Your salary account with N26

Your free salary account

Full banking license and deposit guarantee

2013

Market Launch

24

markets

300,000+

5-star app ratings on iOS and Android

How it works

Open your salary account in just 8 minutes

Download the N26 app and follow the instructions to open your salary account. Don’t forget to enter the promo code N26POWER under 'Promotions'!

Verify your identity

Make sure you have a valid ID ready. With our video verification, you can confirm your identity directly from your smartphone.

Set N26 as your salary account

Share your new bank details with your employer so they can transfer your salary directly to your N26 account.

Enjoy your N26 account!

You're good to go! You can already top up your account and start using your virtual card.

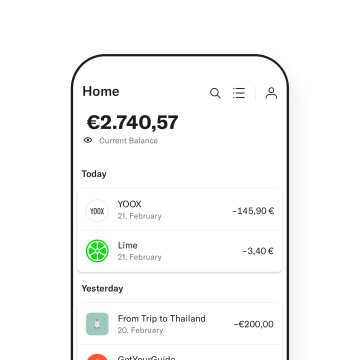

Stay in-the-know with Insights

Financial products

Overdraft

Apply for an N26 Overdraft of up to €10,000 right in your N26 app with just a few taps. Manage all your finances directly from your smartphone, and easily keep an eye on your spending as well as your daily overdraft costs.

Consumer credit

Want more financial flexibility? Request a loan of up to €25,000 directly in-app with N26 Credit—no paperwork involved. Compare loans and manage your payments easily right from your smartphone.

N26 Insurance

Choose an N26 premium membership for insurance coverage that protects the things you value. N26 Go and Metal include a package of travel insurance for lost baggage and trip cancellation, and N26 Metal-exclusive insurance covers your mobile phone and includes purchase protection.

Installment loans

If you need money for an urgent purchase, you can simply get an installment loan for a payment you've made in the past. This way you can increase the funds in your N26 account quickly and stay flexible.

Withdraw and deposit cash

Security first

Push notifications in real-time

Regardless of the activity on your salary account—from direct debit payments to receiving your salary and more—you’ll always receive instant push notifications for every transaction. Just another way N26 puts you in the driver’s seat.

Personalized security settings

Your salary account—your settings. Block or unblock your card, set limits for foreign transactions, online purchases and more—right in your N26 app. And, thanks to Mastercard 3D Secure, you’ll stay protected with two-factor authentication when shopping online.

Customer Support in your language