The bank account for freelancers and the self-employed

Your N26 Business Smart card—all in color

Get cashback on your business spending

Stocks and ETFs the simple way

Intuitive features to manage your business

Track your business expenses

Your spending is automatically categorized with Statistics, and organized in handy financial overview.

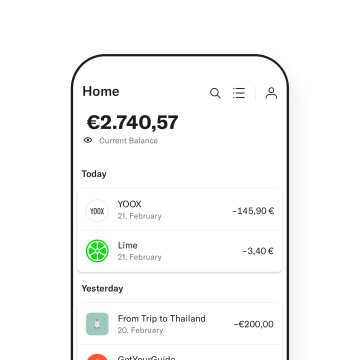

N26 accompanies you wherever you go

Managing your business bank account has never been easier. You control all the parameters of your N26 card from the app, and everything is displayed in real-time—even your account balance.

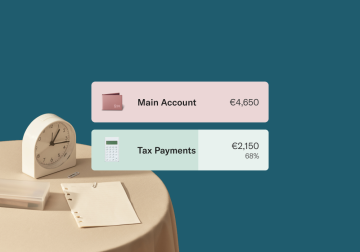

Save with Rules

To save regularly with sub-accounts, set up automatic Rules—define the sum and the frequency, and we’ll take care of the rest.

Organize your tax returns

Download your statements in PDF or CSV from the desktop WebApp, and add personalized hashtags to label your transactions.

Manage your transfers easily

Your secure business bank account

Mastercard 3D Secure

Your online purchases are protected thanks to Mastercard 3D Secure, an advanced two-factor authentication step.

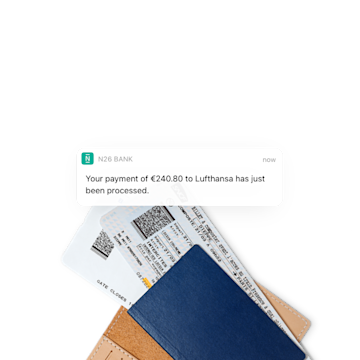

Instant push notifications

Receive alerts on your smartphone after each transaction, and get notified immediately when you receive payments from clients.

Biometric identification

Keep your business banking information safe and your finances secure by signing in with fingerprint identification or facial recognition.

Protection of deposits up to €100,000

As a European bank with a banking license, your money is protected up to €100,000 under the German Deposit Protection Fund.

N26 Customer Support via the phone