Zero foreign currency fees

Get comprehensive travel insurance

Unlimited free trades

8 minutes

to open an international business bank account

Priority phone support

available 7 days a week

Deposit protection

of up to €100,000

A full banking license

since 2016

Reinvest with 0.1% cashback

You’ll receive 0.1% cashback on any purchases made using your N26 Mastercard, calculated monthly and paid directly into your account.

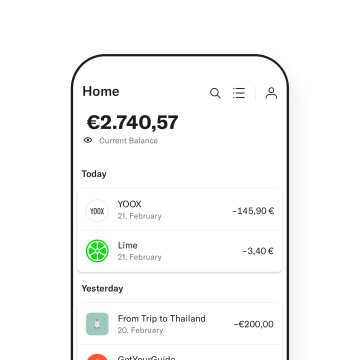

#Tag your transactions

#client, #office, #bizness… create your own personal hashtags and attach them to your transactions to organize them better.

Real-time activity notifications

Stay up to date. Get a push notification immediately after all account activity, including card payments, withdrawals and transfers.

3D Secured payments

Mastercard SecureCode gives you an extra layer of security that helps prevent fraud when making payments online with your N26 Business Go account.

Always get a breakdown of your spending

Discounts on the tools you need

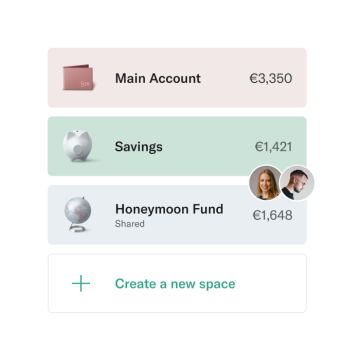

Plan ahead with Spaces sub-accounts

Pay directly from Spaces

With just a few clicks, you can link your N26 Business Go card to a Space sub-account of your choice. That way, the money is deducted directly from the right Space every time you pay.

Sort your incoming transfers into sub-accounts

Automatically set aside a portion of your incoming transfers into your Spaces with Income Sorter — putting aside money for taxes or bills has never been simpler.

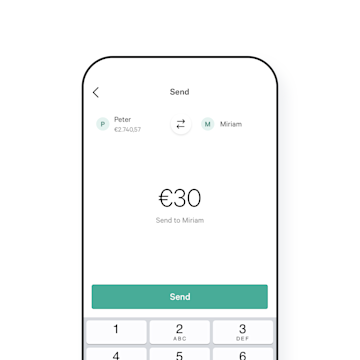

Faster payments with MoneyBeam and SEPA Transfer

An extra card to keep you moving

Free business transactions

Say goodbye to business transaction fees! With our international business bank account, you can enjoy unlimited free business transactions.

Banking on the big screen

Need to download your bank statements for your business bookkeeping? You can also log into your N26 bank account from your laptop or desktop. Plus, our web app offers lots of the same convenient features as the N26 mobile app.

Invest in yourself with N26 Business Metal

Frequently Asked Questions

- You are over 18 and hold a valid form of ID (varies by location)

- You’re a freelancer or are self-employed (the account must be registered in your name, not your business’s name)

- You intend to use the account primarily for business purposes

- You’re not already an N26 user

- You reside in one of the following countries: Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Iceland, Ireland, Italy, Latvia, Lichtenstein, Lithuania, Luxembourg, The Netherlands, Norway, Portugal, Poland, Spain, Slovakia, Slovenia and Sweden.