Buy stocks and ETFs with N26

Invest in yourself

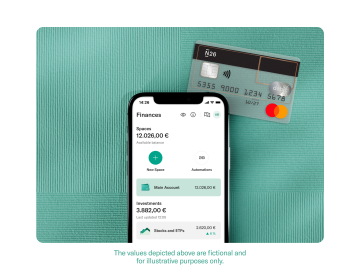

Want to live in the moment while planning for the future? With N26, buy stocks and ETFs right from your phone.

- Simple, intuitive, and easy to use

- Unlimited commission-free trades*

- Trade from €1

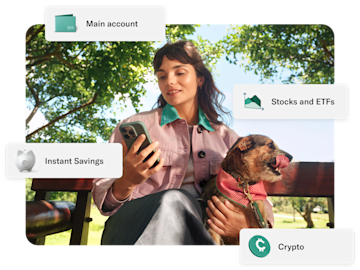

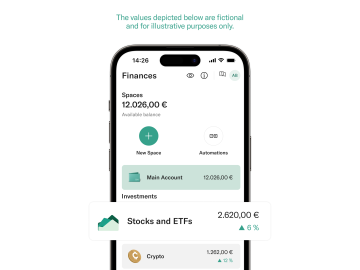

All in one app

N26 combines everyday banking and investing in a seamless way. That means you can manage your stocks, ETFs, and crypto portfolios without having to download another investment app. With N26, all the tools you need to build your financial wealth are in one place.

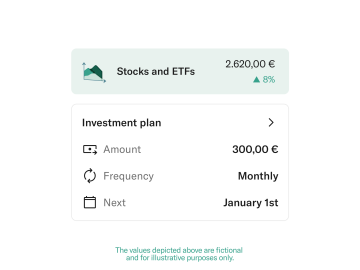

Invest in your future

Investing can be stressful. Save time with a fully-automated investment plan, available for all memberships at no extra cost in the N26 app. You decide how much and how often you want to invest. Start your plan any day you like with more than 3000 stocks and ETFs to choose from, and even more coming soon. Set up your stress-free stock or ETF investment plan now.Investing involves risk of financial loss.

Simple rates and commission-free trades

Say goodbye to hidden fees for good with unlimited commission-free trades* and a complete overview of your portfolio, gains, and losses.Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

What are stocks and ETFs?

Stocks represent ownership in a company. When you buy a stock, you're buying a piece of that company. You can earn some of the company's profits through dividends, or when the price of the stock goes up. ETFs, or ‘Exchange Traded Funds’, are a type of index fund made up of various assets — such as stocks or bonds. Investing involves risk of financial loss.

Pick and choose from 3000+ stocks and ETFs*

Popular ETFs

From some of the largest ETF providers — such as iShares, Xtrackers and Amundi.

Stock market ETFs

Invest directly in a specific stock market of your choice, like S&P 500 or NASDAQ-100.

Emerging markets ETFs

Choose ETFs from specific regions or countries to invest in, such as iShares IV-MSCI China Tech.

Sector ETFs

Invest in ETFs from specific sectors — such as AI, clean energy, or robotics.

Allianz

Offering solutions in insurance and asset management worldwide.

Tesla

The American multinational automotive and clean energy company.

Apple

One of the world’s largest technology companies by revenue.

Netflix

Part of the leading entertainment service providers worldwide.

N26 is simply secure

N26 is a fully-licensed German bank, so your funds are protected up to €100,000 by the German Deposit Protection Scheme. However, because stocks and ETFs include a wide range of securities that fluctuate with the market, we can't guarantee returns or prevent losses. All investments carry a risk of capital loss. Ensure you have sufficient knowledge before making any transactions. You can find more information on risks at the bottom of this page.

Learn more about security at N26

These statements are intended to provide general information and do not constitute investment advice or any other advice on financial services and financial instruments such as Stocks, ETFs and Ready-made funds. These statements also do not constitute an offer to conclude a contract for the purchase or sale of Stocks, ETFs and ready-made funds. Stocks, ETFs and Ready-made funds can be subject to high fluctuations in value. A decline in value or a complete loss of the money invested are possible at any time. A portfolio transfer of fractional shares and ETFs is not possible, so a non-intended sale may be necessary. The values depicted are fictional and for illustrative purposes.The numbers of available Stocks and ETFs can vary per market.

Service of reception and transmission of orders for financial instruments (stocks and ETFs) provided by N26 Bank AG, a public limited company under German law with a share capital of 120,000 euros, Voltairestr. 8, 10179 Berlin, Germany, CR Berlin Charlottenburg HRB 247466 B in partnership with Upvest Securities GmbH, a limited liability company under German law with a share capital of 25,000 euros, Schlesische Straße 33/34, 10997 Berlin, Germany (execution and custody).

The information contained on this page does not constitute investment advice or any other advice on financial services or financial instruments (stocks and ETFs). They are intended to provide general information. These statements do not constitute an offer to conclude a contract for the purchase or sale of financial instruments. The numbers of available Stocks and ETFs can vary per market.

*Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

N26 offers over 1500 ETFs in a variety of categories, including those tracking MSCI World or the S&P 500. We’ll continue to offer more ETFs as time goes on.

N26 offers over 1400 stocks in a variety of categories. We’ll continue to offer more stocks as time goes on.

Stocks and ETFs made available are traded on the stock market just like individual stocks. The prices are constantly changing, and N26 has no control over the profits or losses in your portfolio.

Your deposits at N26 are protected up to €100,000 by the German Deposit Protection Scheme. In addition, our partner Upvest Securities GmbH is a member of the Investor Compensation Scheme that protects 90% of liabilities arising from investment business, limited to the equivalent of €20,000.

All investments carry a risk of capital loss. Stocks and ETFs can be subject to high fluctuations in value. The invested amounts are not guaranteed, and a total loss of your investment is possible at any time. Past performance is not a reliable indicator of future performance. Diversification can reduce risks by spreading out investments across different financial assets rather than concentrating it all in one asset.Ensure you have sufficient knowledge before making any transactions.

Every investment strategy is different, so there’s no governing principle on how to choose the right stock or ETF. In the N26 app, you’ll find detailed information on each stock and ETF we have on offer. Plus, our blog features helpful articles on learning how to invest in stocks and ETFs.

What you pay for an ETF is known as the “market price” — which is determined based on how many people want to buy or sell that ETF at a given time. The market price should be closely aligned with an ETF’s net asset value (NAV). This figure is calculated daily by adding up all the ETF’s assets and cash holdings, subtracting any liabilities, and then dividing by the number of outstanding shares. This may sound confusing, but the point of NAV is to serve as a reference point for people interested in purchasing shares of the ETF, ensuring that they’re paying a fair price.

To get more granular, investors may also reference the ETF’s intraday net asset value iNAV, which is measured throughout the day to keep up with price fluctuations. This figure is a more accurate measure to compare with the market value of the ETF you’re looking to buy, but it may not directly reflect the price you actually pay, as that figure may rise or fall depending on how high or low demand is.

A share price is the price of a single share of a number of saleable equity shares of a company. In simple terms, the stock price is the highest amount someone is willing to pay for the stock, or the lowest amount that it can be bought for.

N26 now offers unlimited commission-free trades for stocks and ETFs for all memberships. That means that, for every purchase or sale of a stock or ETF with N26, you’ll only pay the specific ETF management fee, if applicable.

Profits and dividends from stocks and ETFs are taxable in France — generally, at a flat rate of 30% (Single Fixed Levy, PFU), which includes income tax (12.8%) and social levies (17.2%). You can opt for the progressive income tax scale instead. N26 does not withhold taxes on your behalf in France, so make sure you include it in your annual tax declaration. More information on taxes can be found in our Support Center Article.

Absolutely. Our selection of stocks and ETFs will continue to expand across categories. Stay tuned!

At the moment, stocks and ETFs are only available to eligible N26 customers in Germany, Austria, France, Ireland, and the Netherlands. In the coming months, we'll expand this offer to different countries — so check for email updates or follow us on social media.

This feature isn't available yet, but we’re working to make it possible soon.

Stocks and ETFs are offered in France by N26 Bank AG to all eligible customers holding a French IBAN, in partnership with Upvest Securities GmbH, an investment service provider based in Germany.

N26 provides a service for the reception and transmission of orders to Upvest, which is responsible for executing the orders on the market and for custody. For more information about the details of the service and the counterparties, please read our Support Center Article.