The new business bank account for freelancers

Your colorful Mastercard debit card

Earn 0.1% cashback

Start earning interest

Stocks and ETFs the simple way

N26 Business Smart, packed with benefits

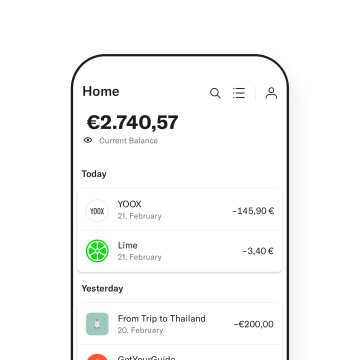

Statistics

All transactions in your N26 account are automatically categorized into a monthly overview. It’s the ideal way to learn from your spending habits and optimize your business expenses.

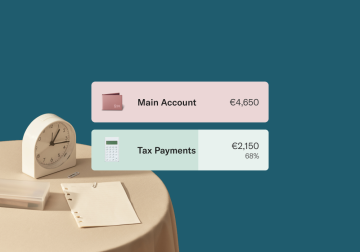

N26 Rules for easier saving

Putting money aside for taxes, or office furniture? Saving is easier with N26 Rules. Set up a rule, and automatically transfer money between your main account and sub-accounts.

100% mobile banking

N26 Business Smart is a business bank account that lives on your smartphone. Manage your money anytime and anywhere, on your phone or through the N26 WebApp.

Tax refunds and invoices made easy

Need to access your statements for the tax man? Download transactions lists in PDF or CSV formats—all easily accessible via the WebApp on your desktop.

Organize your finances with Spaces sub-accounts

Get incoming payments in a flash

Banking safely.

3D Secure

Add an extra layer of protection to your online purchases with Mastercard 3D Secure—an advanced two-factor authentication step.

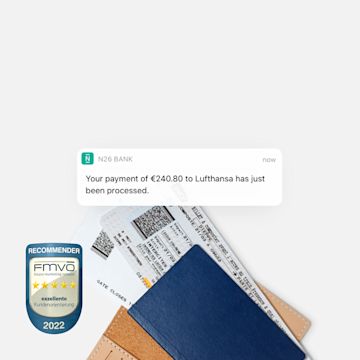

Push notifications in real time

Receive alerts on your smartphone after each transaction, and get notified immediately when you receive payments from clients.

Biometric authentication

Thanks to fingerprint authentication or facial recognition, you can login to your account in seconds and prevent unauthorized access attempts.

Deposit protection up to €100.000

N26 is a fully licensed bank, so any funds that you deposit in your account are protected up to €100.000 by the German Deposit Protection Scheme.

Customer Support via phone and chat