Create the right impression

Zero foreign currency fees

Get comprehensive travel insurance

Reinvest with 0.1% cashback

You’ll receive 0.1% cashback on any purchases made using your N26 Mastercard, calculated monthly and paid directly into your account.

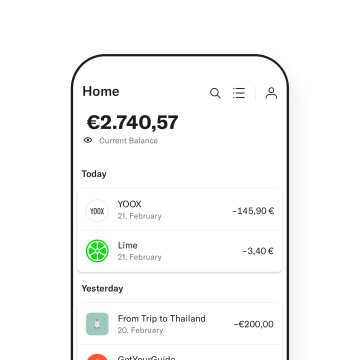

#Tag your transactions

#client, #office, #bizness… create your own personal hashtags and attach them to your transactions to organize them better.

Real-time activity notifications

Stay up to date. Get a push notification immediately after all account activity, including card payments, withdrawals and transfers.

3D Secured payments

Mastercard SecureCode gives you an extra layer of security that helps prevent fraud when making payments online with your N26 Business Go account.

Commission-free trades every month

Always get a breakdown of your spending

Discounts on the tools you need

An extra card to keep you moving

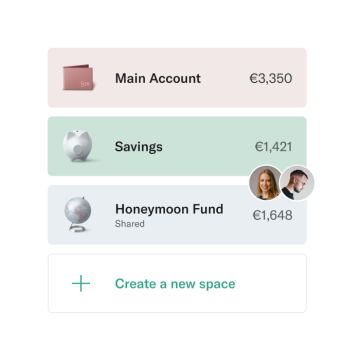

Spaces for planning

Plus, more helpful features...

Print your transactions list

We're mobile, but for easier tax returns and invoicing, export and download your transaction list as CSV or PDF files for easy printing.

Banking on the big screen

First, sign up to N26 using the mobile app. Then, view your account from a desktop or other device using our web app.

N26 Business Metal, THE business account

Frequently Asked Questions

- You are over 18 and hold a valid form of ID (varies by location)

- You’re a freelancer or are self-employed (the account must be registered in your name, not your business’s name)

- You intend to use the account primarily for business purposes

- You’re not already an N26 user

- You reside in one of the following countries: Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Iceland, Ireland, Italy, Latvia, Lichtenstein, Lithuania, Luxembourg, The Netherlands, Norway, Portugal, Poland, Spain, Slovakia, Slovenia and Sweden.