N26 Instant Savings

Get interest on your money

Want your money to work harder for you? Grow your savings with up to 4% p.a.* based on your membership.

- 100% flexible

- No extra fees

- No minimum or maximum deposit limits**

What is N26 Instant Savings?

N26 Instant Savings is an easy-access savings account that’s available at no extra cost in the N26 app.

Earn interest on all your savings with no deposit limits** and instantly withdraw anytime. Win-win.

Welcome to N26! Say hello to your new bank

N26 is the future of banking: beautifully simple, 100% mobile, and trusted by over 8 million customers. Discover why we’re featured in Forbes World’s Best Banks of 2023. Open your free bank account in minutes — directly from your smartphone. No paperwork, stress, or waiting times.

Looking for a more premium banking experience? Upgrade to N26 Smart, N26 You or N26 Metal and unlock access to exclusive tools that help you spend and save with confidence.

Interest Calculator

N26 Instant Savings

Use our interest calculator to see how your money can grow over time with N26.

Enter your starting balance and a time period:

Interest Calculator

N26 Instant Savings

Use our interest calculator to understand how your money can grow over time with N26.

Enter your starting balance and a time period:

To choose the best savings option, consider the conditions of promotional rates — including how long they're valid for. The calculations above show gross amounts before withholding taxes and assume that the daily balance in the savings account remains the same during the whole period. If you keep the paid interest in your N26 Instant Savings account, the total gross interest earned during the whole period will be higher. This is because you'll be earning interest on the interest you've already earned in the previous months.

Saving just got more rewarding

Grow your money

Earn up to 4%* interest p.a. — calculated daily and paid out monthly to grow your balance automatically.

100% flexibility

No need to lock your money away. Deposit and withdraw any amount in seconds, anytime.

No extra fees

Open your N26 Instant Savings account with just a few taps in the N26 app — at no extra cost.

No deposit limits**

Add as much money as you like and earn interest on your total savings balance. The sky’s the limit**.

Start earning interest

Opening your N26 Instant Savings account is easy. Not a customer yet? Sign up to N26 right from your phone.

Once you have your N26 account set up, get your tax ID verified. Then, simply head to the ‘Finances’ tab in the N26 app and tap on ‘Instant Savings’ to create your savings account.

Your money is protected

N26 is a fully-licensed German bank. That means the money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

See how N26 is simply secure*The interest rates vary based on your membership: 2.6% p.a. for Metal, 2.26% p.a. for You and Smart, and 1.26% p.a. for Standard accounts. Please note that regular rates per membership are subject to change over time.

** The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

What's next?

1. Register online

2. Verify your identity in a short videocall

3. Receive your N26 Mastercard

4. Enjoy your N26 account

N26 accounts — Your money deserves an upgrade

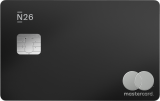

N26 Metal

The premium account with a metal card

- 4% interest p.a. on your Instant Savings

- 15 free monthly trades on stocks and ETFs

- Up to 8 free domestic ATM withdrawals

- 18-gram metal card

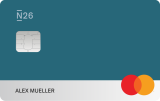

N26 You

The debit card for everyday and travel

- 2.8% interest p.a. on your Instant Savings

- 5 free monthly trades on stocks and ETFs

- Unlimited free withdrawals worldwide

- Travel insurance

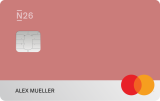

N26 Smart

The bank account that gives you more control

- 2.8% interest p.a. on your Instant Savings

- Up to 10 Spaces sub-accounts

- Up to 5 free ATM withdrawals per month

- Phone support 7 days a week

N26 Standard

The free online bank account

- 2.8% interest p.a. on your Instant Savings

- Up to 3 free domestic ATM withdrawals

- Free payments worldwide

- Apple Pay & Google Pay

Who's eligible for N26 Instant Savings?

To create a savings account, customers need to have a personal N26 bank account, German IBAN, German T&Cs, a verified German tax ID, and a legal residence in Germany. New customers might have to wait up to 5 business days for their Tax ID to be verified. Other eligibility criteria may also apply.

When and how is my interest paid?

The interest you earn is automatically calculated and paid out to your Instant Savings account on the first day of the following month. You’ll see separate transactions: the deposit of the gross interest into your account and the deduction of the taxes that are withheld from the interest you earned.

How is my interest calculated?

Your interest is calculated daily based on your account balance. For example, if you maintain a daily balance of €15,000 in your Instant Savings account for 12 months and you have a Metal membership, you’ll earn a total of €600 in gross interest, before taxes. Similarly, if there are 30 days in a month and your Instant Savings account balance remains at €15,000 for the whole month, you’ll earn a total of €49.32 (€15,000 x 4% x 30/365) in gross interest for that month.

Is there a limit on the amount of money I can deposit to my N26 Instant Savings?

You may deposit as much money as you like into your savings account: you’ll earn interest on the total balance of your Instant Savings account. The sky’s the limit.

What happens if I make a withdrawal before the end of the month?

N26 Instant Savings is a fully flexible, easy-access savings account, so there are no penalties for withdrawing part — or all — of your funds before the end of the month. You won’t lose any interest that was already paid out or the interest you’ve accrued over the previous days of the current month.

Do I need to pay taxes on my earned interest?

Yes, the interest you earn in your N26 Instant Savings account is taxable by the German government. But no stress — we’ll automatically withhold and transfer this tax percentage to the authorities on your behalf every month, when you receive your earned interest. If you've received interest during the calendar year, the annual tax certificate will be sent to you in the first quarter of the following year via the app.

How is the withholding tax calculated for my N26 Savings account?

In Germany, 'withholding tax' (Abgeltungssteuer) is the tax deducted from the money you make from financial investments. This includes the interest you earn on your savings. This tax is automatically calculated, withheld and transferred by N26 to the authorities on your behalf every month, when you receive your earned interest.

The current withholding tax rate in Germany is 25% and, if applicable, a 5.5% solidarity surcharge and a church tax of 8% or 9%. These percentages may change according to new tax laws or personal circumstances.

Can N26 Business customers open an Instant Savings account?

At the moment, only customers with a personal N26 bank account are eligible to open an Instant Savings account.