The clever business bank account for freelancers

A colorful Mastercard with benefits

0.1% cashback on all card purchases

Smarter business banking is here

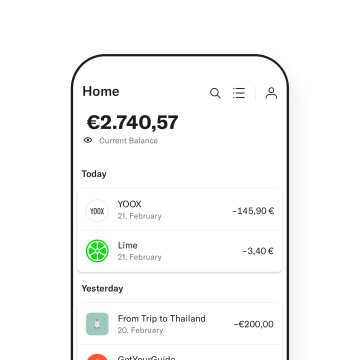

Track your expenses

Get a handy overview of all incoming and outgoing payments every month with Insights. The AI-powered tool automatically categorizes your transactions—a single glance is all it takes to know if you’re on track with your business budget.

Enjoy unlimited free business transactions

Say goodbye to business transaction fees. With N26 Business Smart you get unlimited free business transactions.

Bank anywhere, at anytime

N26 Business Smart is a 100% mobile business bank account that you can access on your smartphone or desktop. Forget waiting in line at a bank branch for hours—get your time back with convenient, digital business banking.

Invoices and tax reports made easy

Simply download your bank statements in PDF or CSV formats using the N26 WebApp on desktop. Browse through transactions directly in the app, create and add your own #hashtags to every transaction, and easily find them later.

Stocks and ETFs the simple way

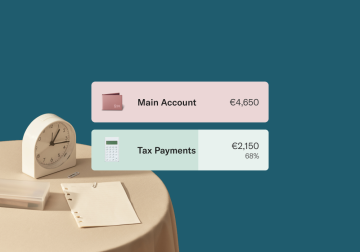

Spaces make your life easier

Automatically set money aside

Set it and forget it with Rules for Spaces sub-accounts. Create Rules to automatically transfer funds between your main account and your Spaces sub-accounts—every day, week, fortnight, or month.

Get your income sorted—into Spaces

Activate the Income Sorter to automatically set aside a portion of your incoming transfers into a Space. This way, you can put aside money for your taxes and bills without having to think about it.

Pay directly from your Spaces

Link your N26 Mastercard to a Space of your choice and pay directly from there. Easily set—and stick to—your budget for business trips, projects, and expenses.

10 Spaces with individual IBANs

Create standing orders for recurring payments, pay bills via direct debit, send and receive SEPA bank transfers, or get paid from clients—right into each sub-account.

Secure business banking

Mastercard 3D Secure

Enjoy peace of mind with Mastercard 3D Secure—the 2-factor authentication step that adds an extra layer of protection to your online card transactions.

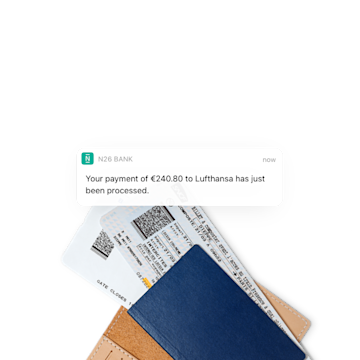

Instant push notifications

Stay up-to-date with your business finances, thanks to real-time alerts on your phone after every transaction—for both outgoing and incoming payments.

Biometric identification

Add another layer of security to your business banking by using FaceID or fingerprint identification to log in.

Deposit guaranteed up to €100,000

As a fully licensed bank, your funds are protected up to €100,000 under the German Deposit Protection Scheme.

Schedule payments and transfer instantly

Phone and live-chat customer support