Tax exemption order — what it is and why you need one

If you’ve never heard of a tax exemption order, then you could be missing out on savings from your bank. Learn here what a tax exemption order is, and why you may need one.

8 min read

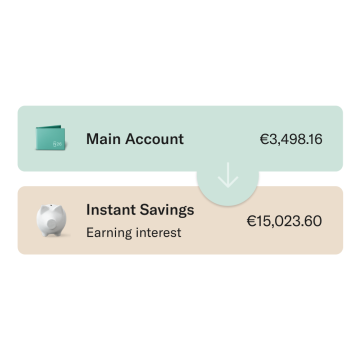

You’ve seen it in the supermarkets, on your electricity bill, and pretty much every other good or service: Life has gotten expensive. And it’s even more frustrating than ever to pay hidden fees — or unnecessary taxes. But that’s something you can avoid with a tax exemption order. Many don’t know this, but tax authorities charge money on every euro customers earn in capital gains. This money is automatically deducted from your earnings — unless you submit a tax exemption order to your bank. Here, we’ll explain what a tax exemption order is, what the limits are for different tax classes, and much more. Do taxes and even banking basics send you into a panic? Here’s the thing: Most of the time, these things seem a lot more complicated than they really are. That’s the case with tax exemption orders, at least. Let’s take a look at the ins and outs, starting with capital gains. If you have a savings account, you’ll likely be earning interest on the money there. From a tax perspective, this interest is seen as income that you’ve earned via something called compound interest. These interest earnings are called “capital gains” — which apply whether you have a passbook, savings account, interest-bearing checking account, or other investments like stocks or mutual funds. You also earn capital gains when you invest in the stock market. If you buy stocks in a company, for example, you’re investing your own money to get a share of their ownership. As part owner, you receive repayment in the form of dividends. When you’ve decided you’ve earned enough, you can sell your shares and (hopefully) make a profit. But whether you’ve earned capital gains from stocks or interest in a savings account, the tax authorities are entitled to a portion of that income — just like we pay taxes on our paycheck. In Germany, the tax authorities deduct this at the source via a withholding tax. Withholding tax is one of 40 types of taxes in Germany. Since 2009, it’s been applied to everyone with money in a savings account, stocks, or other interest-bearing investments. This type of tax is automatically deducted — or “withheld” — from all investment income at the source. And because most banks deduct this tax automatically (at a tax rate of 25%), some customers don’t even realize that their income from interest and dividends is being taxed. 25% is no small amount, not to mention that investors also need to pay an additional solidarity tax (Solidaritätszuschlag) — a tax used to finance the costs of German reunification. Luckily, as with many other taxes, there are allowances up to a certain threshold to lessen your tax burden. However, to claim these allowances, you need to do a bit of work — which brings us to tax exemption orders. An exemption order allows you to instruct your bank to exempt you from capital gains taxes up to a certain point. This is the easiest way to reap the benefits of your tax allowance on interest income, without going through the laborious process of reclaiming these deductions on your tax return. Below, you’ll find out how high this threshold is for you, and what to watch out for when applying. So, you can see the importance of submitting a tax exemption order — but how much interest can you earn before you start being taxed? Let’s take a look. For 2023, the threshold for single taxpayers is €1,000. That means that any interest income you earn under this amount is tax-free. And since the tax rate is 25%, that means that you save up to €250 in taxes. After that threshold, your interest income is taxed at the normal rate. Let’s say you earn €1,500 through dividends and interest throughout the calendar year. You’ll only pay capital gains tax on the difference of €500. And, if your earnings fall below the threshold, you won’t pay any tax on the amount. If you’re married or live in a civil partnership, then your threshold is raised to €2,000 — provided you file your taxes together. Good news: If you paid withholding taxes in 2022, you can get that money back on your tax return. However, note that the 2022 tax exemption threshold was lower — just €801 for singles and €1,602 for couples. As you can see, submitting a tax exemption order to your bank can save you plenty of money. Keep reading to learn how to submit one.Many banks allow you to submit a tax exemption order online or in your mobile banking app — and it takes just a few minutes. In this process, you’ll need to fill out an online form, state which year it applies for, and how high your exemption should be. Before you log in, you should have your tax ID number (steuerliche Identifikationsnummer in German) ready. This 11-digit number can be found on your Lohnsteuerbescheinigung or your income statement, as well as any form from the tax office. It doesn’t matter how old these statements are, either — this number is with you for life, no matter where you move or what your marital status is. Just don’t confuse your tax ID number with your tax number (Steuernummer)!Now that you know the maximum exemption amount, you probably want to set the threshold as high as possible, right? Not so fast. It depends on whether you have one interest-bearing account or multiple ones. The threshold applies to your combined interest income from all accounts. So, you’ll have to estimate how much income you can expect to earn from each investment. Let’s say you have a checking account with a nominal interest rate of 1.26% and a balance of €10,000. Annually, you’ll earn €126 in interest. So, you could choose to set your tax exemption order at €150 for that account. This way, you have enough room for other investment income from stocks or fixed-term accounts. Note that cryptocurrencies currently fall under a different tax category. This means that you won’t have to calculate your crypto earnings when deciding where to set your tax exemption order. Married couples can also submit a tax exemption order (of €2,000 in 2023) for shared accounts, provided you’re filing taxes jointly. This is a very practical option if, for example, only one person in the couple is earning capital gains. However, it’s important that you don’t go higher than this amount. Make sure to check if you have other tax exemption orders set for separate accounts. Simply put: absolutely! If you have investments in multiple accounts, all you need to do is submit an order to each bank. However, make sure that you don’t go over your threshold — the total of all the tax exemption orders combined can’t be higher than your threshold. Keep an eye on your earnings to keep everything in check. Also, if you have multiple accounts with the same bank, one tax exemption order is sufficient — you don’t need multiple ones. As you can see, submitting a tax exemption order is pretty straightforward, even if you have multiple accounts or manage shared finances with a partner. So, there’s no reason not to submit a tax exemption order. Remember: If you don’t submit your tax exemption order, the bank will automatically deduct taxes from your interest income and send them to the tax authorities. And at a time when the European Central Bank continues to raise interest rates, that’s a serious amount of money you’re giving away. Luckily, you can submit your tax exemption order up through the last banking day of the year: December 30 (as long as it doesn't fall on a Saturday or Sunday). However, some banks make the deadline earlier due to the holidays. Other banks offer you even more time — it’s best to contact their customer support to confirm. But what if you’re too late for the 2023 deadline? Fear not! You can get your money back by declaring it on your 2023 tax declaration. For this, you’ll need your interest statement from your bank to determine your refund. Note that if you do nothing, your tax exemption order will automatically be carried over to the following year. This means, you’ll only have to submit it once — provided your threshold stays the same in the following calendar year. Whether you have a passbook, a checking account, or stocks, investing can be an important part of building wealth. Curious how much you can earn with compound interest? Check out our interest calculator to discover how much you can earn on your cash when you set it aside. If savings aren’t a part of your personal finance plan, don’t worry — it’s never too late to get started. With an N26 account, you can take advantage of smart features like Spaces sub-accounts and Insights — helping you keep a pulse on your spending while saving for the goals that matter most. Want to get started with banking you’ll really love? Compare our accounts today and find the one that suits you best.

What is a tax exemption order?

What are capital gains?

What is withholding tax?

What is an exemption order?

Tax exemption orders: How high are the thresholds for 2022 and 2023?

Tax exemptions for 2023

Tax exemptions for 2022

How does a tax exemption order work?

How can I submit a tax exemption order?

How high should your tax exemption order be?

Tax exemption orders for couples

Can I submit tax exemption orders for multiple banks?

What happens if I don’t submit a tax exemption order?

Your money at N26

Find similar stories

BY N26Love your bank

Related Post

These might also interest youTAXESHow to submit a tax declaration in GermanyFiling your taxes can be stressful, especially if you’re not familiar with the German tax system. We’ve put together this simple guide to walk you through it.

7 min read

TAXESSpeculation tax on real estate — what you need to knowSo, you want to sell your property, but you aren’t sure what taxes you’ll have to pay? Our guide will help you understand whether you need to pay speculation tax, and if so, how you can reduce it.

8 min read

TAXESUnderstanding capital gains tax in GermanyIf you’re invested in stocks or ETFs, or earning interest on a savings account, these earnings are subject to capital gains tax. Here, you’ll learn everything you need to know about this tax.

7 min read