Understanding taxes in France

From direct and indirect taxes to income and property taxes, figuring out all the taxes you owe can be stressful. At N26, we’re all about helping you navigate complex financial topics and simplifying money management. So, we’ve put together a handy guide to help you better understand taxes in France.

How do I declare my taxes in France?

Every April, it’s time to start completing your tax return. Even though you get taxed at source in France, submitting a tax return is still mandatory. But fear not—we’ve put together a list of articles to help you get your head around this complex topic. For example, our guide to tax households will help you optimize your tax declaration based on your personal circumstances. Our first tip: remember to declare your N26 account or any other foreign accounts!

Direct taxes: what you need to know

The type of direct tax that most people are familiar with is income tax, but there are other taxes that we pay directly to the state. Find out everything you need to know about income tax schedules in France here. And if you own property—whether it’s a building or a piece of land—then learn more about property tax in our guide.

What are indirect taxes?

You pay value-added tax, or “VAT,” on most products or services—though you likely don’t even notice it! VAT is collected by companies and then paid to the government, and different VAT rates apply according to the type of goods or services being purchased. Our blog explains what VAT is and how it's applied.

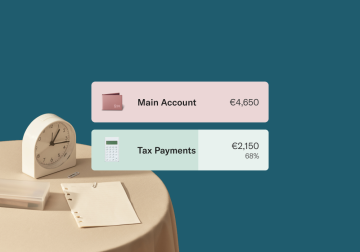

Taxes for the self-employed

Calculating your taxes might not be the most enjoyable part of being self-employed, but it’s still important for estimating your take-home income and setting achievable financial goals. But don’t stress—our practical guide to self-employment taxes in France has tips to make things easier.

Filing tax returns as a student

Starting college is a major milestone in your life, complete with new responsibilities—like filing your first student tax return! Our guide explains what you need to know about how to file your taxes as a student.

Taxes and cryptocurrency

Almost 8% of French taxpayers purchased cryptocurrency or NFTs in 2021. But what taxes apply to cryptocurrencies? Do you need to declare them to the tax authorities? Find out in our handy guide to filing taxes and cryptocurrencies.

Find a plan for you

N26 Standard

The free* online bank account

Virtual Card

€0.00/month

A virtual debit card

Free payments worldwide

Deposit protection

POPULAR

N26 Go

The debit card for everyday and travel

€9.90/month

Up to 5 free withdrawals in the Eurozone

Flight and luggage delay cover

Medical emergency cover

Winter activities insurance

Pandemic coverage

N26 Metal

The premium account with a metal card

€16.90/month

An 18-gram metal card

Up to 8 free withdrawals in the Eurozone

Purchase protection

Phone insurance

Dedicated N26 Metal line

French taxes types hub LP

- Si le solde de votre impôt sur le revenu est de 300€ ou moins, un unique prélèvement sera réalisé en septembre (vers le 25 du mois) ;

- Si le solde dépasse 300€, le paiement sera réparti sur quatre mois, avec des prélèvements égaux de septembre à décembre (vers le 25 de chaque mois).

Les déclarations préremplies sur papier sont envoyées durant tout le mois d'avril et le début du mois de mai 2024 aux contribuables qui n'ont pas choisi la version dématérialisée.

Pour ceux qui n'attendent pas de déclaration préremplie en format papier, il est possible de consulter la version en ligne dans leur espace personnel, déjà remplie avec les informations connues de l'administration fiscale.

Il est important de noter que la déclaration en ligne est requise pour tous les contribuables disposant d'une connexion internet à domicile. Cependant, ceux qui jugent ne pas pouvoir déclarer en ligne peuvent opter pour la version papier.

Pour les nouveaux contribuables qui déclarent leurs revenus pour la première fois, aucune déclaration préremplie sur papier ne sera envoyée, mais ils peuvent procéder à la déclaration en ligne via leur espace personnel.

Source : https://www.impots.gouv.fr/particulier/questions/quand-vais-je-recevoir-ma-declaration-pre-remplie-des-revenus

Vous avez déposé votre déclaration de revenus pour l’année précédente et il reste un montant impayé.

Ce montant ajuste ce que vous devez pour votre impôt sur les revenus de l’année passée. Il représente la somme totale de l'impôt sur le revenu due pour cette année, moins les prélèvements à la source déjà effectués.

Votre avis inclut un calendrier des paiements qui spécifie les dates et les montants de chaque prélèvement.

Le prélèvement de ce solde se fait automatiquement depuis le compte bancaire que vous avez fourni au fisc, suivant ces conditions :

En cas de difficultés financières temporaires vous empêchant de régler vos impôts à la date prévue, il vous est possible de solliciter, selon votre situation, un report exceptionnel de paiement directement dans votre espace particulier.

Source : https://www.impots.gouv.fr/particulier/jai-des-difficultes-pour-payer-page-en-cours-de-creation-0