-oriented investments

Property

Other forms of investment

The benefits of diversification

Investing money in a savings account

Investing money in stocks

Investing money in ETFs

Investing money in crypto

Investing in ready-made funds

Find a plan for you

N26 Standard

The free* online bank account

€0.00/month

A virtual debit card

Free payments worldwide

Deposit protection

N26 Go

The debit card for everyday and travel

€9.90/month

Up to 5 free withdrawals in the Eurozone

Flight and luggage delay cover

Medical emergency cover

Winter activities insurance

Pandemic coverage

N26 Metal

The premium account with a metal card

€16.90/month

An 18-gram metal card

Up to 8 free withdrawals in the Eurozone

Purchase protection

Phone insurance

Dedicated N26 Metal line

FAQs

- Financial goals: Are you investing short-term or long-term? Do you want high or moderate returns?

- Time horizon: How long can you commit your money without needing it?

- Financial situation: How much can you afford to lose without jeopardizing your financial stability?

- Personality: Are you comfortable with risk or do you prefer to play it safe?

- Not doing enough research before making investment decisions.

- Trying to time the market rather than focusing on long-term growth.

- Investing based on emotions or following the latest trends without understanding them.

- Not diversifying your portfolio, which increases risk.

- Ignoring the fees and costs associated with investments, which can erode returns over time.