Free trades every month

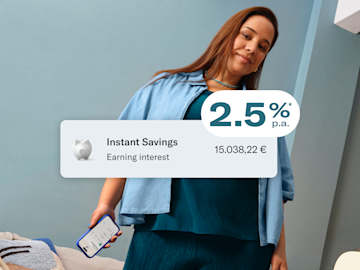

Start earning interest

The easy way to save on crypto fees

8 minutes

to open a premium bank account

Priority customer support

with access to our dedicated hotline

Deposit protection

of up to €100,000

A full banking license

since 2016

Fee-free ATM withdrawals worldwide

Mobile phone insurance

Stay on top on your finances with Spaces sub-accounts

Manage your money seamlessly with sub-accounts

Link your Spaces to your Mastercard

Link your N26 Metal card to a Space with just a few taps to pay directly from it. That way, you'll always be in control of your spending.

10 Spaces sub-accounts with IBAN

Create up to 10 Spaces sub-accounts and give them their own IBAN. Then receive and make SEPA transfers — or set up direct debits and standing orders to pay bills directly from your Spaces.

Automate your savings

Use Round-Ups to save the spare change whenever you pay by card. Each payment with your N26 Metal card is rounded up to the nearest euro and the difference is automatically moved into a Space of your choice.

Sort incoming transactions into your Spaces

Automatically set aside money in Spaces with the N26 Income Sorter. Activate this feature to move a percentage or a fixed amount of your incoming funds to your Spaces, and stay on top of your budget without even thinking about it!

Priority Customer Support

Personal liability while traveling

Coverage up to €500,000 for Personal Liability in case you’re legally liable for damage to a third party or their property during a trip.

Purchase protection

Coverage up to €10,000 in 12 months for stolen or damaged eligible purchases bought with your N26 card

Emergencies when traveling

The N26 Metal policy provides cover for you, your spouse and children in case of a medical emergency abroad, including emergency dental care. You also get access to 24/7 medical phone assistance.

Baggage coverage and delay insurance

Get covered up to €500 for baggage delays over 4 hours, or up to €2,000 if your baggage goes missing.

Travel delay and cancellation

We know how inconvenient it can be when business trips don’t go to plan. Thankfully, if your trip is cancelled or delayed for more than 2 hours, you’ll be covered.

Trip interruption

Get covered up to €10,000 for unused non-refundable trip costs, plus additional accommodation and transportation.

Purchase protection

Coverage up to €10,000 in 12 months for stolen or damaged eligible purchases bought with your N26 card

Personal liability while traveling

Coverage up to €500,000 for Personal Liability in case you’re legally liable for damage to a third party or their property during a trip.

A unique N26 Metal debit card

Your card, your style.

Get a discount when you pay annually

Choose to pay for your N26 Smart, You or Metal account annually and you’ll save 20% — that’s a premium N26 account at much less of a premium.N26 Metal

Our most premium plan

From €13.50/month

An 18-gram metal card

Up to 8 free ATM withdrawals per month

Purchase protection

Priority customer hotline

N26 Go

Travel with premium perks

€9.90/month

1,5% AER/NIR* interest on your N26 Instant Savings

Unlimited free withdrawals in foreign currencies

Insurance for delay and theft of luggage

Medical emergency cover

N26 Standard

The free online bank account

€0.00/month

1,25% AER/NIR* interest on your N26 Instant Savings

Worldwide payments and no foreign transaction fees

Up to 3 free domestic ATM withdrawals

- -

*Need a physical card? Order a transparent debit Mastercard card for an one-time €10 delivery fee.

Frequently Asked Questions

- Travel delays

- Baggage delay

- Baggage coverage

- Emergencies while traveling

- Trip cancellation

- Trip interruption

- Personal liability insurance

- Mobile phone coverage

- Purchase protection