PEA, a tax-friendly way to invest

Open your PEA and enjoy income-tax-free gains. Invest in European companies with no trading fees.Open Bank Account

What is a PEA?

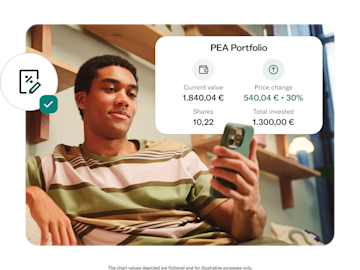

A Plan d’Épargne en Actions (PEA) lets you invest in a portfolio of European companies with tax benefits. You can add up to €150,000 and enjoy income-tax-free gains five years after your first deposit.Investing involves risk of financial loss.

Your PEA at a glance

No fees for you

Opening a PEA with N26 is free — and you won't pay any trading fees either.

European assets

Boost your home market by investing in European companies.

Tax advantages

Keep your investment in your PEA for five years to enjoy income-tax-free gains.

How do I open my PEA?

You can have your PEA ready in just a few minutes:

- In the Investments tab of your N26 app, select ‘PEA’.

- Review your tax information to make sure it’s up to date, and agree to the terms and conditions.

- Open your PEA by adding money to it.

Open an account

*Your PEA is managed by Upvest Securities GmbH. N26 Bank SE provides reception and transmission of orders and PEA access through the N26 app. Never invest more than you can afford to lose.

FAQ

A PEA is a regulated savings product that allows French tax residents to invest in a portfolio of European company securities, while benefitting from tax advantages under certain conditions.

You can open a PEA if you're a French tax resident over 18 years old and an individual — not a company or organization. You can’t open a PEA if you’re dependent on the household of another taxpayer, or already have a PEA or a PEA-PME with another institution.

To save on taxes, keep your investment in your PEA for at least five years after your first deposit. You can withdraw anytime before that, but this will lead to the PEA closure— subject to exceptions.

You can access your investment at any time; however, to benefit from tax advantages, you need to keep your investment in your PEA for a minimum of five years after your first deposit.

Yes. When filing your income tax return, French tax authorities require you to declare any foreign account you may have opened, held, used, or closed during the past fiscal year. As your PEA is held with Upvest Securities GmbH, based in Germany, you must report it by filling in the tax form number 3916-3916 bis. This form is available on your online income tax return (form number. 2042).

You can only have one PEA at a time. To start investing, make sure this is your only PEA account.

You can add up to €150,000 to your PEA, but your portfolio can grow beyond that.

With a PEA, you may only invest in eligible securities, such as shares of companies listed in the European Union, and collective investments, such as UCITS that are invested at least 75% in shares and equivalent securities within the European Economic Area.

At the moment, you can invest in eligible ETFs in your N26 app — with even more eligible investment options being added soon.

N26 Bank SE, and Upvest Securities GmbH have partnered up to offer you a PEA account. That means N26 provides the app you’ll use to manage your PEA and to receive and transmit buy-and-sell orders related to your PEA to Upvest Securities GmbH.

Upvest Securities GmbH is the managing entity of your PEA account. They provide the service for executing buy-and-sell orders related to your PEA, as well as the securities custody service.

Yes. The money in your PEA with Upvest is protected up to €100,000 by the German Deposit Guarantee Scheme of Deutsche Bank AG. This amount does not count towards the €100,000 allowance of your protected deposits at N26.

The tax regime of the PEA is designed to give you several benefits. Have a look at this page for more information on the PEA taxation.

That depends on the timing of your withdrawal in relation to the date of your first deposit, which is also the date your PEA was opened. This page has more information on the PEA taxation.