Taxes in Germany

The world of taxes can feel like a labyrinth—endless, vast, and incomprehensible. The complex legal terms used by the tax authorities are especially confusing. But fear not—we’ve gathered all the relevant tax topics you need to know about, including when your taxes are due, so you’ll never miss a deadline again.

Completing your tax declaration

The amount of taxes you’ll owe and which costs you can offset on your return depend on a variety of factors. Being married, having kids, and whether you’re employed or freelance can all impact your filing status—and, subsequently, your tax rate.

Learn more about how to do your tax declaration correctly and what costs you can deduct from your return.

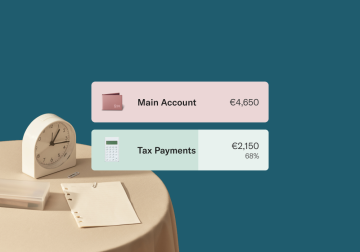

Taxes for freelancers

More and more workers are opting for the independence and freedom of self-employment. However, being your own boss comes at a cost—namely, a more complicated tax situation. But don’t worry—whether you’re self-employed or freelance, we’ve got a breakdown of what you need to get your taxes in shape.

Check out our overview of freelance taxes in Germany, and learn important deadlines for submitting your tax declaration.

Student tax declarations

Student life is a time of newfound freedom and unforgettable experiences. But it can also be a struggle to make ends meet during these years if money is tight. Luckily, many students are able to deduct certain school expenses from their student tax return in Germany and get a refund on overpaid taxes.

Click here to learn more about completing your student tax declaration.

Understanding VAT

Whether you’re earning or spending money, sales tax is an important aspect of financial life. Value-added tax (or Mehrwertsteuer in German) in particular is added on to nearly every good or service we buy or sell. However, the amount of applicable VAT varies depending on the good or service provided—and some charge no VAT at all.

Here, you’ll learn more about the different kinds of VAT, which products and services are taxed, who is required to charge VAT, and much more.

Inheritance tax and property tax

A will puts the wishes of a deceased family member or close relation down in writing, particularly when it comes to inheritance. Depending on the kind of relationship a person has with the deceased, different tax rates apply. Learn more about inheritance tax here. Also—are you considering buying real estate as an investment, with or without the help of an inheritance? If so, check out our article on property tax in Germany.

Cryptocurrency taxes in Germany

As you’ve probably heard, cryptocurrency is a hot new trend—and it’s only getting more popular. But even crypto earnings are subject to tax regulations. This means that if you’re investing in crypto, you need to know your tax obligations.

You can read all about how much tax you’ll have to pay on cryptocurrencies, how high the exemption amount is, and how to enter your profits on your tax declaration here.

Find a plan for you

N26 Standard

The free* online bank account

Virtual Card

€0.00/month

A virtual debit card

Free payments worldwide

Deposit protection

POPULAR

N26 Go

The debit card for everyday and travel

€9.90/month

Up to 5 free withdrawals in the Eurozone

Flight and luggage delay cover

Medical emergency cover

Winter activities insurance

Pandemic coverage

N26 Metal

The premium account with a metal card

€16.90/month

An 18-gram metal card

Up to 8 free withdrawals in the Eurozone

Purchase protection

Phone insurance

Dedicated N26 Metal line