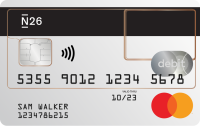

Stand out with your Business Metal card

Get rewarded with 0.5% cashback

Extra peace of mind, wherever you are

Priority Customer Support, always at your service

Investing made simple

Personal liability while traveling

Coverage up to €500,000 for Personal Liability in case you’re legally liable for damage to a third party or their property during a trip.

Purchase protection

Coverage up to €10,000 in 12 months for stolen or damaged eligible purchases bought with your N26 card

Emergencies when traveling

The N26 Metal policy provides cover for you, your spouse and children in case of a medical emergency abroad, including emergency dental care. You also get access to 24/7 medical phone assistance.

Baggage coverage and delay insurance

Get covered up to €500 for baggage delays over 4 hours, or up to €2,000 if your baggage goes missing.

Travel delay and cancellation

We know how inconvenient it can be when business trips don’t go to plan. Thankfully, if your trip is cancelled or delayed for more than 2 hours, you’ll be covered.

Trip interruption

Get covered up to €10,000 for unused non-refundable trip costs, plus additional accommodation and transportation.

Stay covered with mobile phone insurance

Go global with Mastercard, at no extra cost

N26 Business Perks that propel you forward

Get organized with Spaces sub-accounts

Pay from Spaces with your Business Metal card

Link your metal card with just a few taps to a Space of your choice and pay directly from that Space. That way, you'll always be in control of your business expenses.

Organize incoming transfers into Spaces

Optimize your budget planning! Use the N26 Income Sorter to automatically set aside part of your incoming transfers into your Spaces. Set either a percentage or fixed amount and let us take care of the rest.