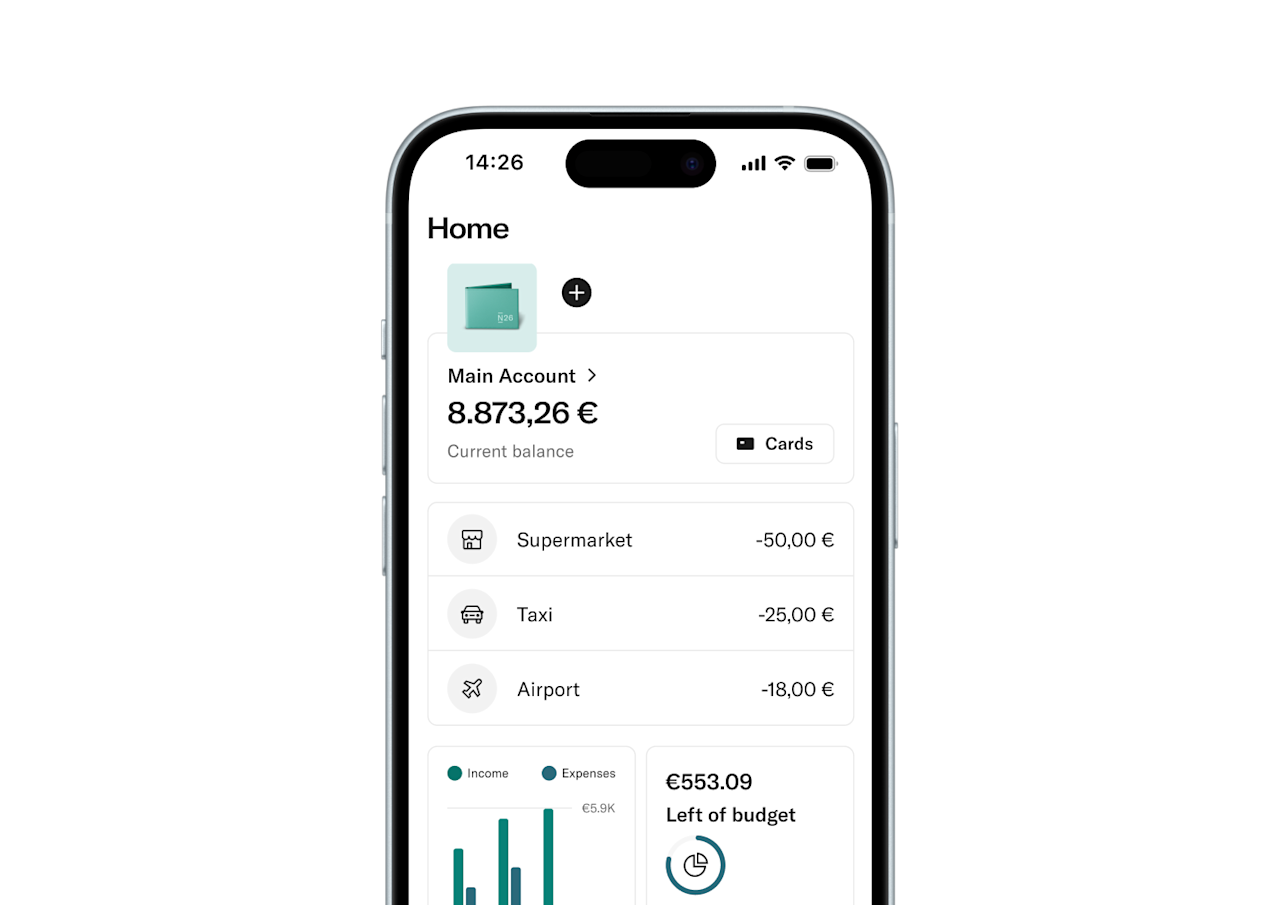

Bank for free with no hidden fees

Open your account in minutes and enjoy 100% mobile banking. Get a free virtual card and monthly ATM withdrawals.

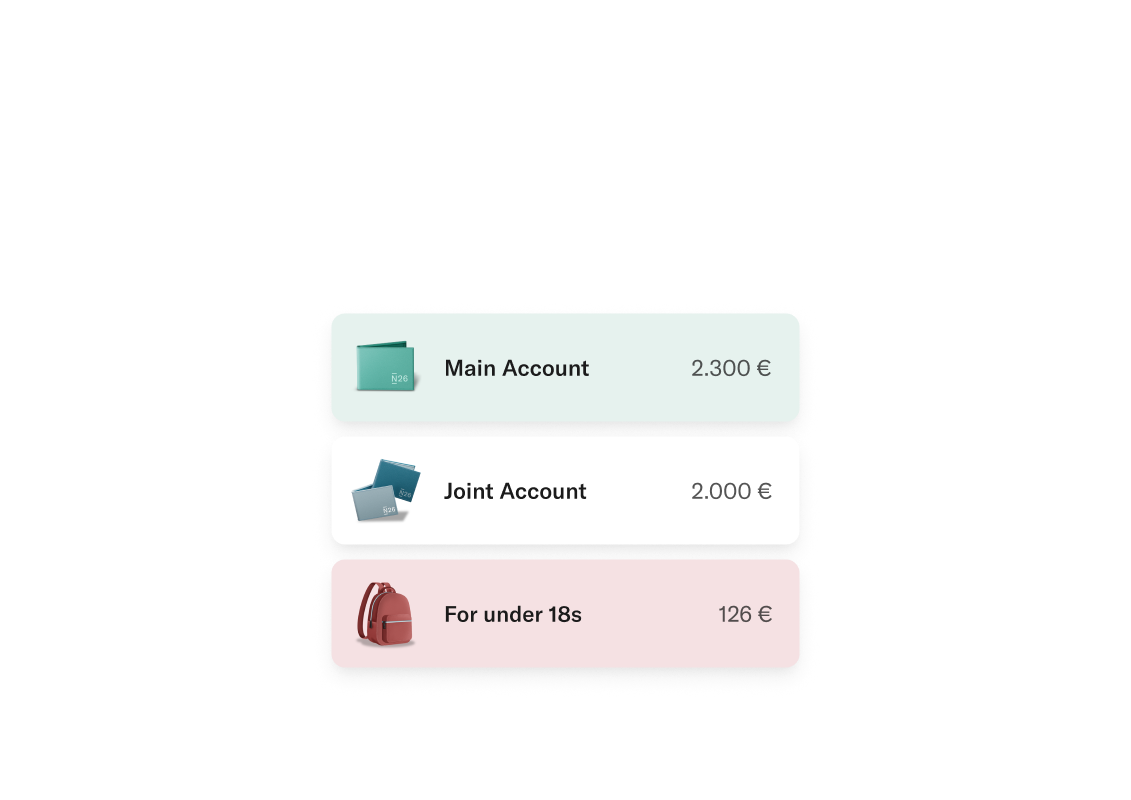

Simplify your shared finances

Get a free joint account with a dedicated IBAN or a card for under 18s with limits set by you.

Free stock and ETF trading

Trade stocks and ETFs for free2. Buy and sell 400+ crypto coins instantly3. Then put it all on autopilot with our free savings plans.Investing involves risk of financial loss.

Get an ECB-linked interest rate

Open a new N26 Metal account and earn 2% interest p.a.1 with N26 Instant Savings — linked to the European Central Bank rate.

Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

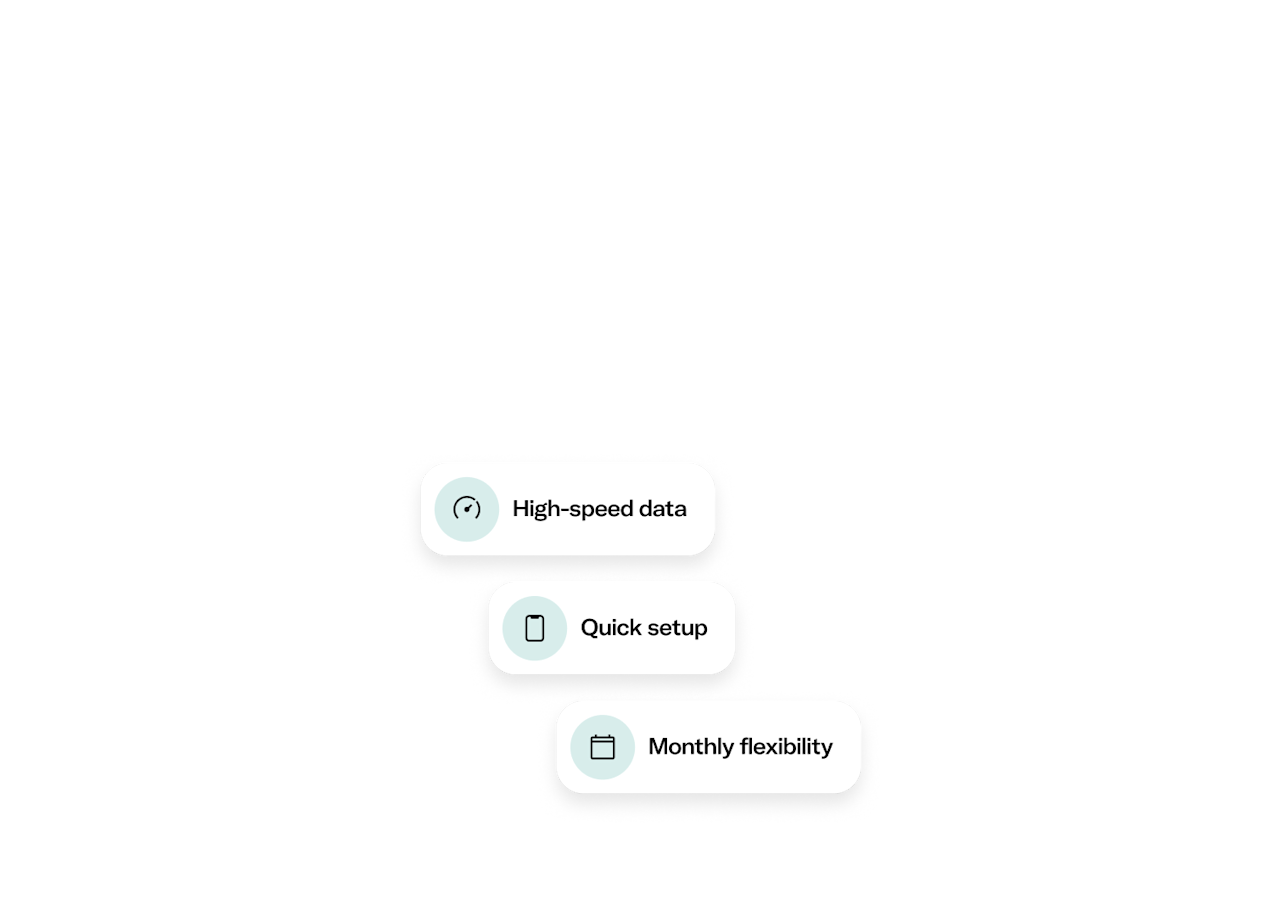

Get a fast and flexible mobile plan

Get connected on Vodafone's 5G network in minutes, with the pricing and flexibility you’ve been waiting for.

Switch banks in minutes

Open your N26 account and move your recurring payments in just a few taps.

Bank for free: There is no account management fee for the N26 Standard Account. For all other account plans fees apply. See List of Prices and Services for current fees.

1 Valid only for new customers who open a new N26 Metal account from 19/02/2025 onwards. The interest rate for the N26 Instant Savings account corresponds to the current European Central Bank deposit facility rate (2% starting on 11/06/2025) and is subject to change by N26 any time. Terms and conditions apply.

For existing customers, N26 Instant Savings account interest rates are based on your main N26 plan: from 11/06/2025 onwards, 0.25% p.a. for Standard and Smart, 0.55% p.a. for N26 Go, and 1.50% p.a. for Metal (before taxes). Please note that rates per plan can be changed by N26 over time.

2 These statements are intended to provide general information and do not constitute investment advice or any other advice on financial services and financial instruments such as Stocks, ETFs and Ready-made funds. These statements also do not constitute an offer to conclude a contract for the purchase or sale of Stocks, ETFs and ready-made funds. Stocks, ETFs and Ready-made funds can be subject to high fluctuations in value. A decline in value or a complete loss of the money invested are possible at any time. A portfolio transfer of fractional shares and ETFs is not possible, so a non-intended sale may be necessary. The values depicted are fictional and for illustrative purposes.The numbers of available Stocks and ETFs can vary per market.Trading stocks and ETFs with N26 is fee-free. Note that fund issuers may charge their own ETF management fees directly.

Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

3 The market for crypto assets constitutes a high risk. A complete loss of the money spent is possible at any time. N26 Crypto is powered by Bitpanda Asset Management GmbH.

4 Eligible spending: Detailed T&Cs for customers who sign up before July 17 and after October 15 can be found here: https://n26.com/hb-ex

N26 is the first 100% mobile bank to be granted and operate with a full German banking license from BaFin. That means your money is fully protected — both in your bank account and Instant Savings account — up to €100,000 by the German Deposit Protection Scheme. We currently operate in 24 markets worldwide and have over 8 million customers.

N26 has been granted a full German banking license from BaFin. By law, each customer’s funds are protected up to €100,000 by the German Deposit Protection Scheme. With 3D Secure, Mastercard Identity Check, and fingerprint and face recognition, the security of our customer's online payments is always guaranteed.

As a bank, N26 is supervised by the Federal Financial Supervisory Authority (BaFin). Our clients' funds are guaranteed up to €100,000 by the German Deposit Protection Scheme. In addition, the N26 app has many features to ensure the security of its users' bank accounts and data.

In order to open a bank account with N26, you must have a government-issued ID. Don’t worry, there’s no fussy paperwork or long wait times involved—just present your valid ID during a quick call and you’ll be up and running. It’s worth noting that you’ll also need a smartphone to use your account, and must live in an eligible country where N26 operates.

The standard N26 bank account is free and doesn’t charge any opening or maintenance fees. The N26 Smart bank account costs €4.90 per month, the N26 Go bank account costs €9.90 per month and the N26 Metal account is available for €16.90 per month. To open an N26 account, no deposit or minimum income is required.

You can easily switch your bank account to N26 from almost every German bank! Just type in the name of your current bank. Discover how to switch banks with our tool to facilitate the process.

You can open your mobile N26 account online in minutes from your phone or the N26 WebApp—no paperwork or waiting times. But best of all: Once your N26 bank account is active, you can start using it right away. This means you can start spending with your virtual card as soon as your account is set up, and you don't have to wait for your physical card to arrive.

Find out more

Deposit protection scheme: why your money is protectedLooking for reassurance that your money is protected? Deposit protection schemes help secure the money in your bank account.

What is investing and how to easily get startedFrom purchasing real estate to buying stocks, investing is the key to a secure and stable financial future. In this guide, learn what investing is and what you need to know to get started.

What's an ETF? An overview for beginner investors Everyone is talking about ETFs. Here's why — and what you need to know before investing in them.