Secure your future with a flexible investment plan

Benefits of investment plans

Dollar-cost averaging

The market moves up and down, so each investment doesn’t buy the same number of shares, but the average cost per share balances out over time.

Complete flexibility

If your budget or the market conditions change, you can easily adjust your monthly amount, pause your plan, or cancel it altogether — whatever works best for you.

Personalized schedule

Instead of making one large investment, you can grow your portfolio step by step, at a pace that suits your personal goals and financial situation.

Compounding returns

Most ETF investment plans are accumulating, which means dividends are automatically reinvested rather than paid out, helping to speed up the growth of your investment.

Who is an investment plan good for?

- Build a private retirement fund

- Put money aside for their kids

- Protect their money from inflation

- Save up to purchase a home

- Fund a major life goal or other investment

Investment plan for retirement

For many people, government pensions aren’t quite enough to live comfortably. That’s why it’s crucial to set money aside for your retirement. Private pension plans can be expensive, often due to broker fees and administrative costs. With an ETF investment plan, you can take control of your retirement savings while keeping costs low.Investment plan for kids

Whether you’re expecting your first child or already a proud parent, an investment plan for your kids can help you prepare for significant milestones, like a study abroad program, college tuition, a first car, or even a future home purchase. It’s a great way to give your child a strong start into adulthood.Investment plan to combat inflation

While saving is always a good idea, remember that keeping it in a regular account means your money will lose value over time due to inflation. By investing in an investment plan, you can offset inflation through mechanisms like dividend payments.Investment plan for real estate

With rising interest rates and soaring property prices, taking out a loan is becoming increasingly expensive. An investment plan can help you grow your equity, making it easier to finance a home purchase later down the line.Investment plan for personal goals

Dreaming of starting your own business as a content creator? Want to turn your attic into a yoga studio? Or maybe you’ve got your heart set on owning a camper van? Whatever your goals are, a stock or ETF investment plan can help you grow the budget you need to make them happen. Pro tip: Use an investment plan calculator Investment plan calculators can help you simulate how your investments will likely grow. Some platforms even offer ETF-specific calculators. Just remember, these are only estimates — neither tools nor people can predict the exact performance of your investments. Still, they’re a useful way to figure out the right savings rate and time horizon for your financial goals.Find the right broker for your investment plan

Trading fees and ongoing costs

To maximize your returns, choose a platform that offers commission-free stock and ETF investment plans and keeps fees low.

Availability of different plans

Compare brokers to see what investment plans they offer, and check for special deals or promotions.

Minimum investment and flexibility

Check what the minimum monthly investment amount is and whether you can adjust the plan to fit your needs.

Transparency and user-friendliness

Opt for a provider with clear, upfront fees and an intuitive, easy-to-use interface.

Make your future self proud with a plan

How to set up your investment plan

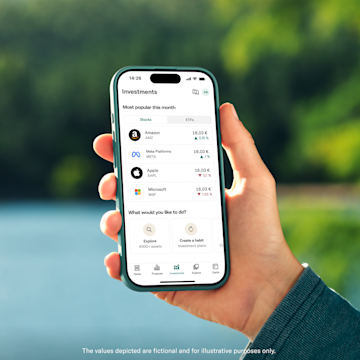

Find a reliable broker

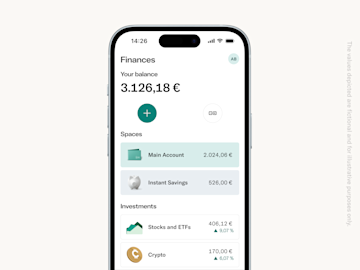

Choose a trusted broker that allows you to set up and manage investment plans — with N26, you can do everything right from the app.

Choose the right plan

Pick an investment plan — whether it's for stocks, ETFs, or cryptocurrencies — that suits your goals and risk tolerance, or even set up multiple plans to diversify your portfolio.

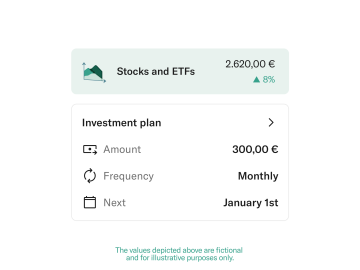

Set amounts and frequency

Based on your budget, decide how much you want to invest and how often, and remember that you can always adjust these settings later if needed.

Finalize and automate

Choose your start date, place the order, and watch your fully automated investment plan go to work to grow your money.

ETF investment plan

Stock investment plan

Fund investment plan

Savings account investment plan

Find a plan for you

N26 Standard

The free* online bank account

€0.00/month

A virtual debit card

Free payments worldwide

Deposit protection

N26 Go

The debit card for everyday and travel

€9.90/month

Up to 5 free withdrawals in the Eurozone

Flight and luggage delay cover

Medical emergency cover

Winter activities insurance

Pandemic coverage

N26 Metal

The premium account with a metal card

€16.90/month

An 18-gram metal card

Up to 8 free withdrawals in the Eurozone

Purchase protection

Phone insurance

Dedicated N26 Metal line

FAQs

- Financial goals: Are you investing short-term or long-term? Do you want high or moderate returns?

- Time horizon: How long can you commit your money without needing it?

- Financial situation: How much can you afford to lose without jeopardizing your financial stability?

- Personality: Are you comfortable with risk or do you prefer to play it safe?