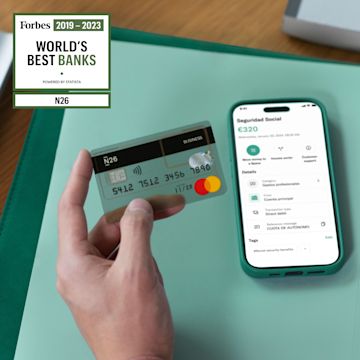

The free bank account for freelancers

- With no monthly fees

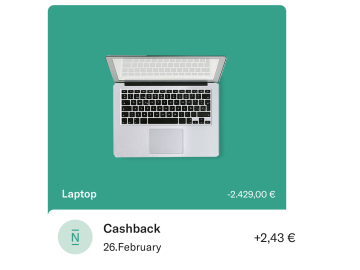

- 0.1% cashback on all your card purchases

- Unlimited bank transfers

- Free card payments worldwide

N26 gives you back 5% of your self-employed fee for free*

Pay your taxes with N26

No conditions or commissions

0.1% cashback on purchases

How to open your N26 account

2013

Market Launch

24

Markets

~8 million

Customers

A full banking license

since 2016

See our available plans

N26 Business Standard

The free online business bank account

€0.00/month

Apple Pay & Google Pay

Free card payment worldwide

0.1% cashback on all card purchases

- -

*Need a physical card? Order a transparent debit Mastercard card for an one-time €10 delivery fee.

N26 Business Smart

The intelligent business bank account for freelancers

€4.90/month

A physical and virtual card

Up to 5 free ATM withdrawals per month

10 Spaces sub-accounts

Phone support 7 days a week

N26 Business You

The business bank account for everyday and travel

€9.90/month

Unlimited free withdrawals in foreign currencies

Emergency medical coverage

Flight delay compensation

Luggage loss and delay insurance

N26 Business Metal

The premium business account for freelancers

€16.90/month

An 18-gram metal card

0.5% cashback in all your purchases

Up to 8 free ATM withdrawals per month

Priority customer hotline

Frequently Asked Questions

- use the account primarily for business purposes

- not be already an N26 user

- reside in a country where N26 Business is available: Germany, Austria, France, Italy, Spain, Portugal, Ireland, Greece, the Netherlands, Belgium, Luxembourg, Finland, Latvia, Estonia, Lithuania, Slovakia, Slovenia and Switzerland.