Open you online account for non residents in Spain

- Free bank account

- No conditions

- Send and receive money instantly with Bizum

- Earn 2% AER* interest with N26 Instant Savings

Risk indicator for all N26 accounts.

1

/6

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

N26 Standard – the free online bank account

Discover N26 Standard, the free online bank account with zero hidden fees. Sign up online in minutes, and start spending right away with your free virtual debit Mastercard in apps, in stores, and online. Prefer a physical card? Order yours now for a one-off €10 delivery fee.

Send and receive money instantly with Bizum

Bizum is now available in all N26 accounts so you can send, receive and request money immediately, only with the recipient's phone number. In addition, you can also make payments through Bizum in electronic stores that allow it (available from October 5th). Open your N26 account and enjoy all the advantages of a 100% online bank, now with Bizum included!

Find out what documents you need to open your N26 account

We aren’t huge fans of paperwork — or of making you waste your time looking for the information you need. To make it easier for you, we explain here in detail what identity documents you need to open your N26 bank account, depending on your nationality.

See list of documents

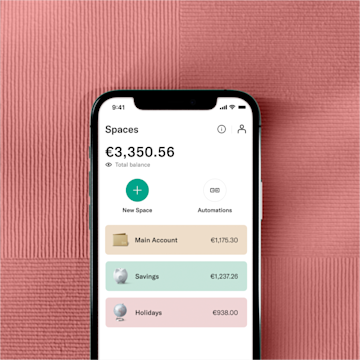

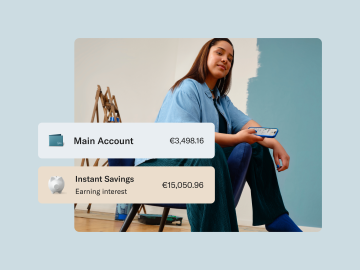

N26 Instant Savings account

N26 Instant Savings is an easy-access savings account that’s 100% flexible and available for free in the N26 app. Grow your savings with 2% AER* interest — and dip into it anytime you need to.Earn interest on all your savings (no minimum or maximum deposit limits), and instantly withdraw anytime — without losing any interest you’ve already earned. Win-win.

Discover our Business Mastercard for freelancers

N26 Business is free to open online, with no account management fees. It’s the easiest business bank account to open if you’re a freelancer or you’re self-employed.

- Spanish IBAN

- 0.1% cashback

- Fast sign-up process

- 100% app-based banking: no paperwork required

Discover N26 Business

2013

Founded

~1,500

Employees

~8 Million

Customers

~1.8 B $

Funding

N26 accounts — your money deserves an upgrade

N26 Standard

The free online bank account

Virtual Card

€0.00/month

0.5% NIR/AER* interest on your N26 Instant Savings

Worldwide payments and no foreign transaction fees

Up to 3 free domestic ATM withdrawals

- -

*Need a physical card? Order a transparent debit Mastercard card for an one-time €10 delivery fee.

N26 Go

Travel with premium perks

€9.90/month

All benefits of N26 Smart, Plus

0.1% NIR/AER* interest on your N26 Instant Savings

Unlimited free withdrawals in foreign currencies

Insurance for delay and theft of luggage

Medical emergency cover

N26 Metal

Our most premium plan

€16.90/month

All benefits of N26 Go, Plus

1.5% NIR (1.3% AER)* interest on your N26 Instant Savings

An 18-gram metal card

Up to 8 free ATM withdrawals per month

Priority customer hotline

Savings Account: *2% AER (2% annual NIR). With this interest rate, if you maintain a daily balance of 15,000 euros in your N26 Instant Savings account for a period of 12 months, you will obtain a total gross interest of 300 euros. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no minimum or maximum deposit limit. See conditions at https://n26.com To benefit from this offer, you’ll need to open an N26 bank account. After that, you may open a separate N26 Instant Savings account to earn interest alongside everyday banking.

Smart: TIN 0%, APR: -1.17% for a scenario in which a daily balance of €5,000 is maintained consistently for 1 year, applying an annual nominal interest rate of 0% and the monthly cost of the account of €4,90/month. The settlement of the account is made monthly.

Go: TIN 0%, APR: -2.35% for a scenario in which a daily balance of €5,000 is maintained consistently for 1 year, applying an annual nominal interest rate of 0% and the monthly cost of the account of €9,90/month. The settlement of the account is made monthly.

Metal: TIN 0%, APR: -3.98% for a scenario in which a daily balance of €5,000 is maintained consistently for 1 year, applying an annual nominal interest rate of 0% and the monthly cost of the account of €16,90/month. The settlement of the account is made monthly.