Stand out with Business Metal

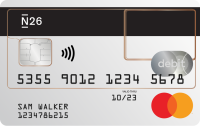

Discover a beautiful banking experience, with N26 Business Metal’s premium Mastercard in 18-grams of stainless steel. Available in 3 distinct metallic shades that best suit your style, the engraved contactless debit card offers a stylish, minimalist aesthetic that means business—and delivers all the functionality you need.

Get rewarded with 0.5% cashback

Earn 0.5% cashback on all card purchases and get money straight back into your account on a monthly basis. A smart way to reinvest it in your business—no fuss, no strings attached.

N26 Business Perks that propel you forward

Enjoy partner deals, perfectly suited to freelancers and the self-employed. Fill your mind with big ideas and subscriptions that upskill you, tap into tools that help build, manage and grow your business, or just do more with your money thanks to brands such as Fiverr, Dropbox, Taxfix, and NordVPN. Additionally, support your lifestyle with offers from the likes of Readly, Skill Yoga, Blinkist, and BookBeat.View the Perks available to you—and learn how to redeem them—in your N26 app.

Extra peace of mind, wherever you are

Whatever your day throws at you and wherever your business takes you, rest assured that you’re covered with N26 Business Metal. Thanks to your account’s extensive package of travel, mobility and lifestyle insurance, enjoy that extra peace of mind—both at home and further afield.

Insurance for travel, mobility and lifestyle

Emergencies when travelling

Up to €1 million coverage for emergency medical and up to €250 for emergency dental costs while traveling

Purchase protection

Coverage up to €10,000 in 12 months for stolen or damaged eligible purchases bought with your N26 card

Baggage coverage and delay insurance

Get covered up to €500 for baggage delays over 4 hours, or up to €2,000 if your baggage goes missing.

Travel delay and cancellation

We know how inconvenient it can be when business trips don’t go to plan. Thankfully, if your trip is cancelled or delayed for more than 2 hours, you’ll be covered.

Stay covered with mobile phone insurance

We've all been there, but losing your smartphone doesn't have to be a big deal. To avoid the unexpected, your Business Metal account covers your phone in case of theft or damage up to €2,000, regardless of whether you paid for it with your N26 Business Metal card or not.

Go global with Mastercard, at no extra cost

Wherever your business takes you, make payments anywhere in the world with zero foreign transaction fees and at Mastercard’s best exchange rate. Plus, enjoy free unlimited ATM withdrawals abroad and stay up-to-date with instant push notifications that inform you of what comes in and out of your account.

Smart management tools at your fingertips

Forget clunky spreadsheets and mountains of paperwork—your N26 Business Metal bank account helps you keep track of all your business expenses all in one place. Get an automatic categorization of your spending with our Insights feature, and log in to the web app on your desktop to download your statements for easier tax returns.

Open Bank Account

Get organized with Spaces sub-accounts

Stay on top of your business finances with 10 Spaces sub-accounts, each with its own IBAN. Automatically set money aside from your main account with Rules, then pay your bills via direct debit, set up standing orders for recurring payments, send and receive SEPA transfers, or get paid from clients—directly in each sub-account. Saving up for future projects? Try Round-Ups to save up the spare change whenever you pay by card. With Shared Spaces, it's easy to pool money together with others, too.

Priority Customer Support, always at your service

Whatever you need, we’re here to help. Whether it’s a quick question about your account, guidance on using a feature, or urgent technical support, just reach out to a dedicated Customer Support specialist on the phone, or chat to the team directly via your N26 app.

Your card, your business style.

Join N26 or upgrade to Business Metal to redefine your banking experience.The N26 Standard current account includes zero fees for the maintenance of the account, the issuance of a virtual debit card and the authorization of virtual debit card transactions, ordinary SEPA transfers in Euros, standing transfer orders, SEPA direct debits, three cash withdrawals a month at ATMs in the Euro area. Fees and charges are applicable for services other than those indicated.

Advertising message for promotional purposes. For complete contractual and economic conditions, please see the information sheets in the Legal Documents section.

FAQ

To open a bank account with N26, you must meet the eligibility criteria. You can then register on our website or via the app—all you need is your smartphone and a photo ID to get started. The sign-up process only takes a few minutes and no paperwork is needed—and you don’t even need a minimum deposit amount.

You can find more information on how to open a business bank account at our Support Center.

Your N26 Business Metal bank account comes with a free contactless Mastercard debit in 18-grams of stainless steel. Once you’ve signed up and your identity has been verified, we’ll send your Business Metal card — in your choice of metallic shade — to the delivery address you’ve provided. Please note that we don’t currently offer credit cards at N26 for our business bank accounts.

Looking for a current account with cashback? With N26 Business Metal, earn 0.5% cashback on all your purchases made with your N26 Mastercard. This money is paid straight back into your account on a monthly basis.

Your N26 Business Metal account comes with travel insurance, courtesy of Allianz Assistance. Benefit from emergency medical coverage abroad for you, your spouse and your children, trip interruption or cancellation insurance, compensation for travel delays and baggage delays and baggage loss, mobile phone coverage in case of theft or damage, personal liability when travelling and purchase protection.

Find out more about what’s included in the Terms and Conditions.

Yes, it’s included with N26 Business Metal. You’re covered in case of theft or damage up to €2,000, regardless of whether you paid for your smartphone with your N26 card or not.

Yes, as a premium Business Metal customer, you can enjoy a wide selection of business-orientated perks from brands such as Fiverr, Dropbox, Taxfix, and NordVPN. On top of this, benefit from a range of lifestyle deals and offers that support your general wellbeing.

The N26 Business Metal account costs €16.90 per month, and it’s a yearly subscription.