Create the right impression

N26 Business Go is a bank account with travel insurance for freelancers and the self-employed with 0.1% cashback plus free ATM withdrawals abroad and your choice of card color: Ocean, Rhubarb, Sand, Aqua, or Slate.

Earning interest on your savings

No deposit limits, easy access, and simple conditions. With N26 Instant Savings, you get a non-regulated and flexible savings account at no added cost — directly in your N26 app.

More about the Instant Savings account

No fees for foreign currencies

When it comes to business, small fees can add up fast. With N26 Business Go, enjoy fee-free card payments anywhere in the world and unlimited free ATM withdrawals abroad — in any currency.

Make the world your home office

Work from anywhere, thanks to Allianz Assistance extended travel insurance. Whether it's travel delays, a canceled or interrupted trip, or lost or stolen baggage, we've got you covered. Plus, you get personal liability protection if you’re responsible for third-party damage while you're traveling. And of course, you're insured in case of a travel medical care — including dental emergencies.

Earn 0.1% cashback for your business

Each time you make a purchase with your N26 Mastercard, you'll get 0.1% cashback — calculated and deposit automatically into your account every month.

#Tag your expenses

#subscriptions, #office, #client, #bizness… use personalized hashtags to label your transactions and keep organized.

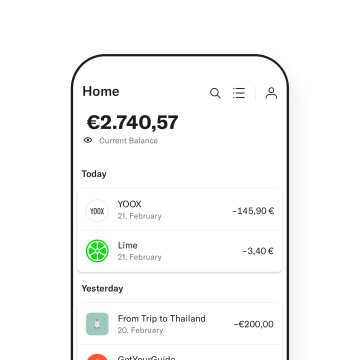

Up-to-date activity

Never miss a payment or a paid invoice. Instant notifications help you stay on top of your finances, including card transactions, withdrawals, and incoming transfers.

Safe payments with 3D Secure

Thanks to Mastercard SecureCode, your N26 Business Go account has an extra layer of security against fraudulent online payments.

Stay organized with built-in bookkeeping

Keeping track of your business finances just got way easier. As a N26 Business Go customer, you get a clear financial overview of your expenses and earnings, right in your N26 app. Artificial intelligence automatically categorizes your transactions, so you don't have to.

Save money on subscriptions and more

N26 Business Go comes with deals from brand-name partners like Grover, Bolt, and Booking.com to help you save money and grow your freelance business. Discover the current range of offers and discounts in the N26 app — and check back often, because we're continuously adding more.

Back-up your business with a spare card

A small glitch can really set you back when you're running a business. Order an additional card for your N26 Business Go account so that you always have access to your funds — even when your wallet is buried in your other bag.

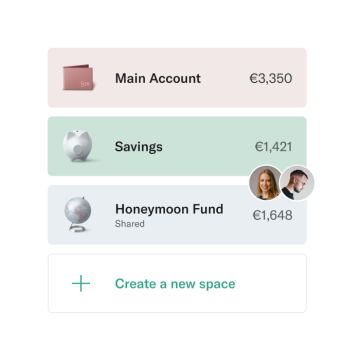

Save with Spaces

The N26 Spaces feature is powerful, simple way to save. You can have up to 10 of these sub-accounts alongside your main account, perfect for setting money aside for important business expenses. Once you've created a Space, simply drag and drop funds — whether it's for freelance taxes or a big Q4 project, your money is safely tucked away in its designated Space.

N26 Business Metal — upgrade your business account

Go premium with a N26 Business Metal account, designed for you and your business. Make a statement with your new metal Mastercard, and boost your cashback rate to 0.5% on all your purchases. Plus, get extended insurance, exclusive partner perks, and more.

Upgrade to N26 Business Metal

Important information about the insurance

N26 Business Go is a premium membership supplementing the N26 current banking account. N26 is the policyholder of a collective insurance agreement, as detailed in the Conditions for Beneficiaries. The insurance agreement is held by N26 and is underwritten by Allianz Assistance.

The insurance benefits are embedded within N26 Business Go and are only available to the customer for the duration of their membership. A summary of the cover can be found in the FAQ. German law is applicable.

Please note that the premium for the insurance policy is paid by N26 Bank AG. The insurance cannot be purchased separately from the N26 Go membership.

The insurance coverage begins with the subscription to the membership and ends when the customer terminates their N26 Business Go membership, which can be terminated at any time by the customer. Discounts granted for an annual over a monthly subscription will then lapse.

Information on dispute resolution can be found here https://n26.com/en-be/imprint

Further information can be found in the Conditions for Beneficiaries.

Frequently Asked Questions

- You are over 18 and hold a valid form of ID (varies by location)

- You’re a freelancer or are self-employed (the account must be registered in your name, not your business’s name)

- You intend to use the account primarily for business purposes

- You’re not already an N26 user

- You reside in one of the following countries: Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Iceland, Ireland, Italy, Latvia, Lichtenstein, Lithuania, Luxembourg, The Netherlands, Norway, Portugal, Poland, Spain, Slovakia, Slovenia and Sweden.

- Death; Illness (incl. epidemic/pandemic disease of the beneficiary, such as COVID-19) or medical condition; Injury; Hospitalization

- Individual quarantine and other events listed in the collective insurance agreement What will be reimbursed?

- Cancellation fees up to € 10.000 per trip for trip cancellation

- Serious accidental injury or unexpected serious illness including an epidemic/pandemic disease such as COVID-19 or Individual quarantine What will be reimbursed?

- Prorated costs of the covered travel services booked but unused at the destination up to € 10.000 per trip

- Necessary transportation expenses to continue the trip or return home

- Additional accommodation/ transportation expenses if prolongation of the trip is necessary up to € 100/day/per trip for a max. of 3 days

- Trip delayed due to covered reasons by at least 2 hours. What will be reimbursed?

- Additional expenses for meals, accommodation, additional transportation expenses up to 500 € per trip

- Reimbursement in case of damage, theft or loss of items

- Reimbursement for essential items purchased if luggage is delayed by more than 4 hours What will be reimbursed? Baggage: Up to € 2.000 per trip Baggage delay: Up to € 500 per trip

- Reimbursement in case of damage, theft or loss of travel documents What will be reimbursed? Necessary costs for emergency replacement identification document up to € 500 per trip

- Illness or accidental injury during travel - including treatment for an epidemic or pandemic disease such as COVID-19 What will be reimbursed?

- Reimbursement of medical expenses abroad

- Costs for emergency transportation and medically advisable and justifiable medical repatriation Max. amount covered:

- For medical emergency treatment: Up to € 1.000.000 per trip

- For dental emergency treatment: Up to € 250 per trip

- For medical repatriation: Up to the actual cost For search, rescue and recovery: Up to € 2.300 per trip

- Costs payable to a third party following damage or injury Max. amount covered: Up to € 500.000 per trip

- General exclusions apply to the whole policy and some benefit sections contains conditions specific to that section.

- Events occurring outside the validity dates indicated in the conditions for beneficiaries.

- Claims arising from an event the beneficiary had prior knowledge of before opening their account (or booking a trip for travel-related claims).

- Natural disasters, events directly or caused by or contributed to or arising from nuclear reactivity.

- Damage of any kind caused intentionally by the beneficiary or with their complicity.

- An epidemic or pandemic, except as expressly stated under Trip Cancellation, Trip Interruption, Emergency Medical/Dental Services Abroad, and Emergency Transportation sections.

- Systemic (non-individual) epidemic/pandemic events.

- Claims arising due to pre-existing medical conditions.

- Violation of international sanctions, laws, or regulations.

- The policy deductible that is applicable to claims made under some benefit sections.

- Financial limits apply to each benefit section.

- There are general conditions that you must meet for cover to apply and some benefit sections contain conditions specific to that section.

- War (declared or undeclared) or acts of war

- Civil disorder or unrest, except when and to the extent that civil disorder or unrest is expressly referenced in and covered under trip interruption coverage or travel delay coverage

- Terrorist events, except when and to the extent that terrorist events are expressly referenced. This exclusion does not apply to Emergency Medical or Emergency Transportation coverage.

- Intentional self-harm or attempt of suicide.

- Unstabilized illnesses or injuries that were diagnosed or treated.

- An epidemic or pandemic, except when and to the extent that an epidemic or pandemic is expressly referenced in the coverage description.

- Local health situations, pollution, weather or climate events.

- Natural disaster, except when and to the extent that a natural disaster is expressly referenced in the coverage description.

- Expenses incurred without the prior agreement of our assistance department.

- The cost of treatment or care not resulting from a medical emergency.

- The consumption of alcohol or drugs not medically prescribed.

- Participation in a professional or dangerous sport.

- Trip cancellation: deductible: €20 per beneficiary.

N26 Business Go is a premium membership bank account purely intended for freelancers and the self-employed. It has all the same benefits of N26 Go, plus 0.1% cashback on purchases.

You may be eligible to open an N26 Business Go bank account if…

You’ll receive your 0.1% cashback on all Mastercard purchases made directly into your N26 Business Go automatically. This is calculated and deposited on a monthly basis. You don’t need to take any additional action!

N26 Business Go comes with an extensive insurance package provided by Allianz. This includes trip cancellation insurance, coverage for luggage loss and theft, and coverage for travel delays and medical emergencies while traveling.

No, it doesn’t have any foreign transaction fees. You can withdraw money for free worldwide, and pay anywhere Mastercard is accepted. With N26 Business Go, you’ll never pay foreign currency fees and we’ll never charge you for withdrawing money.

N26 Go is a personal account, not to be used for business purposes. In comparison, N26 Business Go is a business account for freelancers and the self-employed, who also benefit from 0.1% cashback on purchases in addition to all the benefits of N26 Go. At the moment, it’s only possible to hold one bank account per person with N26.

To find out more about the insurance benefits associated with your N26 Business Go account please refer to the Insurance Product Information Document (IPID) and the Conditions for Beneficiaries.

Trip Cancellation

Which events are covered?

To find out more about the insurance benefits associated with your N26 Business Go account please refer to the legal documents made available to you, especially the Insurance Product Information Document (IPID) and the Conditions for Beneficiaries.

Please consult the respective Section of each benefit in the Conditions for Beneficiaries for a precise overview of the respective restrictions and limitations.

Main exclusions