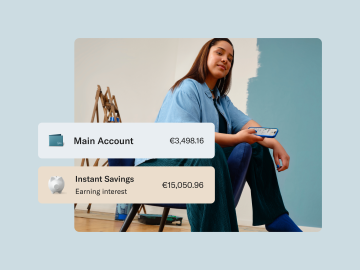

Grow your savings by 2,26% AER — only with N26

- 2.26% AER* interest calculated daily, paid monthly

- No minimum deposit

- No conditions or fees

- Instant access

What is N26 Instant Savings?

Interest Calculator

Calculate interest

Calculate your future savings and brutto interest income (before withholded tax).

Fill the following information

Total deposit

€15,225.00

Interest paid

€225.00

Saving just got more rewarding

Grow your money

Earn interest on your savings — calculated daily and paid out monthly to grow your balance automatically.

Access anytime

No need to lock your money away. Deposit and withdraw any amount in seconds via the N26 app, as often as you like

No extra fees

Open your Instant Savings account with just a few taps in the N26 app — for free.

No deposit limits

No minimum or maximum deposit limits and no penalties for withdrawals, you’re free to save at your own pace.

Start earning interest today

Welcome to N26! Say hello to your new bank

What's next?

N26 accounts — your money deserves an upgrade

N26 Standard

The free online bank account

€0.00/month

1,25% AER/NIR* interest on your N26 Instant Savings

Worldwide payments and no foreign transaction fees

Up to 3 free domestic ATM withdrawals

- -

*Need a physical card? Order a transparent debit Mastercard card for an one-time €10 delivery fee.

N26 Go

Travel with premium perks

€9.90/month

1,5% AER/NIR* interest on your N26 Instant Savings

Unlimited free withdrawals in foreign currencies

Insurance for delay and theft of luggage

Medical emergency cover

N26 Metal

Our most premium plan

€16.90/month

2.5% AER (3% NIR)* interest on your N26 Instant Savings

An 18-gram metal card

Up to 8 free ATM withdrawals per month

Priority customer hotline