N26 Business Smart

Earning interest on your savings

A N26 Business Smart card — in full color

Earn cashback when you spend

Your business finances, streamlined and simple

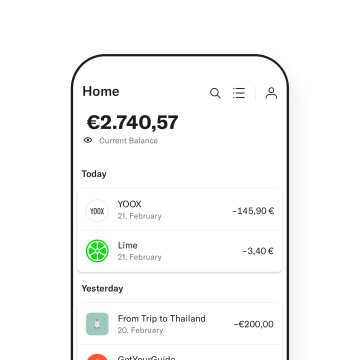

Track business expenses

Let the Statistics feature automatically categorize your spending, so you can get a clear overview of your business financial health.

Manage settings on the go

Stay on top of your business bank account without missing a beat. Adjust any of your N26 card settings directly from the app, and keep up with your account activity as it happens.

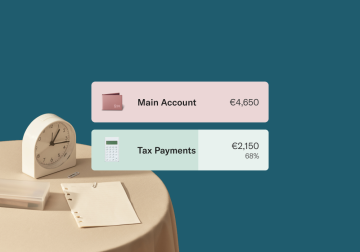

Set aside funds with Rules

Need to dedicate money to certain purposes or projects? Use N26 Spaces sub-accounts and automated Rules — you decide how much to set aside and how often, and we'll handle the rest.

Get ready for tax time

Download your account history in PDF or CSV formats from the desktop WebApp to make tax season less stressful. And to get even more organized, label your transactions with personalized hashtags.

Move money instantly

A business bank account with serious security

Online purchase protection

Thanks to Mastercard 3D Secure, an advanced two-factor authentication process, purchases that you make online with your N26 card are fully secured.

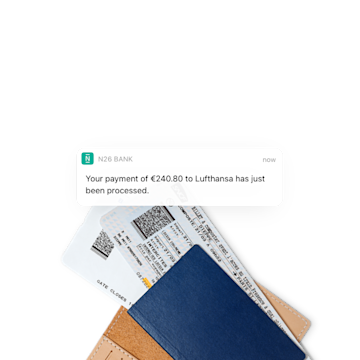

Real-time account notifications

Get smartphone alerts about your account activity, like immediate payment notifications when your clients settle their invoices.

Biometric log-in process

Use your fingerprint or face to sign in — it's part of how we keep your banking information secure and your business funds safe.

Up to €100,000 protected

Since we're a European bank with a full banking license, your funds are protected up to €100,000 under the German Deposit Protection Fund.

Our team is here to help