Intelligent business banking for freelancers

Your unique Business Mastercard, accepted worldwide

0.1% cashback on all card purchases

Smart business banking is here

Real-time spending Statistics

Track your business expenses with Statistics, an intelligent tool that automatically categorizes your transactions. Get a complete overview of all your outgoing and incoming transactions, and easily keep track of your monthly budget.

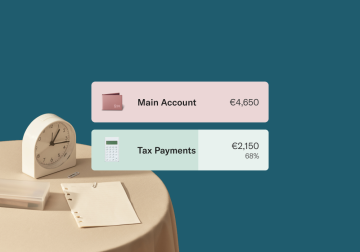

Never forget to save with Rules

Need to set money aside for your upcoming tax payment? Create Rules to set up recurring transfers between your main account and your Spaces sub-accounts—every day, week, fortnight, or month.

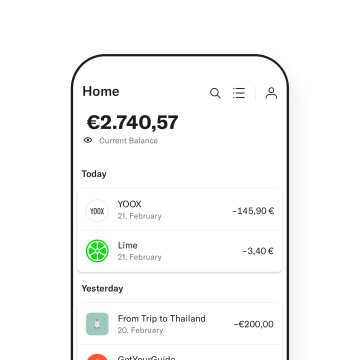

Bank from anywhere, at anytime

Say goodbye to inconvenient banking hours and waiting in line. You can access your N26 Business Smart bank account online on your smartphone or desktop 24/7, so you can save your time for what really matters.

Easier bookkeeping and tax returns

A few clicks is all it takes to export your bank statements as PDF or CSV files via the N26 WebApp on desktop. Stay organized by adding your own #tags to each transaction, and easily find them again in the future.

Get paid in seconds with instant bank transfers

Secure business banking

Mastercard 3D Secure

Shop online with peace of mind thanks to Mastercard 3D Secure—the two-factor authentication step that protects your online payments.

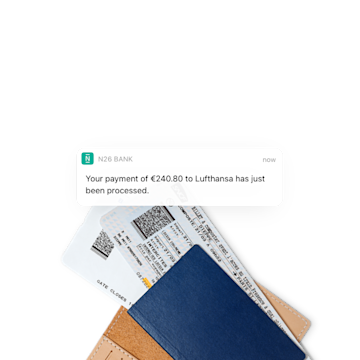

Push notifications after every transaction

Receive instant alerts on your smartphone for all activity in your bank account—track your card payments, ATM withdrawals, direct debits, and incoming transfers.

Log in with biometric authentication

Keep your banking logins extra secure by using FaceID or fingerprint identification to verify your identity.

Full control of your security settings

Lost your card? A few seconds is all it takes to stay secure. Lock or unlock your card, change your PIN, and order a new card in just a few taps from your N26 app.