Banking basics 101

When it comes to your finances, no question is too big or too small. At N26, we know that navigating the world of banking can be difficult—but it shouldn’t have to be.Ready to bust the banking jargon, and find simple, easy explanations of the most popular banking terms? Read on to learn the banking basics—from contactless payments to digital wallets—and manage your money with confidence, together with N26.

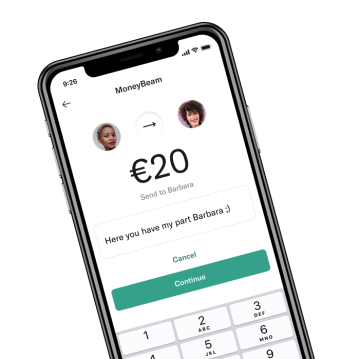

Online payments

As our daily lives become more digital, a range of online payment methods have cropped up to make buying online quick and simple. From digital wallets to virtual payment platforms—sending and receiving money has never been more convenient. But with so many options, it can be difficult to know which option is right for you. Discover the different online payment methods, the benefits of using them, and how you can make a payment online.

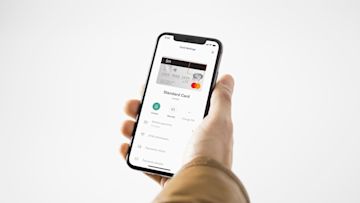

Credit vs. debit cards

Have you ever wondered what the difference is between credit and debit cards? They may look similar, but the money comes from two different sources when you pay with a credit card vs. a debit card. Prepaid cards are also available, but they work slightly differently. By comparing the advantages and drawbacks of these options, you can manage your money in the best way for you. Find out all about credit vs. debit cards, and understand their differences to make the most of their benefits.

Contactless payment

Contactless card payments have completely changed the way we pay for shopping or services. With just a single tap on the card reader machine, paying on-the-go is instant and effortless. Your bank card and the card reader machine communicate with each other using NFC technology—but how does it really work, and is it safe?Learn about contactless payments, how NFC technology works, and how your data is kept secure—so you can pay contactless with peace of mind.

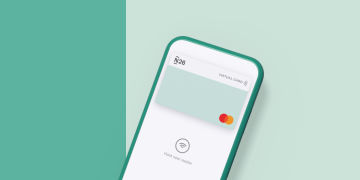

Digital wallets and virtual cards

In a world that’s increasingly becoming cash-free, having a digital wallet can be a convenient way to pay without digging out your bank card. By having a digital wallet on your phone, you can easily store digital versions of your physical cards—also known as virtual cards—and also switch between different accounts with ease.Click through to learn all about virtual cards and digital wallets—from how to set them up on your smartphone, to all the extra security benefits of using a digital wallet.

Security and 3D Secure

When it comes to your hard-earned money, it’s important that your bank has smart security features in place to keep your account safe. 3D Secure (or 3DS) is a type of two-factor card authentication that helps your bank verify your online payments by asking you to confirm your purchase with a pre-determined password or pin.Get answers to your questions about security and 3D Secure here, and discover how two-factor authentication protects your money and your personal data.

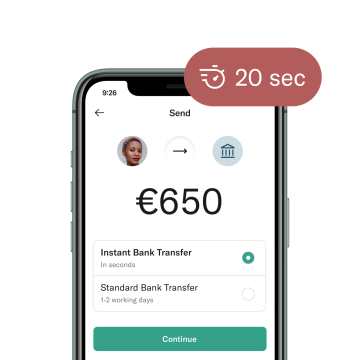

Top-up and withdrawals

Accessing your own money should be fast and easy, whenever and wherever you are. By keeping track of your spending and your account balance, you’ll always know if you need to top-up or if you can withdraw money. Discover how ATM withdrawals work, and everything you need to know about account top-ups here. Get tips on the best ways to access cash when you need it, and how to top up instantly.

Cashback

Did you know that it’s possible to get money back on your everyday purchases? There’s a whole host of rewards schemes and cashback options available, so you can earn money back every time you spend. Ready to make your hard-earned money go further?Read about cashback here and discover how cashback reward programs work, how much you can earn, and how to sign up today.

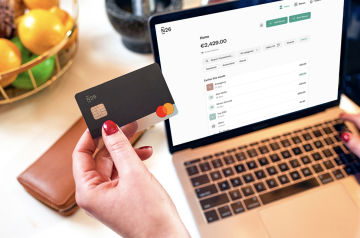

Banking statements

Knowing the status of your bank account is important when managing your money. Bank statements are great for keeping tabs on your account activity—these documents show your every transaction, typically sorted by each month. Bank statements are also a great way to spot any unusual activity on your account, so that you can follow up with your bank.Find answers to your questions on bank statements here—from how to download bank statements, how to actually read them, and what to watch out for.

IBAN, SWIFT and BIC

Whenever we send and receive bank transfers domestically and overseas, coded security is needed to keep your money safe during the process. But what’s the difference between an IBAN number and a SWIFT code? Or a SWIFT code and a BIC code?Use our handy, simple guides on IBAN numbers and SWIFT and BIC codes to learn the differences. You’ll learn how banks use them globally, what each digit represents, and how to find your own unique codes.

Banking license

When choosing a bank, it’s important to check that they have a banking licence before you open an account. A banking license means that the bank is providing appropriate security measures to protect your money, and that they’re following the rules set out by central banks and local governments. With a banking licence, you can rest assured that your deposited funds are in safe hands. Discover more on bank licenses here—like the types of banking licenses, and the requirements the bank must meet.

Interest Rates

Interest rates are important whether you’re taking out a loan or opening a new savings account. If you’re looking to borrow money, you’ll want to understand exactly what you need to pay back. If you’re hoping to save, you’ll want to know how much your funds will grow by. Find answers to common questions around interest rates here—including the difference between simple and compound interest rates, and how to make sense of your interest rate.

Foreign transactions and currency exchange

Customers are often caught short by bank fees when making foreign transactions. Foreign transactions can include withdrawing money when you’re overseas, purchasing online from an international store, and paying in a foreign currency. Currency exchange is the process of changing one currency into another, and there are often fees involved there, too. Learn more about foreign transactions and currency exchange—from the different types of transactions, to the fees involved and why they’re charged.

Find a plan for you

N26 Standard

The free* online bank account

Virtual Card

€0.00/month

A virtual debit card

Free payments worldwide

Deposit protection

POPULAR

N26 Go

The debit card for everyday and travel

€9.90/month

Up to 5 free withdrawals in the Eurozone

Flight and luggage delay cover

Medical emergency cover

Winter activities insurance

Pandemic coverage

N26 Metal

The premium account with a metal card

€16.90/month

An 18-gram metal card

Up to 8 free withdrawals in the Eurozone

Purchase protection

Phone insurance

Dedicated N26 Metal line