Open a bank account online in minutes

Sign up

Hit the button below and enter your personal details in order to create your account.

Verify your identity

Please have a valid ID at hand. We don't have branches so you can verify your identity within the app.

Add your card to your wallet

Your N26 virtual debit card is ready to use.

Enjoy your N26 account!

You're good to go! You can already top up your account and start using your virtual card.

All in one app

N26 Standard—your free bank account

More than an app: A fully licensed bank

N26 features you’ll love

Get a virtual or physical debit Mastercard

Your debit Mastercard is accepted worldwide and offers zero foreign transaction fees—as well as SecureCode authentication for extra security.

Virtual card

Connect your virtual card to Apple Pay or Google pay, and start spending right from your mobile wallet the minute you open your account.

Instant payments

Send or receive money 24/7, and top up your account in seconds with instant payments. Plus, easily transfer money to other N26 customers via MoneyBeam.

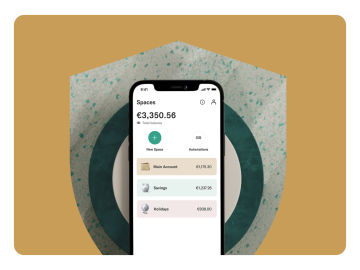

Budgeting tools

From instant push notifications to spending limits to in-depth features like N26 Insights, you’ll have all the tools you need to stay within budget.

Get an ECB-linked interest rate

Withdraw and deposit cash

Stress-free dining with Split the Bill

Find a plan for you

N26 Standard

The free* online bank account

€0.00/month

A virtual debit card

Free payments worldwide

Deposit protection

N26 Go

The debit card for everyday and travel

€9.90/month

Up to 5 free withdrawals in the Eurozone

Flight and luggage delay cover

Medical emergency cover

Winter activities insurance

Pandemic coverage

N26 Metal

The premium account with a metal card

€16.90/month

An 18-gram metal card

Up to 8 free withdrawals in the Eurozone

Purchase protection

Phone insurance

Dedicated N26 Metal line

FAQs

- Choose a Bank: Decide on a bank that meets your needs.

- Application Process: Complete the account opening form, either online or in the branch. Provide personal information and select the type of account.

- Identity Verification: Authenticate yourself, for example, via video identification.

- Documents: Review and sign the contract.

- Activation: After verification and approval by the bank, the account is activated and you will receive access data and possibly payment instruments like a card.

- Traditional branch banks

- Online banks

- Savings banks

- Cooperative banks

- Specialized financial service providers