A credit loan is a binding commitment and must be reimbursed. Please check your ability to reimburse before committing yourself.

Your trusted credit provider

Younited, a credit institution regulated by the European Central Bank and the Bank of France, has provided over a million customers with simple, transparent loans and holds a 4.7/5 Trustpilot rating.

Get your loan in your N26 account

You can choose to have your Younited loan transferred directly to your N26 account.

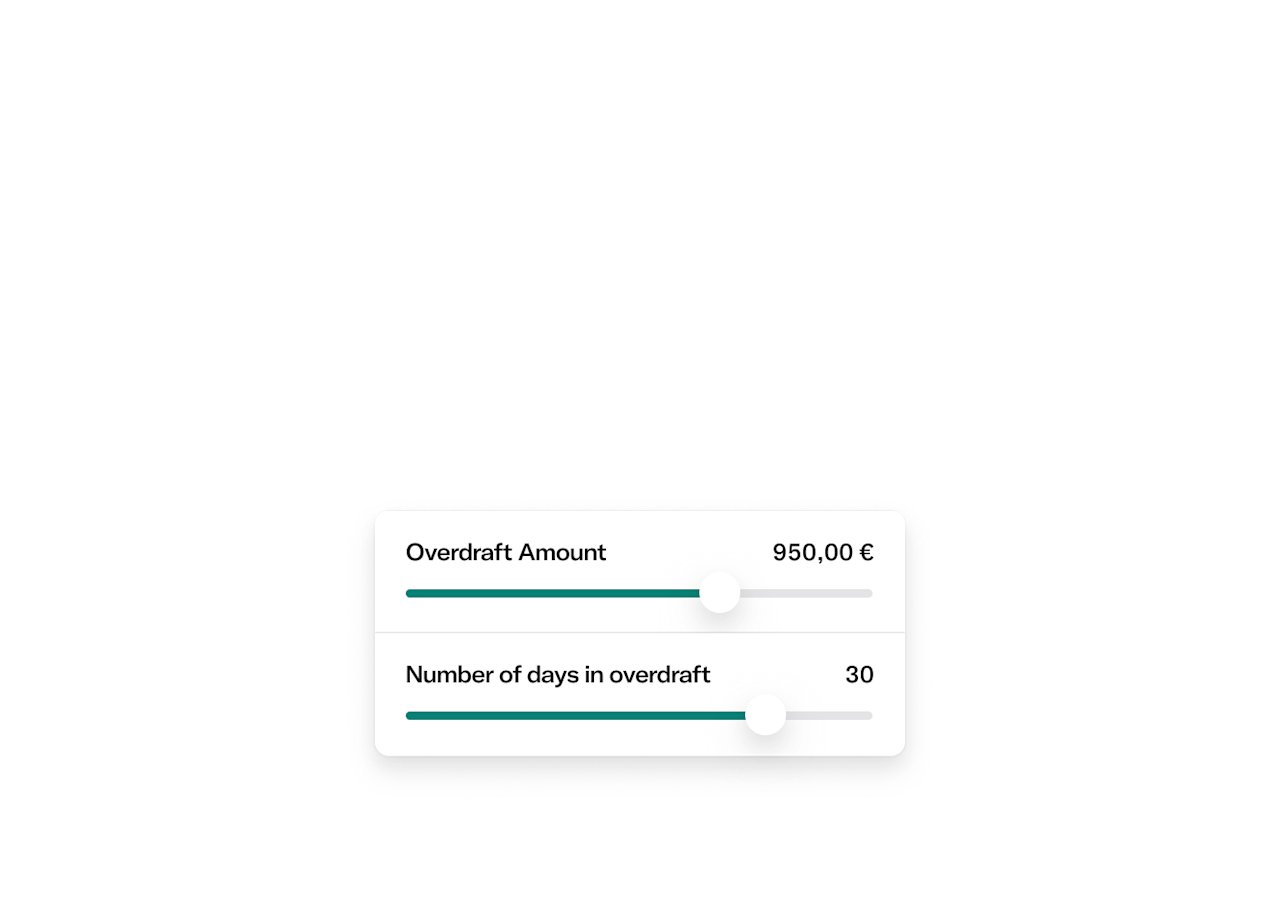

Pay at your own pace

Pick a payment plan from 6 to 84 months and set your monthly amount.

Money in minutes

Get a Younited loan offer without the wait. Once you confirm your loan, final approval is typically instant, but may take up to 24 hours.

Open an N26 account and see if you qualify

Open your account in minutes, with no paperwork, and enjoy 100% mobile banking.

Frequently Asked Questions

Your personal loan offer, including the interest rate, is based on several factors: the amount you want to borrow, the repayment time frame, and your creditworthiness. Depending on these factors, Younited offers effective interest rates ranging from 8.6% to 23%* (as of April 1, 2025) and repayment periods from 6 to 84 months.

You’ll receive a loan offer minutes after submitting your credit application with Younited. Final approval may follow immediately or take up to 24 hours, after Younited assesses your credit application and financial situation. To confirm your loan, you’ll need to give Younited an e-signature. You’ll receive the loan a few days later directly into your N26 account or the bank of your choice.

With Younited Credit, your personal loan offer is prepared in real time. Once you have reviewed the offer and decided to accept, you can electronically sign the loan agreement. You should receive your money from Younited within 7 to 14 days.

Younited is a leading instant credit provider in Europe. The company is a credit institute, approved and supervised by the European Central Bank, and the Bank of France. We selected Younited Credit to be our credit partner in France because they have a simple and paperless system for providing loans. They keep things simple for you.

Younited S.A. is a French company located at 21 rue de Châteaudun - 75009 Paris (France) and registered with the RCS of Paris with the unique number 517 586 376.

We selected Younited to be our partner in France offering simple, transparent loans. N26 doesn't provide credit loans in France, and we're not part of any contract you agree with Younited Credit. N26 does not in any way participate in the credit application or granting process. The loan approval process and repayment plan will be entirely managed by Younited.

Disclaimers

English version: A credit loan is a binding commitment and shall be reimbursed. Please check your ability to reimburse before committing yourself.

Younited is authorised as a credit institution and Investment Services Provider by the French Prudential Control and Resolution Authority (ACPR, approval number: 16488)

A credit loan is granted subject to final acceptance by Younited after examination of your credit application. You have a right of withdrawal of 14 calendar days from the signing of the loan contract offer. If your application is definitively accepted, Younited will process your data as data controller, as outlined in the Younited Privacy Policy.

Younited: A public limited company with a Management Board and Supervisory Board with capital of €1,861,342 - Head office: 21 rue de

Châteaudun – 75009 PARIS – RCS de Paris 517 586 376 –

ORIAS number 11061269 – Younited.com

Mandatory French version: Un crédit vous engage et doit être remboursé. Vérifiez vos

capacités de remboursement avant de vous engager.”

Younited est agréé en tant qu’établissement de crédit – Prestataire de Services d’Investissement par l’Autorité de Contrôle Prudentiel et de Résolution (ACPR, n° d’agrément : 16488).

Le financement est accordé sous réserve d’acceptation définitive par Younited après l’étude de votre dossier. Vous disposez d’un droit de rétractation de 14 jours calendaires révolus à compter de la signature de l’offre de contrat de prêt.

Younited : SA à Directoire et Conseil de Surveillance au capital de 1 861 342€ - Siège social : Siège social : 21 rue de Châteaudun – 75009 PARIS – RCS de Paris 517 586 376 – Numéro ORIAS 11061269 – Younited.com

*The interest rate offered depends on several factors: the amount you wish to borrow, the repayment period and your creditworthiness. Depending on these factors, Younited offers fixed effective borrowing rates (APR) which vary from 8.60% to 23% and with a loan duration of between 6 and 84 months.

Example of a personal loan for a total amount of €10,000 repayable in 84 monthly instalments of €157.25 (excluding optional insurance). Fixed Annual Percentage Rate (APR) of 8.60% (excluding optional insurance). Fixed borrowing rate of 8.28%. 0% of service charge. Total cost of borrowing: €3,209.3. Total amount owed by the borrower: €13 209.3. The monthly cost of the Death-Total and Irreversible Loss of Autonomy-Interruption of Work due to Accident or Illness-Loss of Employment insurance is €26.59, i.e. an Annual Effective Rate of Insurance (AEIR) of 5.6% and a total amount due of €2,333.56, and is added to the monthly loan repayments. The first instalment is due between 30 and 60 days after the funds have been made available, with instalments taken on the 4th of each month. Offer valid for applications made between 17:00 on 01/04/2024 and 23:59 on 30/06/2025.