How does foreign currency exchange work?

When sending money abroad or overseas, foreign currency exchange swaps one local currency into another. An international money transfer via a bank or transfer services allows a customer to convert their existing currency into the desired foreign currency, using exchange rates based on the global trade markets.

International, digital money transfers

With online foreign currency exchange, a customer makes international money transfers through a digital bank or firm, which quotes an exchange rate before processing the transaction.All digital banks offer transfer services, and there are firms that specialize in international currency transactions, such as Wise, MoneyGram, or WorldRemit. International money transfers at N26 are powered by Wise, so you can send and receive money quickly and reliably, anywhere in the world.

How does foreign currency exchange work?

Foreign currency exchange converts one currency into another, but it’s not usually at a 1:1 ratio. Exchange rates change regularly based on fluctuations in global trade markets.When an international money transfer is made between currencies, the rate calculates the difference based on the markets at that exact time.The amount the customer sends is then transferred at this rate into the other currency.Learn more

Foreign currency exchange rates and fees

Once a bank or firm quotes the exchange rate, the customer chooses to accept the rate or not. If they accept, the transaction goes through. On top of the exchange rate conversion, there might be certain transaction fees for sending or receiving an international money transfer.Rates and fees can differ greatly from bank to bank and from one transfer company to another. Learn more about foreign transaction fees here, and how to make sure you get the best deal.

International money transfers with N26

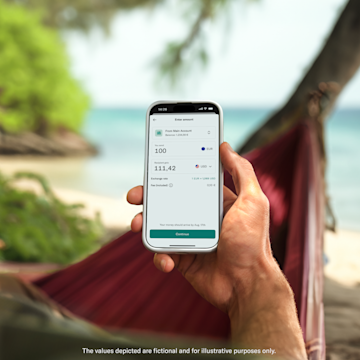

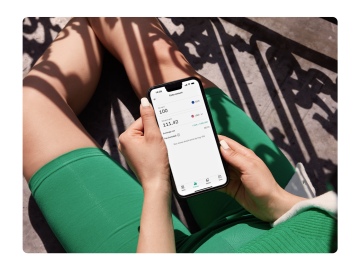

Global money transfers at N26 are powered by Wise (formerly TransferWise) — a specialist in foreign currency exchange. With 35+ currencies and real-time market rates, you can send money around the globe quickly and easily. Just a few taps in your N26 app, and your money arrives in 35+ countries with no hidden fees. N26 doesn’t charge anything extra for this service. When you make an international money transfer with N26 and Wise, you know you’ll be getting the best rate.Comparing international money transfer services

There are other international money transfer services, like MoneyGram and WorldRemit. MoneyGram offers fast transfers that take up to one working day, and WorldRemit also authorizes most transactions in mere minutes.However, MoneyGram’s and WorldRemit’s fees vary widely between countries, and they’re not always transparent with their exchange rates or costs. Although both prioritize speed, they may not be the most economical option.

How to access Wise with N26

N26 customers can access international money transfers in just a few taps directly in their N26 app.Simply open your N26 app, go to the ‘Home’ screen, and tap on ‘Send Money.’ Then tap the ‘+’ symbol on the top right and select ‘Foreign currency transfer.’ Enter the transfer amount and choose the currency to get a quote.Add and review your recipient’s bank details, and confirm the transfer!

Find a plan for you

POPULAR

N26 Go

The debit card for everyday and travel

€9.90/month

Up to 5 free withdrawals in the Eurozone

Flight and luggage delay cover

Medical emergency cover

Winter activities insurance

Pandemic coverage

N26 Metal

The premium account with a metal card

€16.90/month

An 18-gram metal card

Up to 8 free withdrawals in the Eurozone

Purchase protection

Phone insurance

Dedicated N26 Metal line

An international money transfer is when someone sends money overseas, either between their own international accounts or by making a payment to another individual’s foreign account. The money is converted from one currency into another through a foreign currency exchange.

The value between two different currencies during a foreign currency exchange is calculated using an exchange rate. The amount the customer is transferring from their current currency is measured against the currency of the destination using the current foreign exchange rate. This rate is calculated based on the global trade market.

Based on the foreign global trade markets, an exchange rate is the value of one currency compared to the value of another. The global markets change regularly — therefore, so do global exchange rates.

There are generally some fees and charges when making international money transfers, although some banks and money transfer companies charge more than others, or might not be transparent about their full costs ahead of the transaction. Sometimes the fees between different country transfers can also differ greatly. Be sure to read the fine print carefully before you authorize a foreign currency exchange.

Yes, N26 has a foreign currency transfer feature integrated right into our banking app. With N26, your foreign currency transfers are powered by Wise, allowing customers to send money to 35+ currencies (132 from USD) in just a few taps. Wise uses the best exchange rates, and you’ll get a transparent overview of your transfer conversion and fees, so you can feel confident in your transaction.